Have you ever met a single person who doesn’t love money?

The answer is no.

Money can solve problems, build schools, cure illnesses, improve infrastructure, elect politicians, and help entrepreneurs make their dreams a reality.

You can use money for the betterment of humanity or the destruction of humanity.

Unfortunately, there are a lot of wealthy people who have evil agendas… 💔

People who “hate money” or people with money have a deeper complex.

Either they’re disappointed in their own failures, lifestyle choices, or they had a bad experience with a wealthy person and are holding some kind of a grudge.

People are constantly projecting their own issues…

Obviously, you don’t need money to be happy or have a meaningful life, but if someone offered you $10,000,000, wouldn’t you take it?

Shocking Facts About Americans’ Money Habits

Do you fall into any of these categories?

1. Most Americans Do NOT Pay Taxes

Did you know that 57% of Americans paid ZERO income tax in 2021?

You heard that right.

Most people don’t pay any income tax.

I’m not sure if I should be alarmed or relieved. If 57% of Americans didn’t pay any income tax in 2021, that means that they’re either living in poverty or they’re really having fun with those tax loopholes.

In the end, TAX IS THEFT.

Most of our taxes aren’t spent appropriately. Why should we pay taxes if the government prints money whenever they feel like it? If you steal money, you usually go to jail. Laws don’t apply to governments though, unfortunately.

2. Most Americans Have NO MONEY in Their Savings!

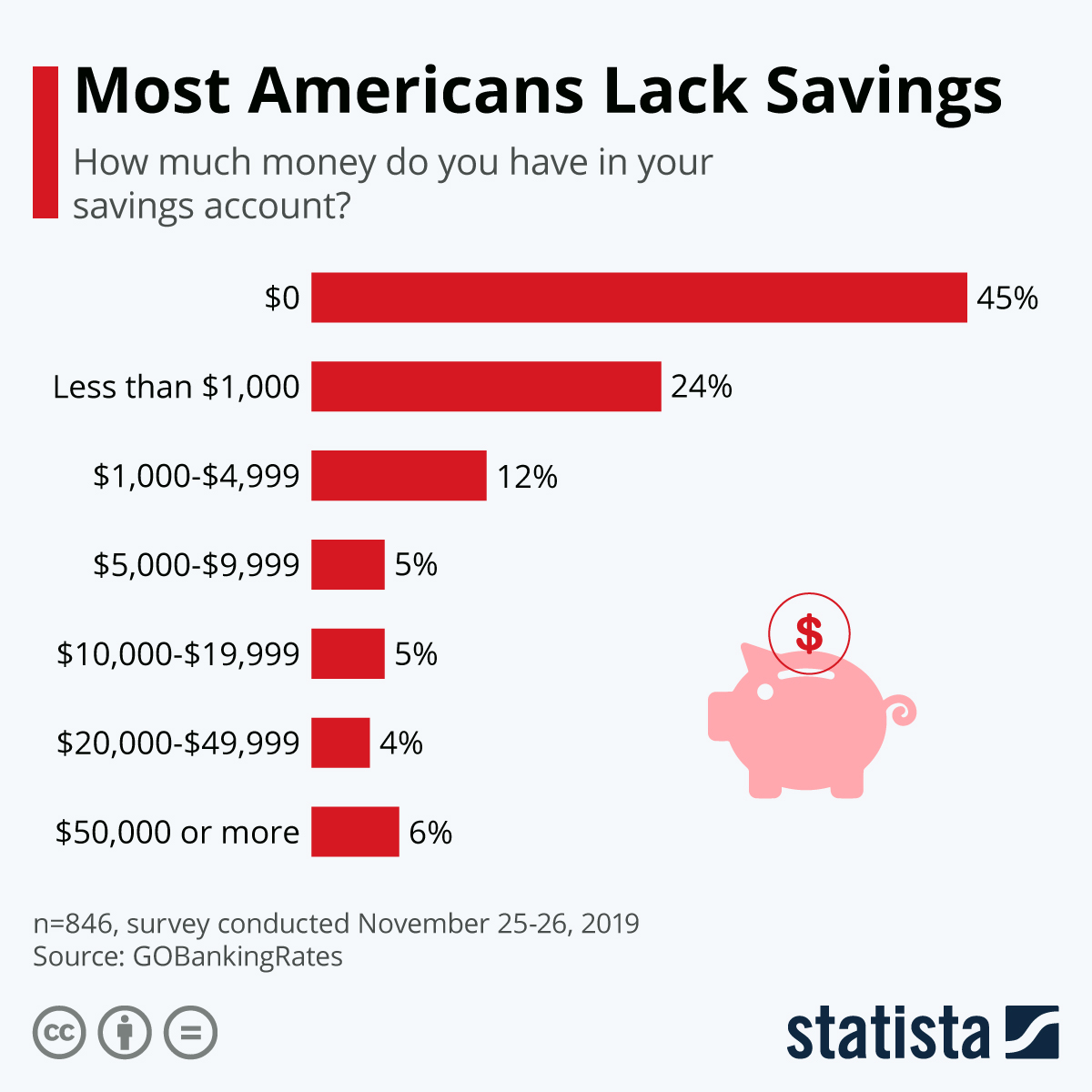

45% of Americans have NOTHING in their savings.

This is an American tragedy and major crisis our citizens are facing.

The statistics are very worrisome.

This is what happens when you don’t teach people how to manage their money and properly prioritize.

What is the education system doing to address this? Absolutely nothing.

3. Americans Have Interesting Spending Habits…

Which category do you fall into?

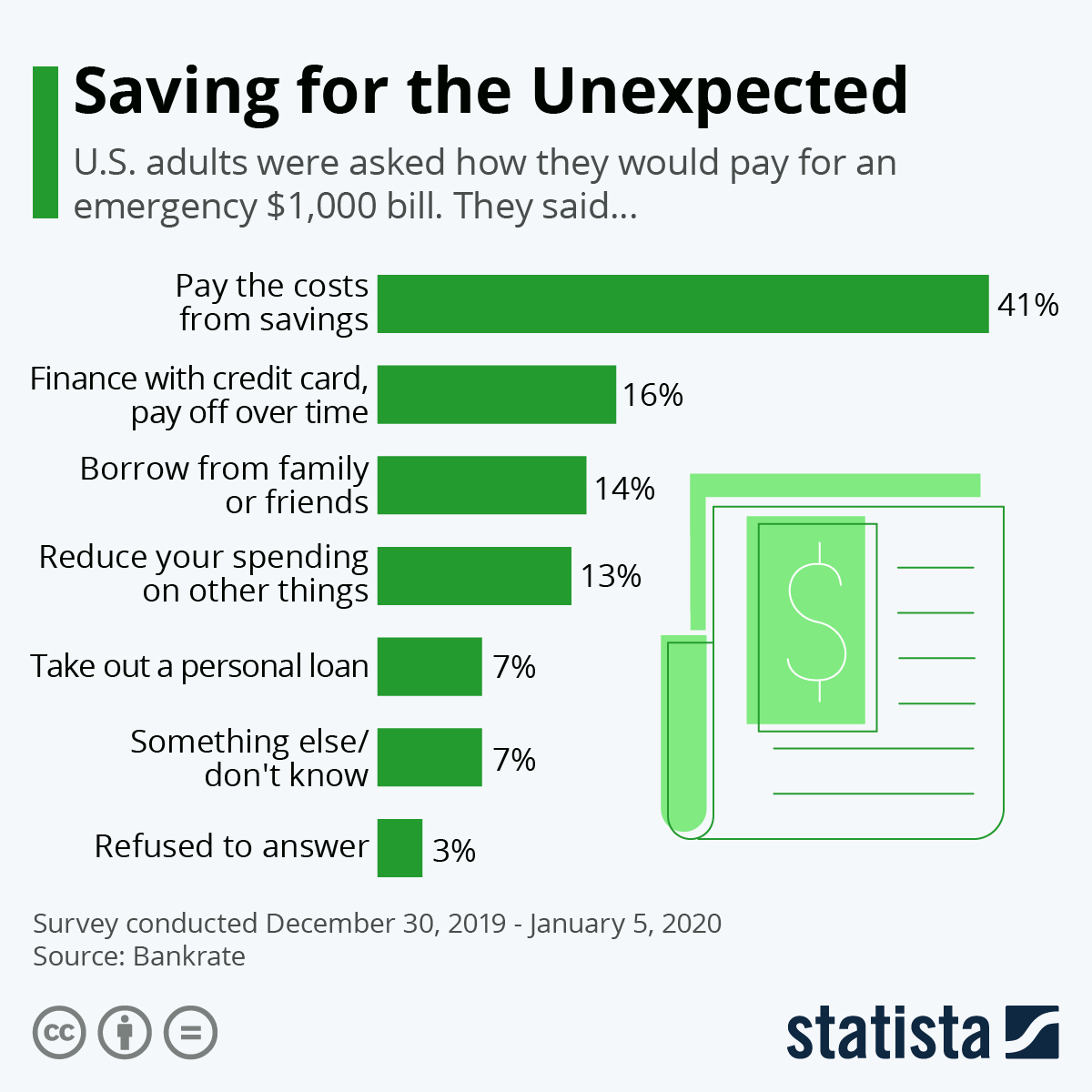

Nearly 6 in 10 Americans don’t have enough savings to cover a $500 or $1,000 unplanned expense, according to a report from Bankrate.

The problem is not that Americans are making too little, but that as peoples’ wages increase, so do their expenses.

However, we do have a major problem. Inflation has increased tremendously, but has your paycheck gone up? NOPE!

Should businesses be required to increase their employees wages depending on inflation? Hmmm…

It’s not like it’s citizens faults that inflation is so high! Why do we have to pay the price?

4. Americans Are Worried About Their Financial Futures

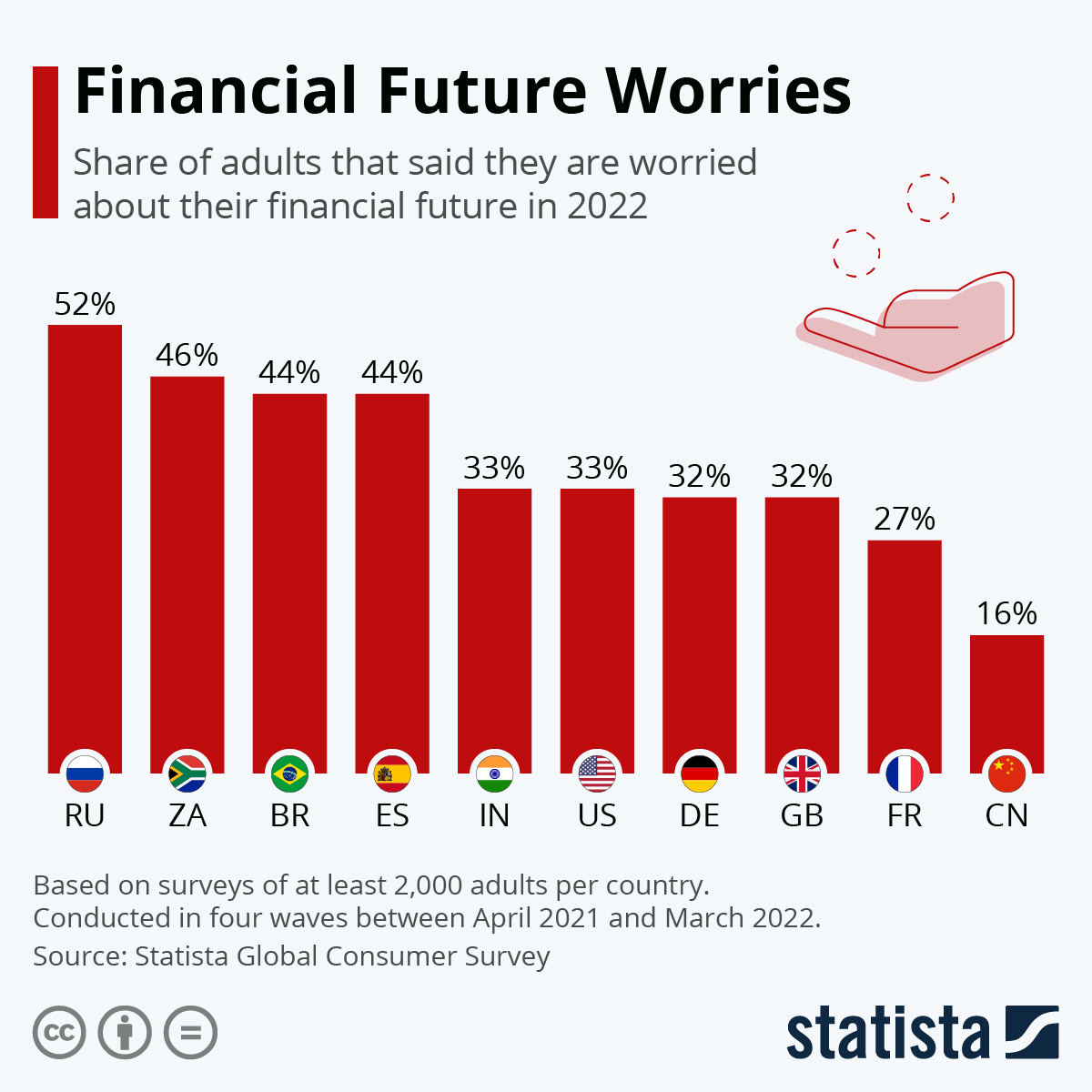

33% of Americans are worried about their financial futures.

The number seems kind of low, considering that 45% of Americans have no money in their savings.

Clearly, they don’t have their priorities in order, or maybe they just take a lot of Xanax to numb their worries.

It just doesn’t add up. If 45% of Americans have nothing in their savings and an additional 24% have less than $1000 in their savings, that means 69% of Americans have between $0 and $1000 in their savings.

And yet America is probably the most consumerist nation in the world. Interesting….

5. Americans Are Increasingly Worried About Retirement, Medical Costs, Bills, and Maintaining Their Standard of Living.

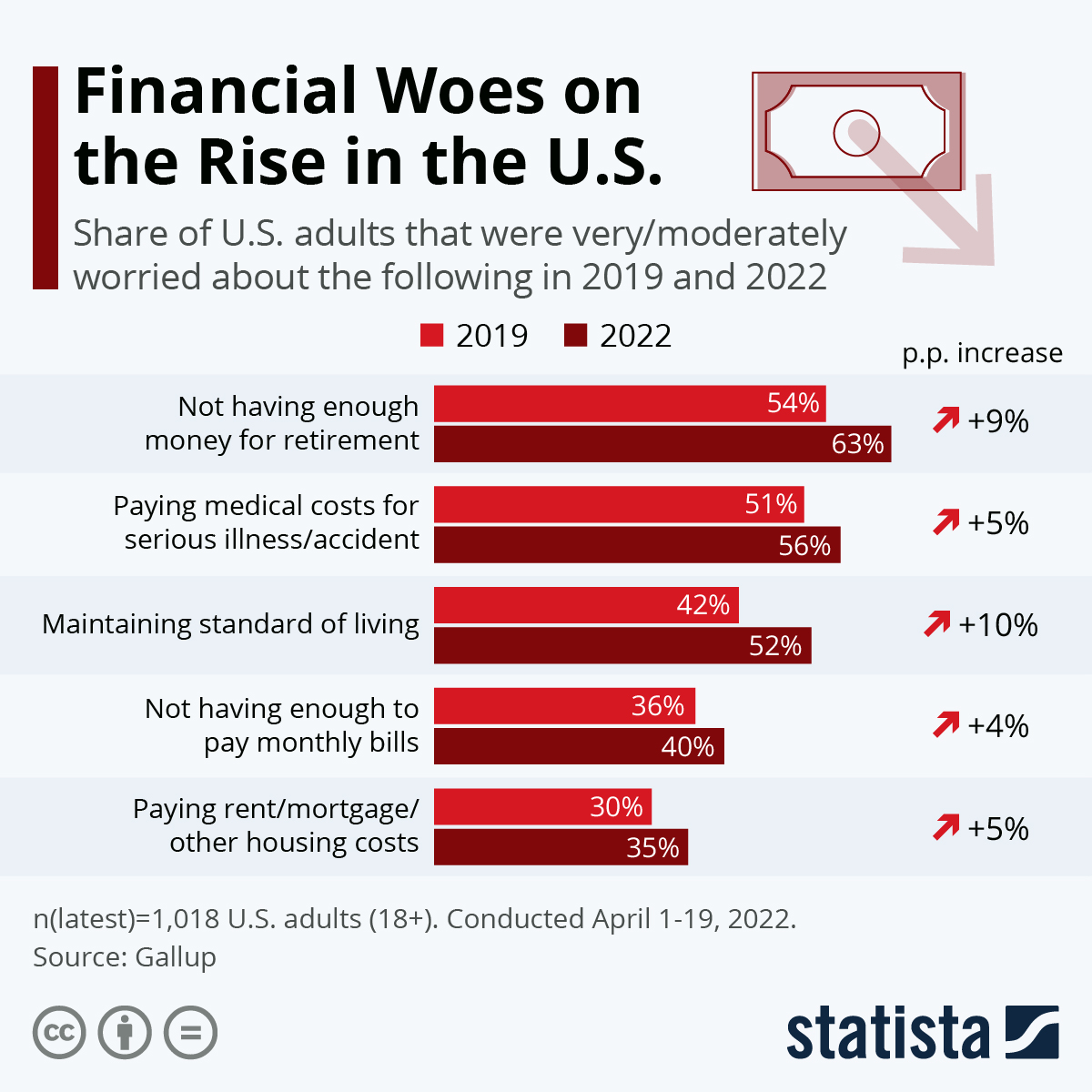

The statistics prove that Americans are becoming more stressed about paying their expenses.

Everything is getting more expensive.

People are struggling. We see it and we feel it.

What can we say at this point. You want me to tell you things are good? They aren’t.

Look around you. Does it look like things are thriving?

All we can do is focus on ourselves, our families, and how we can make things better.

We got this. 💪

Add comment