While critics continue to predict a bubble within the non-fungible token (NFT) world, real-life money continues to be exchanged at staggering levels.

“Non-fungible” items are unique; they can’t be traded straight up because there is nothing else like a particular item.

(For context, “fungible” items include dollars, stocks and oil.)

In a recent Reuters story, art collector Pablo Rodriguez-Fraile was reported last year to have spent almost $67,000 on a 10-second video artwork. Last month, he sold it for $6.6 million.

Who saw the value in that? It doesn’t matter because the clip turned out to be worth just as much as a buyer would pay.

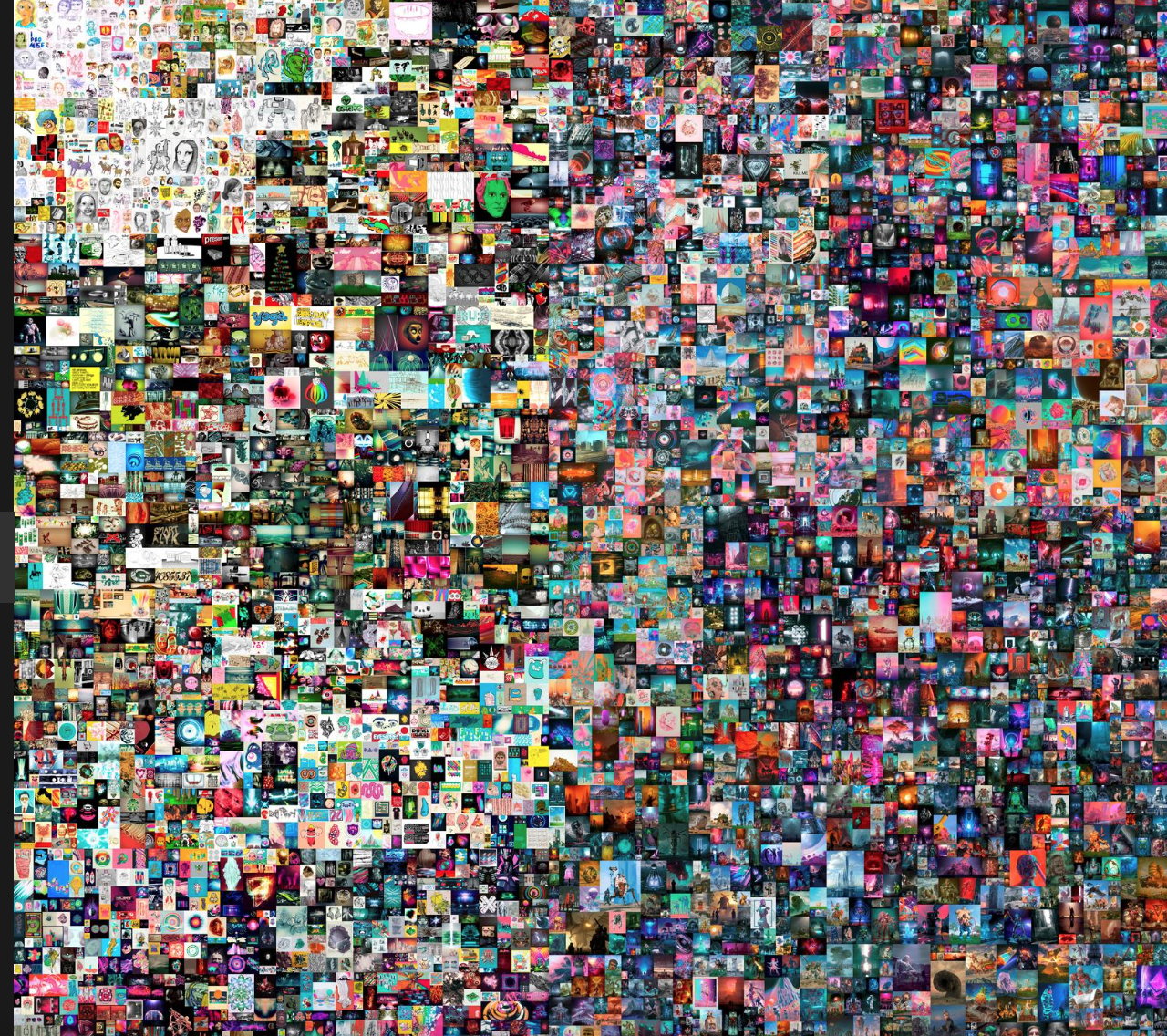

Other examples of NFTs range from digital artworks and sports cards to pieces of land in virtual environments.

Via Forbes: Estate 331, “The Secret of Satoshis Tea Garden,” is only computer code – not a physical plot of land – but it’s a legit real estate holding. In March 2019, someone purchased it for more than $80,000.

Earlier this year, a plot of land on the Axie Infinity gaming and virtual real estate platform sold for $1.5 million.

And the business-savvy operators are lining up.

In a Reuters story, OpenSea, a marketplace for NFTs, grew its monthly sales from $1.5 million 12 months ago to $8 million in January to an amazing $86.3 million last month, with a few days left as of the publication of that story.

The National Basketball Association’s digital arm works with “Top Shot” to handle NFTs including video highlights.

The hype is real. Two weeks ago, a user paid $208,000 for a video of a LeBron James dunk.

And it’s hard to see a bubble just yet.

Add comment