In case you don’t know, OPEC acts as a price setting cartel for the global oil market. It produces 40% of the world’s crude oil and exports roughly 60% of petroleum.

Remember all the talk about “Energy Independence” during the Trump presidency? This was exactly why Trump deregulated fracking and encouraged pipeline projects. Because otherwise OPEC has the power to heavily influence global oil prices.

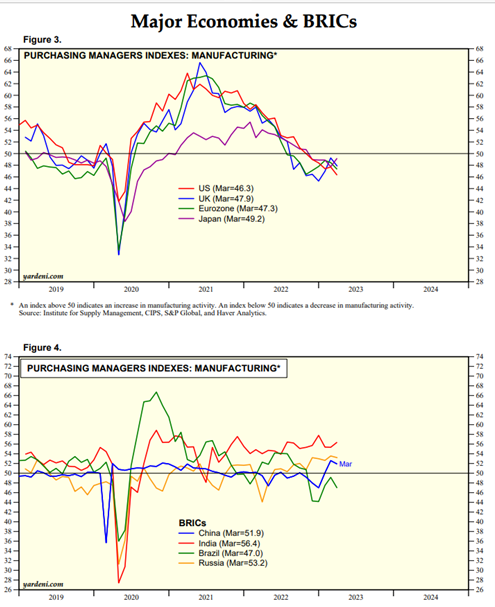

Macro experts are saying the main reason OPEC has cut supply is because the PMI manufacturing data has been indicating a low level of demand for oil.

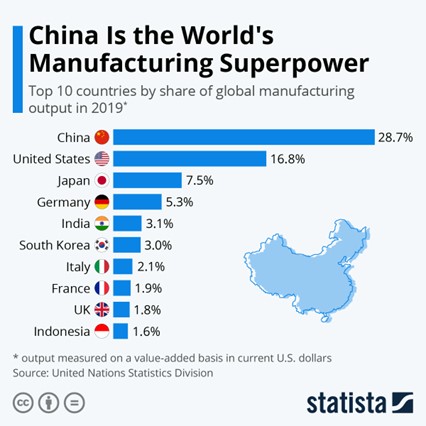

Here’s a chart of the top manufacturing countries.

Here’s a look at the PMI manufacturing trends by country.

China reopening from lockdown at the beginning of 2023 was expected to increase demand for oil. There was an initial spike, but it seems to have fell short of expectations up to this point. That is why OPEC is cutting supply, they want oil to stay in the range of $80 per barrel, as you can see it was falling below that prior to this decision.

See oil chart below.

This was just the tip of the iceberg regarding the factors that impact the oil market, but its important to know what OPEC is thinking.

Let me know if you’re interested in this type of information or if you have any questions!

Sincerely,

Brandon

Add comment