Patrick Bet-David highlights a pivotal development in the cryptocurrency world: the SEC’s official approval of 11 applicants, including BlackRock, for Bitcoin ETFs.

This decision marks a significant turning point for Bitcoin, potentially catalyzing its growth and integration into mainstream financial markets, beginning with the big players in the finance sector including BlackRock, Fidelity Investments, Ark Investments, Invesco, Wisdom Tree, Bitwise Asset Management, Valkyrie, and Grayscale, who have submitted applications for Bitcoin ETFs.

This move signals a growing acceptance and interest in cryptocurrency from major institutional investors.

Ark Invest founder Cathie Wood says the price of one Bitcoin could rise to $1.5 million.

In his statement announcing the new ETFs, Securities and Exchange Commission (SEC) Chair Gary Gensler said the approval should not be taken as a sign that the agency is relaxing its enforcement of regulations on cryptocurrency.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

“Such regulated exchanges are required to have rules designed to prevent fraud and manipulation, and we will monitor them closely to ensure that they are enforcing those rules,” he said. “Furthermore, the Commission will fully investigate any fraud or manipulation in the securities markets, including schemes that use social media platforms …. Today’s action does not approve or endorse crypto trading platforms or intermediaries, which, for the most part, are non-compliant with the federal securities laws and often have conflicts of interest.”

Gensler’s comments and the legal fine print surrounding the SEC’s approval of the ETFs, have caused many to read the move as a step toward a punitive and domineering regulation of crypto.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” Gensler added by way of a disclaimer.

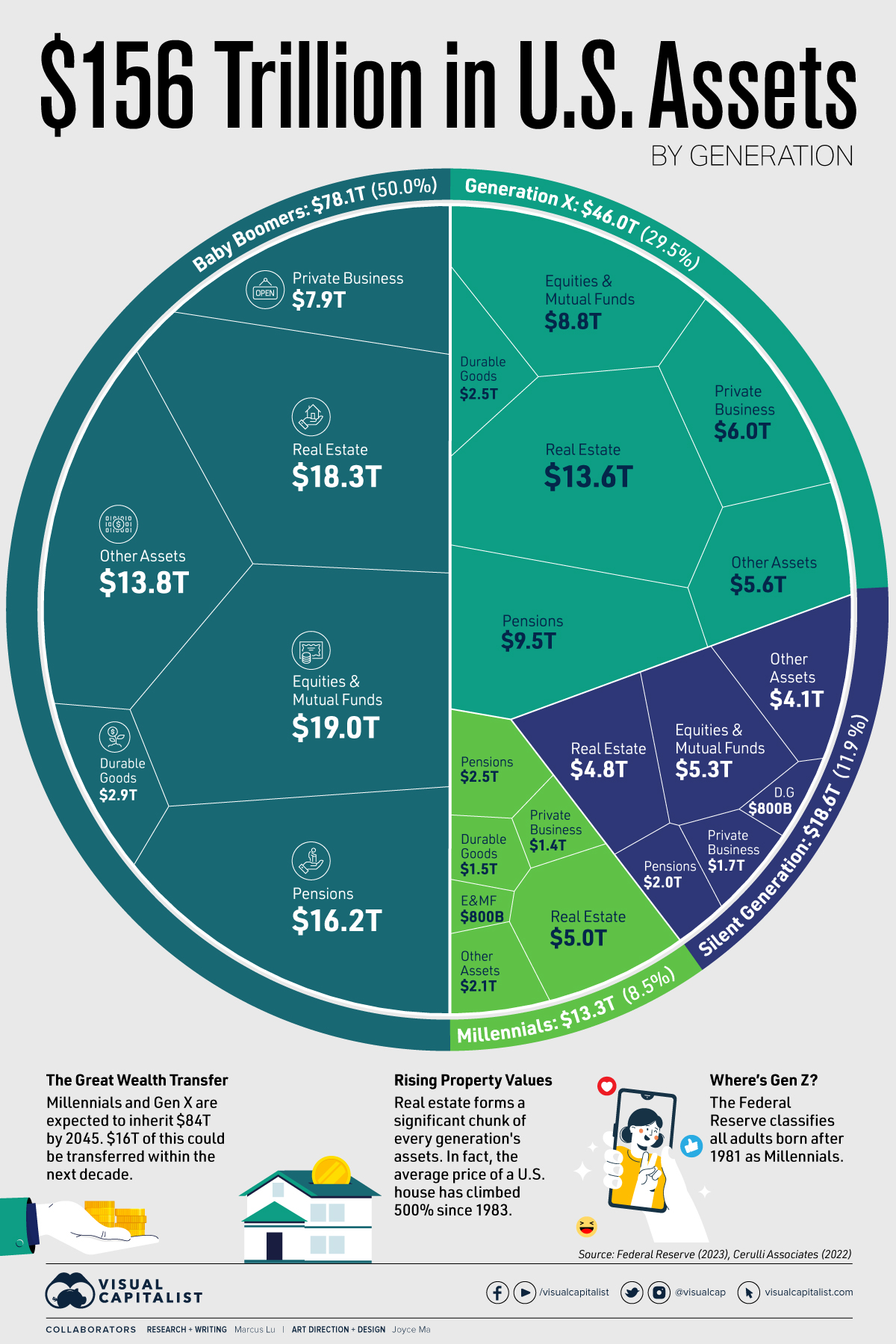

The American public owns $156 trillion worth of assets. Baby Boomers currently have $19 trillion in equities and mutual funds. Imagine what would happen to the price of Bitcoin if hedge funds and wealth management firms began convincing Boomers to put a small percentage of their portfolios into Bitcoin…

At the moment, Bitcoin’s market cap is around $800 billion. If Cathie Wood is correct, we would see its cap raised to $24 trillion. (Watch until the end of the video to hear Elon Musk’s prediction).

On its initial trading day, Bitcoin ETFs saw an inflow of over $4.3 billion, a record-breaking milestone for ETF products. BlackRock’s iShares Bitcoin Trust ETF brought in more than $1 billion, and Grayscale’s Bitcoin Trust saw inflows of over $2 billion.

On June 16th, 2023, BlackRock filed for a spot Bitcoin ETF, naming it the “iShares Bitcoin Trust.” The news from this alone caused Bitcoin to go from $25,000 to $30,000 in just a few days. Bitcoin has gained roughly 63 percentage points since BlackRock filed its ETF application.

BlackRock had named Jane Street and JPMorgan Securities as its authorized participants should it gain approval.

According to Arthur Hayes, co-founder of BitMex, BlackRock and other “TradFi asset managers” will “completely destroy” Bitcoin. He reasons:

Bitcoin is the first monetary asset in human history that exists only if it moves. After Bitcoin block rewards hit zero around 2140, miners will only be rewarded for validating transactions via transaction fees. That means miners will only receive Bitcoin income if the network is used. In essence, if Bitcoin moves, it has value. But if there was never another Bitcoin transaction between two entities, miners would be unable to afford the energy it costs to secure the network. As a result, they would shut off their machines.

Without the miners, the network dies, and Bitcoin vanishes.

Blackrock, the world’s largest TradFi asset manager, is in the asset accumulation game. They vacuum up assets, store them in a metaphorical vault, issue a tradable security, and charge a management fee for their “hard” work. They don’t use the things they hold on behalf of their clients, which presents a problem for Bitcoin if we take an extreme view of a possible future.

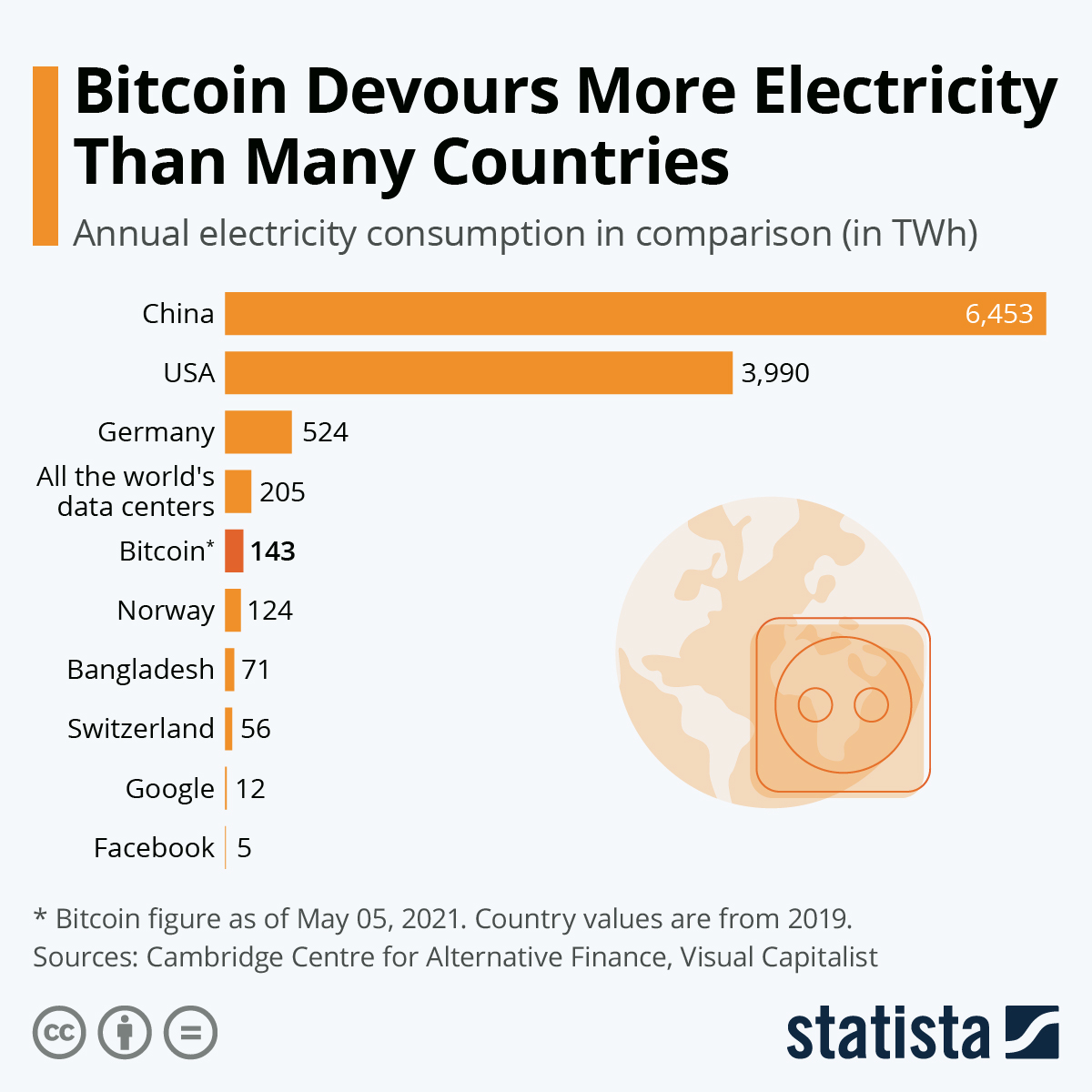

What’s the deal with Bitcoin Miners and the costs of production? Well, as we have seen, Bitcoin mining uses more electricity than most countries do on an annual basis.

Watch the rest of the video to understand how Bitcoin mining works and what Bitcoin price halving is.

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment