According to a new report from the S&P Global Ratings, the number of corporations defaulting on their debt has hit its fastest pace since the 2008-2009 financial crisis, also known as the “Great Recession.”

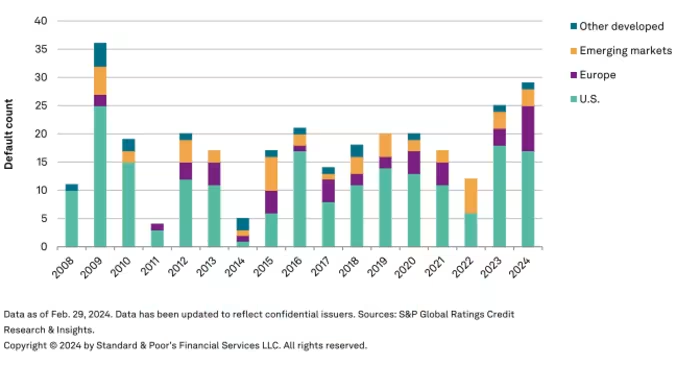

Since the start of 2024, the number of defaults occurring globally has risen to 29—the highest amount at this point in a calendar year since 2009. (At this point in 2009, 36 had defaulted.)

While the majority of bankruptcies are occurring in the US (as has been the case in recent years), it is a spike in European corporate defaults in particular that is worrying observers. Analysts are attributing this to inflation and high interest rates, which are putting additional pressure on unstable borrowers. The S&P says lowering consumer demand and rising wages also contributed.

“What’s going on is exactly what’s been going on since the [Federal Reserve] began to raise interest rates [in March 2022],” chief economist at Apollo Investment Group Torsten Slok said. “Default rates are rising . . . because higher interest rates continue to bite harder and harder on highly levered companies.”

Learn the benefits of becoming a Valuetainment Member and subscribe today!

“Given the still-high total of lower-rated companies in the region, we expect European defaults to remain elevated over the near term, adding to a slight rise in defaults rates over the summer,” read the report.

Related: New York Community Bancorp Stock Crashes, Striking Fear in Regional Banks

According to the data, eight European companies have defaulted so far, while in 2023 only three had defaulted by mid-March. Meanwhile, 17 US corporations have defaulted, one less than the 18 seen at this point last year. This is more than double the rate at which European companies have defaulted in any year since 2008.

Of the bankruptcies that occurred in February, some 40 percent were in healthcare or the entertainment/media industries. The S&P Global expects many more defaults from media and healthcare companies, in addition to companies that make consumable goods.

Four companies outside of Europe and the US have defaulted since the start of 2024, including Canadian commercial real estate services company Avison Young and Argentina-based infrastructure service provider CLISA.

Related: WeWork Bankruptcy, HELOCS and Consumer Debt | BIZDOC EP 36

The S&P reported on January 16th this year that corporate defaults had shot up by 80 percent in 2023 for a total of 153 across the globe. It disclosed that US corporations made up 63 percent of said defaults. A large minority—42 percent—of the corporations affected were “consumer-facing sectors.”

The single greatest driver of defaults in 2023 was distressed exchanges, comprising more than 40 percent of defaults for the third year in a row. Distressed exchanges agreements are formed by private equity lenders and the companies they back as a way to hand over fewer assets than are owed as a way to avoid bankruptcy proceedings (which can become costly). Nearly half (14) of the corporations that have defaulted in 2024 were designated as distressed exchanges by the S&P.

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment