The BlackRock Story:

- BlackRock was founded in 1988 by Larry Fink and has since grown to become the world’s largest asset manager with roughly $10 trillion in assets under management.

- Fink started his career in 1976 at First Boston, a New York-based investment bank Fink added an estimated $1 billion to First Boston’s bottom line.

- Fink was successful until 1986, when he lost the bank $100 million after he incorrectly predicted interest rate movement.

- This experience forever changed his investing philosophy.

- BlackRock spent years developing risk management software called (Aladdin) which launched in 1999, the same year the company went public. BlackRock also sells the Aladdin product to other companies. Aladdin has become the foundation for hundreds of companies.

- According to a Bloomberg article, Aladdin monitored more than $18 trillion by 2018.

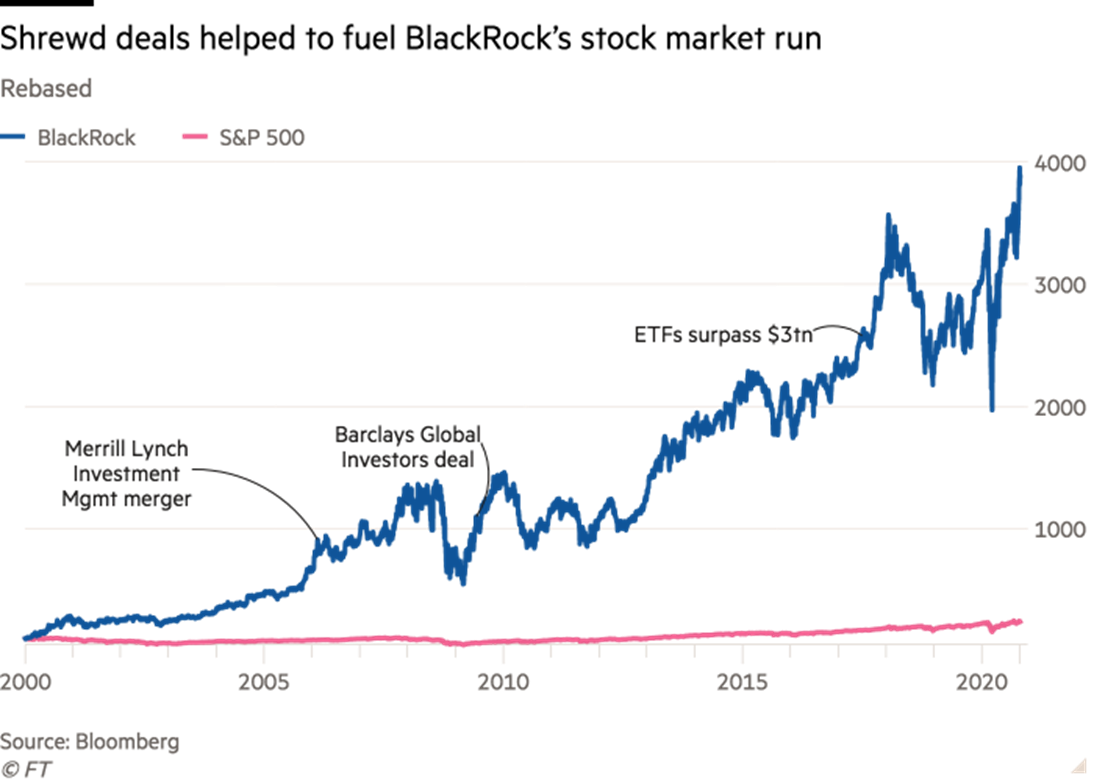

- BlackRock’s stock price has increased by roughly 7,000% since 1999.

- Another strategy that sets BlackRock apart is that it started offering ETFs or index funds at a very low price.

- Fink says he realized the best way to protect against risk is to have exposure to the entire market.

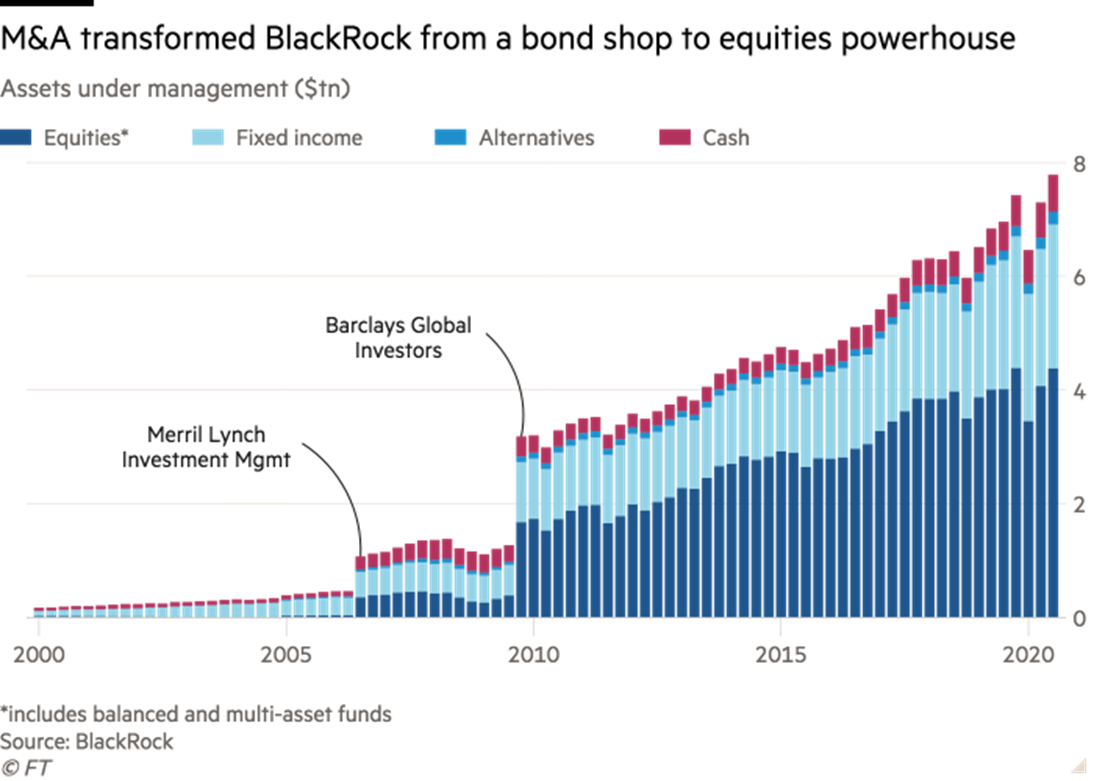

- Mergers & Acquisitions have played a huge role in BlackRock’s growth.

- In 2009 BlackRock made the landmark acquisition of Barclays for $13 billion, gaining ownership of iShares.

- iShares is one of the world’s largest and well-known ETF providers, ETFs from iShares are a flexible, low-cost way for investors to gain exposure to diversified markets, like bonds, emerging markets, broad-based indexes, mutual funds, exchange-traded funds, hedge funds, and private equity.

- BlackRock’s ETF business has boomed in recent years, as investors have increasingly desired low-cost, passive investment options.

- The S&P 500 yearly return is typically how investor success is measured. If they beat the S&P they succeeded, if they don’t it’s a failure.

BlackRock has dominated the S&P 500:

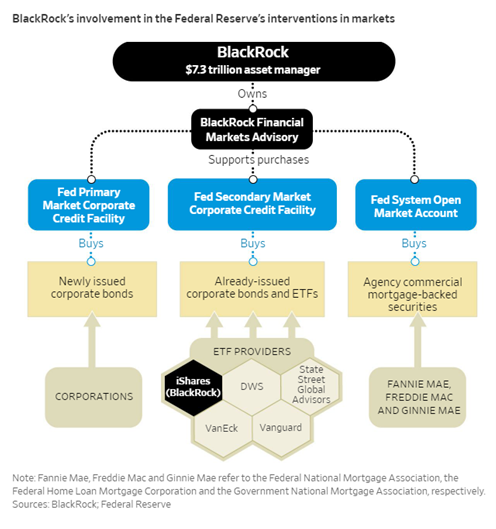

- The most important thing to know about BlackRock is when a financial crisis happens, the Fed calls BlackRock for help.

- Fink is an expert at managing distressed debt

- In 2008 BlackRock advised the Fed on how to deploy the purchase of billions of dollars in commercial mortgage-backed securities and investment-grade corporate bonds.

- The Fed bought ETFs that track investment-grade bonds that BlackRock sells.

- In 2020, the same thing happened.

Here’s how it works:

- Of the 16 ETFs the Fed ultimately purchased, eight were BlackRock’s iShares funds (WSJ)

- Think about how powerful of an advantage it is for an asset management firm to have the ability to point the money printer in any direction they want.

- People ask, why has BlackRock gone so heavily into pushing ESG?

- Likely for the same Facebook bends over for the government, it’s much easier to dominate an industry with the wind of the at your back instead of going against you.

Sincerely,

Brandon

Add comment