In this episode of The Biz Doc podcast, Tom Ellsworth talks debt, home equity lines of credit (HELOCS), and bankruptcy, using WeWork as the basis for his case study on bankruptcies.

Last week, office space sharing company WeWork filed for bankruptcy following a months-long struggle to meet basic interest payments. Once a promising startup valued at $47 billion in 2019, WeWork cascaded downward to $0.84 stock in Oct. 2023 when rumor got out that it was set to declare Chapter 11.

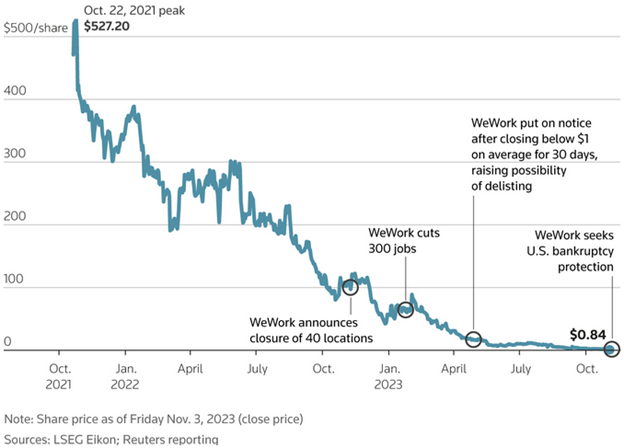

Biz Doc gives us a quick history of the company using a graphic from Reuters.

In October of 2021, WeWork was valued at $527.20 a share. That declined to just $0.84 per share when rumor of its bankruptcy declaration spread in the first week of November 2023, a drop of -526.36 in only two years!

Halfway through this period in November of 2022, when its shares were around $100, WeWork announced it was closing 40 locations. A little after January 2023, WeWork then announced it was slashing 300 jobs. At that point, its shares were valued around $80.

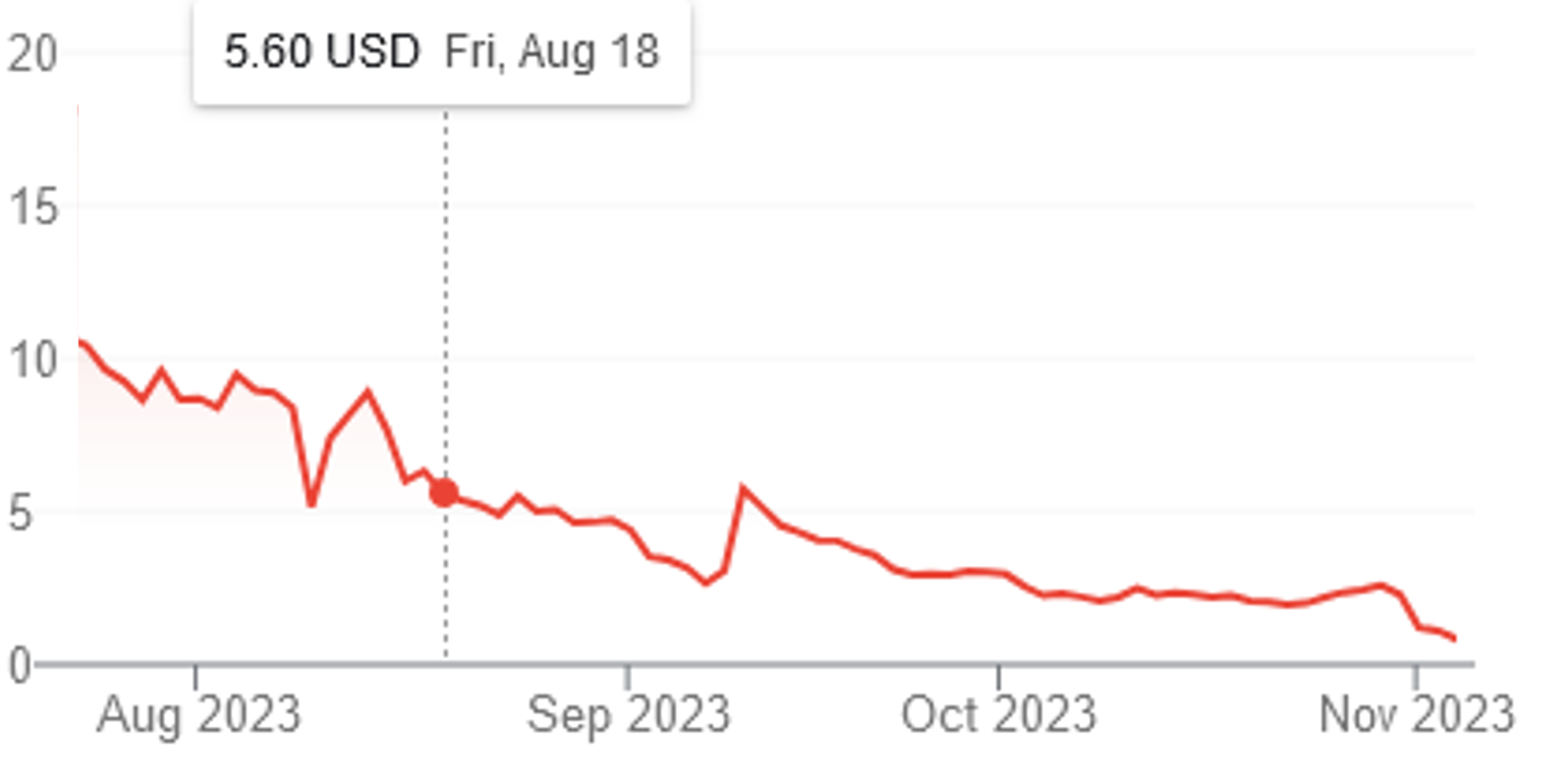

To avoid being delisted—taken off the stock exchange as a non-investable due to failure to maintain an acceptable price—WeWork did a 1-for-40 stock split in August 2023. That means they tightened their share supply to artificially boost their share prices by taking 40 shares off the market at $0.14 and putting one share back at $5.60. But this is largely an artificial move, due to its numerous headwinds.

As Biz Doc discussed in a previous episode, WeWork faced multiple headwinds: the impact from COVID (“why would I need office space if I can work from home?”), a subsequent uptick in commercial real estate availability, a mountain of debt, and competition from its own landlords (traditional property owners) when they started offering short-term “flex leases” to undercut WeWork’s model and exploit the COVID-era situation.

These headwinds persistently stopped WeWork at its every turn to boost its share values, which only served to accelerate their share devaluation. Simply put, the stock market did not buy their story.

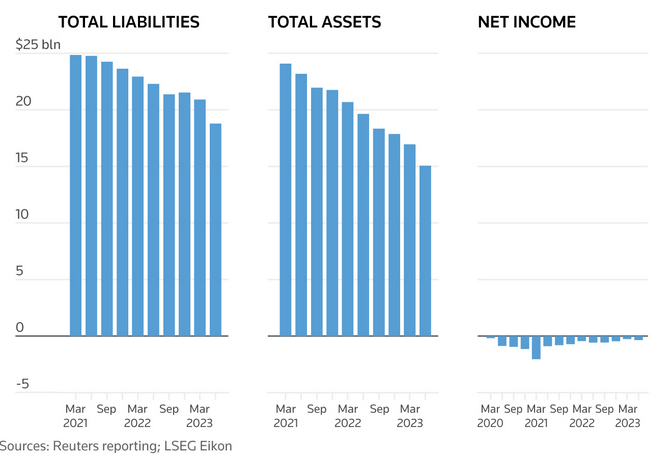

While WeWork was able to balance its assets and its liabilities in 2021, by March 2023 a nearly $5 billion gap had formed, meaning it had $5 billion more in expenses than it had in savings to pay for it. On top of that, it hardly had any income—so it had no way to pay it. And so they entered into bankruptcy.

As Biz Doc points out, many companies are going bankrupt right now, not just WeWork. But WeWork is a shining example of an ongoing trend, a microcosm that explains the macrocosm.

To see him explain the different types of bankruptcies, the current rate of bankruptcies, and most importantly why corporations don’t suffer as much as individuals do when they declare bankruptcy, watch the full video here.

Add comment