Patrick Bet-David discusses the growing number of Zombie Companies in America, the cause behind them, and the impact they will have on the economy.

Zombie Companies are companies that are pulling in enough revenue to continue operating and servicing debt, but are unable to pay off their debt and invest in growth. In other words, these are companies that should be out of business and are hanging onto somebody else’s market share. Another company could take their market share and do better things with it, but because the Zombie Company has the name recognition and ‘legacy’ it is cordoning off that sector of profitability.

Financial experts estimate that 18 percent of companies listed in the Bloomberg Total Return Index are Zombie Companies. In 1997, only one percent of companies were thought to be Zombies, according to the IMF.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

The concept of a Zombie Company originates from Japan during its so-called “Lost Decade” of the 1990s, which followed the collapse of the country’s asset price bubble. In this era, companies became dependent on heavy bank financing in order to remain operational — despite the fact that they were either failing or near failing. If they couldn’t secure a loan from a financial institution, they could not meet their expenses and would go out of business.

Their inefficiency and lack of competitive performance was wedded to an inability to generate sufficient revenue to offset operating costs and necessary debt payments. Here’s the kicker: the proliferation of zombie companies was mainly attributed to the banks themselves, which refused to let a borrower fail, and government policies that sought above all else to preserve employment and “social stability.”

Not good for the economy, but good for ulterior political and social goals. In response, economists complained that the presence of Zombie Companies was hindering the economy’s recovery, taking resources away from more productive and ambitious firms and giving them to ailing giants. Protective measures were causing innovation and productivity to be held back.

A similar practice in the United States made Zombie Companies famous in 2008. Spearheaded by TARP (Troubled Asset Relief Program), the federal initiative that began under the Bush administration, companies that had reached a terminal slump were being kept alive just enough to continue making debt and interest payments, essentially making them slaves. They were effectively owned by the debt holders.

Government bailouts, particularly through the $700 billion TARP, were blamed for keeping failing firms alive.

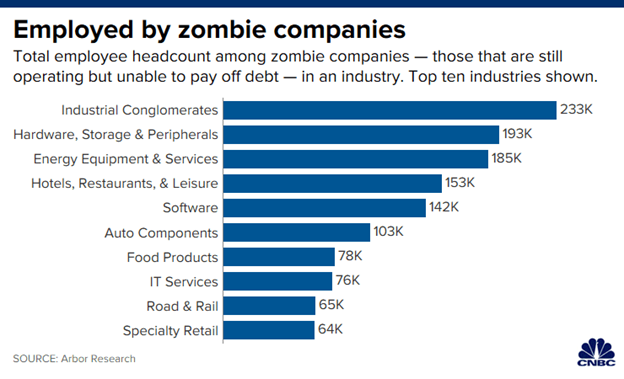

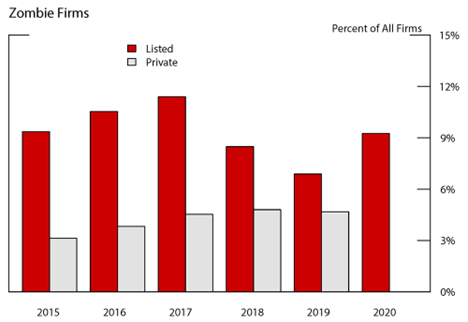

Below is a chart from the US Federal Reserve. The number of publicly listed firms in “Zombie” status increased from 2015 to 2017, and then declined when the Trump administration started increasing rates.

Failing companies like Toys-R-Us, JCPenney, Sears, and iHeart Media and collapsed during the Trump period. And what’s more, Trump wasn’t in favor of Fed Chair Jerome Powell’s interest hikes: he complained about him raising rates. The Biden administration is also against Powell’s continual interest hikes. This is how one can tell that Powell is a neutral player and a good force to have in the Federal Reserve, because at the end of the day he will prevent a lot of fake success from skirting by. The pruning process will weed out all the artificial wealth.

Watch the rest of Patrick Bet-David’s video to understand the different types of Zombie Companies and how you can detect them in the future:

Add comment