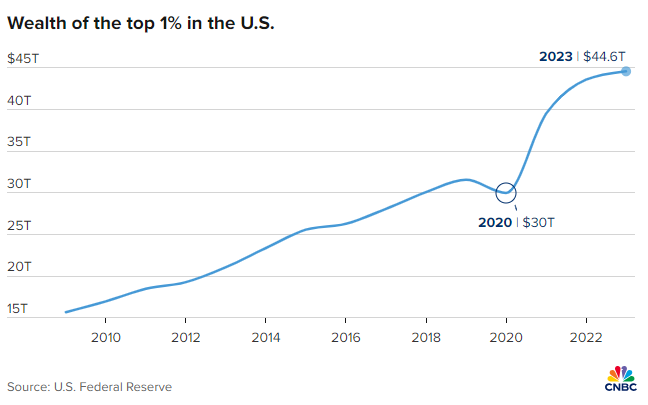

The wealth possessed by the top 1% of the American population has reached a record-breaking $44.6 trillion, according to new data from the Federal Reserve.

A rally in the stock market buoyed up their portfolios in the fourth quarter of fiscal year 2023. The fourth quarter alone accounted for a growth of $2 trillion, all of which was from stock holdings.

The top 1% is currently defined by the Federal Reserve as Americans with net worths over $11 million. The value of corporate equities and mutual fund shares held by this segment of the population increased from $17.65 trillion to $19.7 trillion in the last quarter.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

As Valuetainment previously reported, the American public owns $156 trillion worth of assets, and Baby Boomers currently have $19 trillion in equities and mutual funds alone.

Real estate values went up in Q4, but privately held businesses declined, which effectively negated all gains made outside of the stock market.

Data gathered from the Federal Reserve by CNBC shows the astronomical rise of the wealthiest percentage of the America people, which shot up after the short-lived pandemic bust.

The wealth of the top 1% has surged by almost $15 trillion since 2020, marking a 49 percent increase. But the middle class has also enjoyed a surge, with the middle 50 percent-to-90 percent of Americans experiencing a wealth increase of 50 percent.

The American economy is currently experiencing a 71 score on the Fear-Greed Index, on the verge of “Extreme Greed,” indicating a very confident consuming base. Analysts are referring to this as the “wealth effect,” where the gains made in the stock market reinforce gung-ho buying and spending habits.

The Fed report also reveals that the top 10 percent of the American population owns 87 percent of individually held stocks and mutual funds, and the top 1% owns half.

The deluge of money that is currently being spent, which is driving the economy away from a recession, is not being spent equally. “Those households in the top one-third of the income distribution and who own the bulk of the stock holdings account for approximately two-thirds of consumer spending,” said Mark Zandi, chief economist of data firm Moody’s Analytics.

“The wealth effect from surging stock prices is a powerful tailwind to consumer confidence, spending and broader economic growth,” he continued. “Of course, this highlights a vulnerability of the economy if the stock market were to falter. This isn’t the most likely scenario, but it is a scenario given that stocks appear richly (over) valued.”

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment