President Biden printed 40% of the total dollars ever produced in U.S. history.

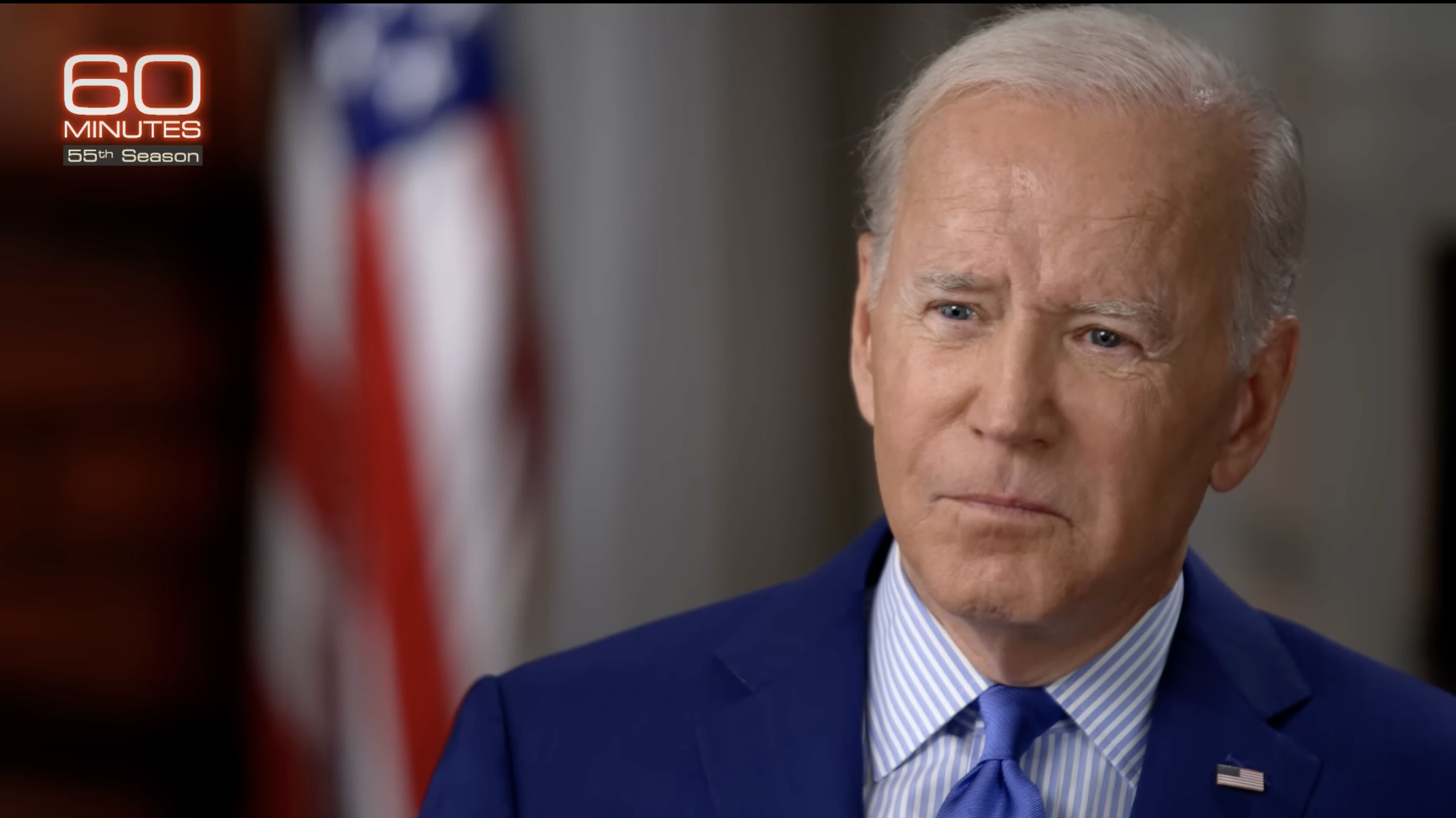

“I’m more optimistic than I’ve been in a long time,” says President Biden.

During his interview on 60 Minutes, President Biden discussed the future of the American economy.

The president discussed how he has “reduced the debt and energy costs” and how he plans on helping the middle class.

“We have reduced the debt,” Biden claims.

“We have reduced the deficit by $350 billion dollars my first year.”

“This year, it’s going to be over a trillion…..500 billion…. ..er..dollars reduce the debt,” mumbled Biden.

“…So to continue to put people in the position to be able to make a decent living and grow. and grow. And increase their capacity to grow.”

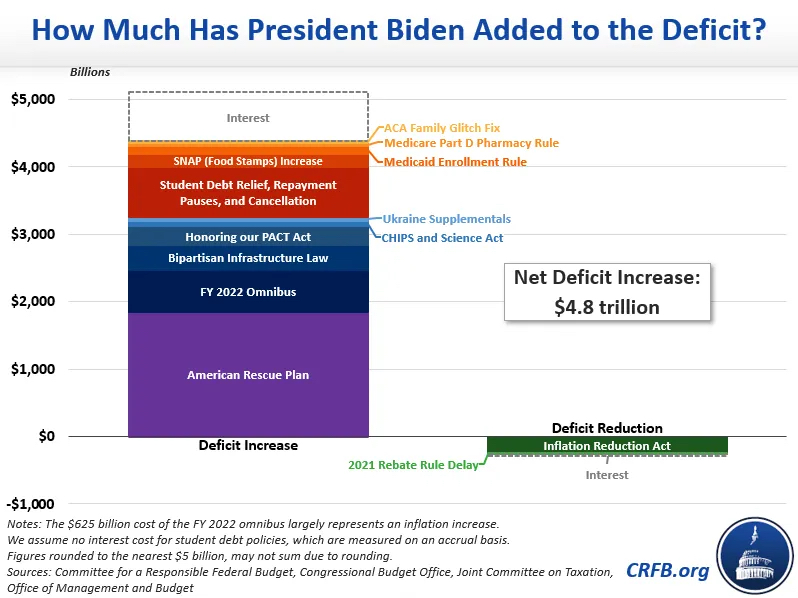

According to the Committee for a Responsible Federal Budget, President Biden has not reduced the debt but has added to it.

The specific policies that have impacted deficits include:

- American Rescue Plan ($1.85 trillion) – The American Rescue Plan Act of 2021 was largely a COVID relief bill, which included funding to state and local governments, $1,400 payments to individuals, an extension of expanded unemployment benefits, new money to combat the pandemic, and other spending. It was regarded by many as larger than necessary given the state of the economy.

- FY 2022 Omnibus Bill ($625 billion) – In March of 2022, Congress agreed to fund the discretionary budget for Fiscal Year (FY) 2022 at 6 percent above 2021 levels. Assuming discretionary spending continues to keep pace with inflation going forward, the Congressional Budget Office has estimated spending will be roughly $625 billion higher than in its prior baseline as a result. Importantly, much of this increase is consistent with keeping pace with inflation.

- Bipartisan Infrastructure Law ($370 billion) – The Infrastructure Investment and Jobs Act of 2021 was a bipartisan package of new spending on transportation infrastructure like roads and bridges as well as on other infrastructure like power, water, and broadband. The package also included several offsets including repurposing of unspent COVID relief funds, delaying implementation of a drug rebate rule, and improving information reporting for digital currencies. However, the bill still added $370 billion to deficits after accounting for those offsets.

- Honoring our PACT Act ($280 billion) – The Honoring our PACT Act of 2022 expanded veterans’ health and disability benefits to veterans who have (or are presumed to have) been exposed to toxic substances while on active duty and have been diagnosed with certain health ailments that could be connected to this exposure. The law was estimated to cost $280 billion and includes no offsets. It would also allow up to $390 billion of discretionary funding to be reclassified mandatory, though that effect is not included in our estimates.1

- SNAP (Food Stamps) Increase ($185 billion) – In August 2021, the U.S. Department of Agriculture announced that it would be revising the Thrifty Food Plan, used for the calculation of Supplemental Nutrition Assistance Program (SNAP) benefits, otherwise known as “food stamps.” The revision increases the reference food plan’s cost by 21 percent.

- Health-Related Executive Orders ($175 billion) – The Biden Administration has announced several executive orders relating to health care that have a combined deficit impact of $175 billion over ten years, assuming all rules are finalized. Early in the Biden Administration, they delayed implementation of a Trump Administration rule regarding prescription drug rebates for a year, saving nearly $15 billion in 2021. They later implemented a different rule requiring pharmacy benefit managers to apply negotiated discounts they receive from pharmacies to the price paid by consumers for drugs under Medicare Part D at a cost of $40 billion. Additionally, President Biden’s proposed rule fixing the “family glitch” in Affordable Care Act subsidies will add another $30 billion to deficits, assuming it becomes finalized later this year. Most recently, the Administration proposed a rule overhauling the enrollment process for Medicaid, which we estimate would cost $120 billion over ten years.

- CHIPS and Science Act ($80 billion) – The CHIPS and Science Act of 2022 included more than $50 billion for incentivizing the expansion of the semiconductor manufacturing industry in the U.S. It also increased funding for the Advanced Manufacturing Investment Tax Credit by nearly $25 billion and provided nearly $5 billion for research and innovation. In addition, it included new authorizations not counted in our cost estimate because they would require future appropriations.

- Ukraine Supplementals ($55 billion) – Since Russia invaded Ukraine in February 2022, Congress has approved a total of $55 billion in military, foreign, and humanitarian aid to Ukraine through two supplemental appropriations bills. The first bill passed in March provided $13 billion, while the second bill passed in May provided nearly $42 billion.

- Inflation Reduction Act (-$240 billion) – In August 2022, President Biden signed the Inflation Reduction Act of 2022, a reconciliation bill allowed by the FY 2022 budget. The legislation included spending and tax credits for energy and climate as well as new health spending, but it was more than offset through tax increases, improved tax enforcement, and prescription drug savings, resulting in $240 billion of deficit reduction through 2031.

- Student Debt Relief, Repayment Pauses, and Cancellation ($750 billion) – Over the first 18 months of his Presidency, President Biden extended a pandemic era pause on student debt repayments four times at a cost of roughly $85 billion while also implementing a number of targeted student debt changes that we estimate will cost another $165 billion. More recently, he announced a final pause extension, a cancellation of up to $10,000 to $20,000 per student loan borrower, and a new income-driven repayment plan that we estimate will cost a combined $500 billion.2

- Net Interest ($700 billion) – Increased borrowing results in higher debt and increased federal interest payments. We estimate the legislative and executive actions approved by the President will increase interest costs by $700 billion, with the largest share coming from the American Rescue Plan. This does not account for any interest effects associated with student loan changes, which are generally measured on an accrual basis.

In total, the Biden Administration has added $4.8 trillion to the deficit over the 2021-2031 period as a result of legislative and executive actions.

With inflation at a 40-year high and debt headed for record levels, substantial deficit reduction will be needed to put the country on a sustainable fiscal course.

Scott Pelley then asked, “With the federal reserve rapidly raising interest rates, what can you do to prevent a recession?”

“Continue to grow the economy. We are growing the economy. It’s growing in a way it hasn’t in years and years,” Biden responded.

“We are growing entire new industries. Eight-five thousand new manufacturing jobs since I became President of the United States….” the President mumbled and slurred his words a bit.

“Continue to give hard-working people in terms of– We pay the highest drug prices in the world of any industrialized nation. Making sure that medicare can negotiate down those prices. ”

“The annual inflation rate Mr. President as you know, last Tuesday, the annual inflation rate came in at 8.3%, the stock market nose-dived, people are shocked by their grocery bills. What can you do better and faster?”

“Well, first of all, let’s put this in perspective,” says Biden.

“Inflation rate month-to-month is up by just an inch. Hardly at all,” the President argued.

“You’re not arguing that 8.3% is good news?” Asked Pelley.

“No! I’m not saying it is good news. But it was 8.2 before!” Biden responded. “I can make it sound like all of a sudden, MY GOD, it went to 8.2%”

Scott Pelley interrupted the President mid-sentence to tell him that “the United States is facing the highest inflation rate in 40 years.”

“I got that! But guess where we are. We’re in the position for the last several months, it hasn’t spiked, its been barely, it’s stayed basically even.”

“And in the meantime, we’ve created all these jobs, and prices have gone up, but they’ve gone down for energy.”

“The fact is, we’ve created 10 million new jobs since we’ve come to office,”says President Biden.

President Biden added, “We’re in a situation where, the unemployment rate, 3.7% is one of the lowest in history, we’re in a situation where manufacturing is coming back to the united states in a big way… ”

“And look down the road, we have massive investments being made in computer chips and employment….” says Biden.

“This is a process…” says President Biden.

“Is the economy gonna get worst before it gets better?” asked Scott Pelley.

“No, I don’t think so” responded President Biden.

“We hope we can have a soft landing. A transition to a place where we don’t lose the gains that I ran to make for the middle class in the first place. Being able to generate good paying jobs and expansion, and at the same time make sure that we are able to continue to grow.”

“You would tell the American people that inflation is going to continue to decline?” asked Pelley.

“No. I’m telling the American people that we are going to get control of inflation.”

“Prescription drug prices will be a lot lower, healthcare costs will be a lot lower, their energy prices will be lower, they will be in a situation where they will be in control again.”

Add comment