China’s free marketplace is not particularly free; designed as a carefully watched landscape to ensure businesses don’t exceed their reach.

The stepped up regulations imposed by the Chinese government are costing the country’s huge tech companies billions in lost overseas share value.

But there is no public outcry.

Chinese consumers believe the measures are necessary because of the modern distrust of tech companies, which face major questions about online lending, treating merchants unfairly and abusing consumer data.

“With China, it immediately becomes about the Communist Party. But if the UK government were doing this, people would probably be OK with it,” said Jeffrey Towson, head of research at Asia Tech Strategy.

“These actions look quite reasonable.”

E-commerce giants Alibaba and JD.com, along with messaging/gaming super-company Tencent, have exploded in growth because of their laser focus on Chinese digital lifestyles – and their country’s government ban on major U.S. competitors.

Alibaba is a behemoth similar to Amazon, but its co-founder Jack Ma recently discovered the differences in operating under the government’s gaze.

Ma publicly criticized China’s regulators for their warnings about Ant Group, his company’s financial arm.

From a report by AFP in Yahoo!Finance:

“The official response to Ma’s unusual outburst has been uncompromising: Ant’s record-breaking $35 billion Hong Kong-Shanghai IPO was abruptly suspended, Ma disappeared from public view for weeks, and regulatory screws have been tightened.”

China wants to maintain a financial system free of dangerous debt build-up.

Debt spiraled to 335 percent of GDP by the end of 2020, according to the Institute of International Finance.

While just over 20 percent of U.S. retail spending takes place online, China is forecast to surpass 50 percent this year.

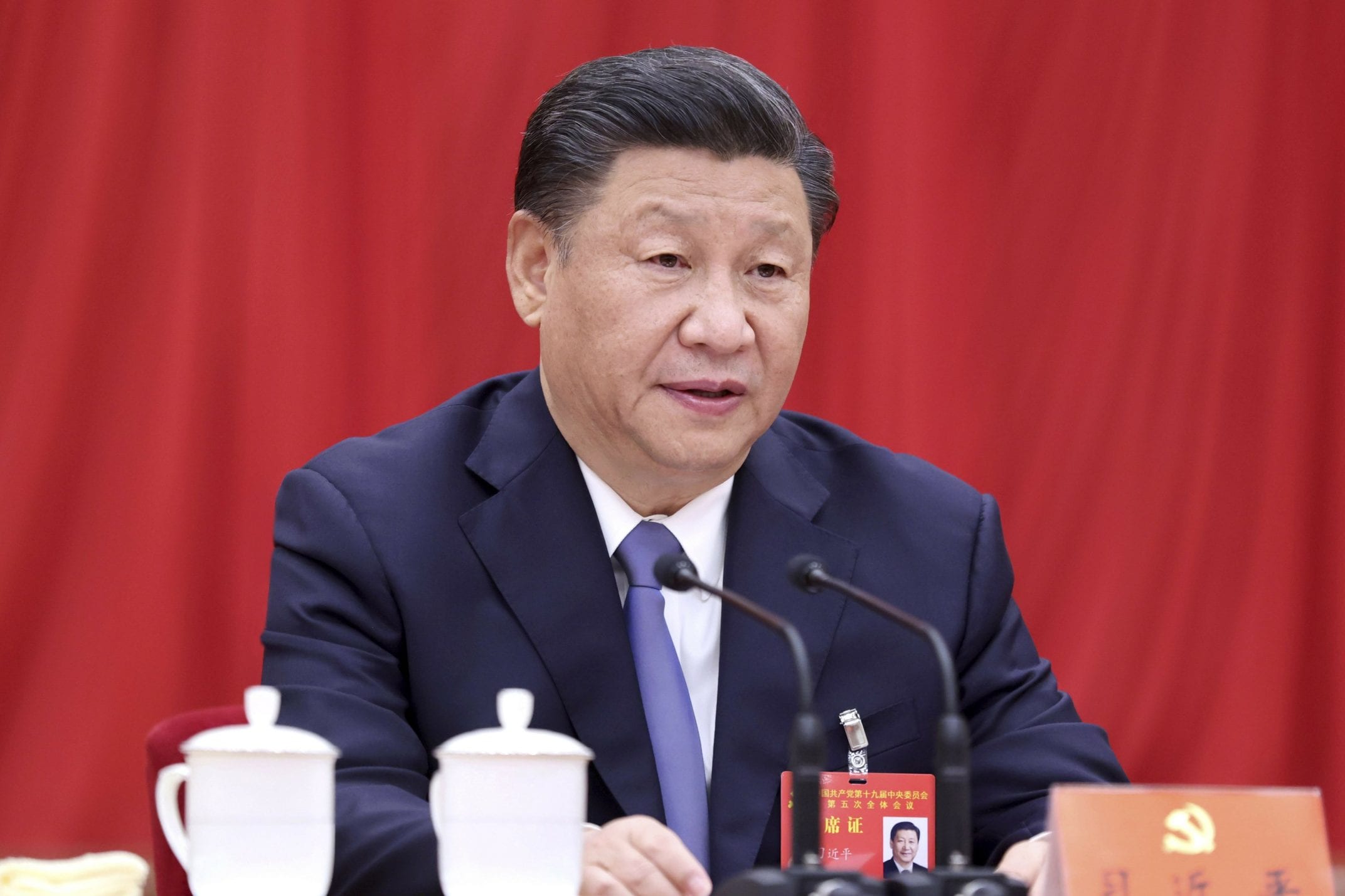

And more measures could be coming. President Xi Jinping last week again called for tightened oversight to fight online monopolies and financial danger.

Add comment