Tuesday morning, the Bureau of Labor Statistics (BLS) revealed there was a 0.5 percent rise in wholesale prices (PPI) in the month of April, supplying more ammunition to Federal Reserve Chair Jerome Powell’s argument that inflation is high and that rates should not receive cuts anytime soon.

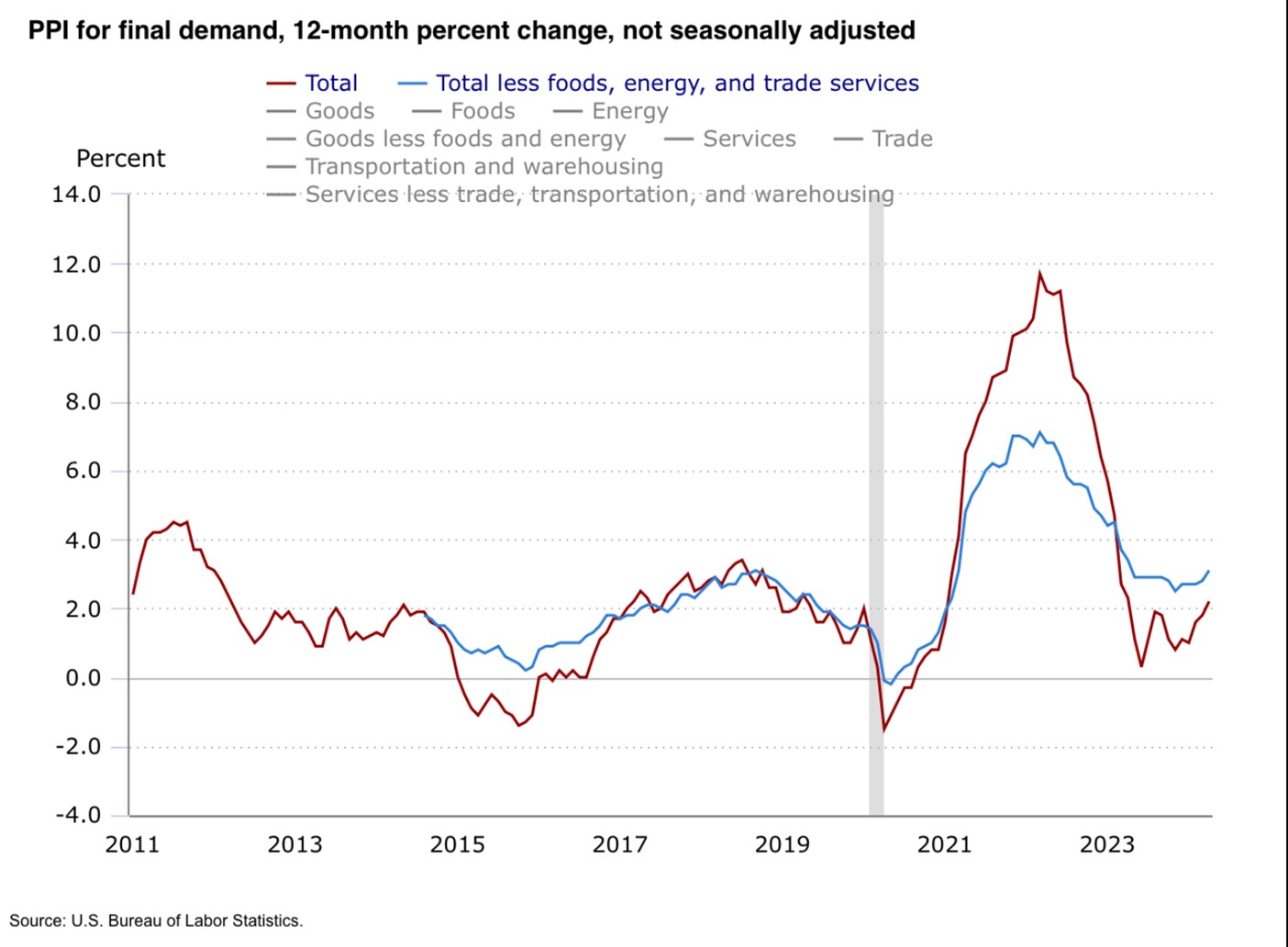

The monthly Producer Price Inflation (PPI) report, which measures what producers actually receive for the goods they make, showed a 0.5 percent rise in April for a 2.2 percent increase in the twelve months ending April 2024. PPI is an important metric the government uses to track inflation, which informs monetary policy. While metrics like the Consumer Price Index (CPI) are meant to track inflation by looking at retail items like grocery store products, clothes, electronics, etc., the PPI looks at prices of products before they hit retail shelves.

For example, if a company produces bread, the PPI would measure the prices they pay for their raw ingredients, as well as the wholesale price they charge grocery stores. The CPI would measure the final price for the bread to the end consumer. This follows from last month’s release of March CPI data, which showed a 3.5 percent annual increase.

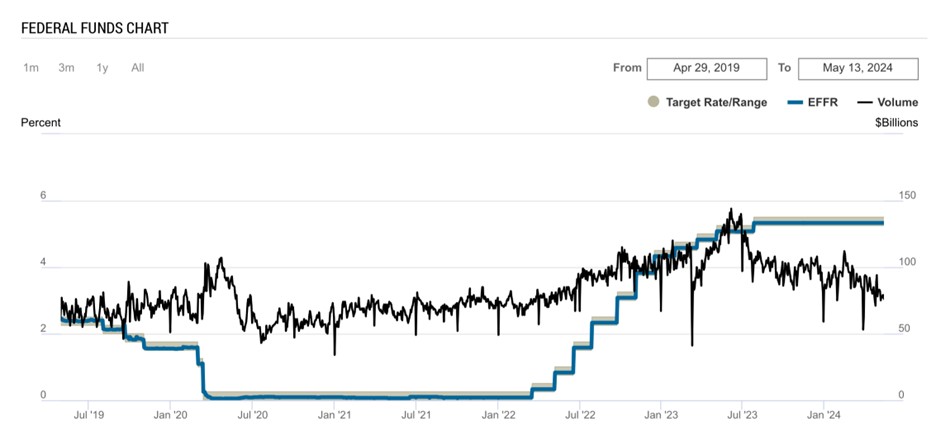

PPI has cooled off from its highs in 2021 and 2022, but monetary policy makers may be concerned with the uptick in a higher interest rate environment. Speaking at a conference in Amsterdam on Tuesday, Powell said the Fed would be “keeping policy at the current rate for a longer time than had been thought” because the US economy, while “performing very well lately,” has been notable for its “lack of progress” in the first months of 2024. The Fed must be “patient and let restrictive policy do its work,” he added.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

The Federal Reserve operates on the understanding that higher interest rates can be used to restrain inflation. This may provide insight into the recent Fed interest rate decisions over the past year.

Adherents of the economics schools of Modern Monetary Theory (MMT) would place blame for the recent inflation on suppliers. However, the PPI data shows fundamental pressure on suppliers as well. Adherents of the Austrian School of economics have a contrasting conception of inflation. As The Mises Institute, named after famous economist Ludwig Von Mises, argues in a 2020 article: “The reality of inflation is its association with the diversion of real wealth from one individual to another by means of an expansion in the money supply.” In other words, the root cause is the government printing money, not suppliers arbitrarily deciding to raise prices.

Politicians and pundits have sparred over these competing ideas about inflation. Democratic Socialist Senator Bernie Sanders (I-VT) places the blame on “corporate greed” in various large industries.

The oil and gas industry is making huge profits. The pharmaceutical industry is making huge profits. The food industry is making huge profits. Outrageous levels of corporate greed are fueling the inflation that is hurting so many people. pic.twitter.com/M562JslXgx

— Bernie Sanders (@BernieSanders) October 16, 2022

By contrast, free market commentator Peter Schiff took to X to criticize the Fed, pointing to their “easy monetary policy during COVID” as a root cause of the inflation problem.

#Powell refuses to acknowledge that the Fed's excessively easy monetary policy during Covid was a mistake and that it resulted in the current #inflation problem. Since the #Fed doesn't understand its own mistakes it's sure to repeat them. Therefore Inflation is headed far higher.

— Peter Schiff (@PeterSchiff) May 14, 2024

A Heritage Foundation economist posted that “inflation is not dead; it is getting worse.”

August came early to DC today: it's hot and sticky inflation in producer prices w/ PPI up 0.5% M/M for Apr and 2.2% Y/Y – that's the fastest annual increase since Apr '23…

…inflation is NOT dead; it's getting worse: pic.twitter.com/QXsIjmWfNO— E.J. Antoni, Ph.D. (@RealEJAntoni) May 14, 2024

This new inflation data and discourse surrounding it are likely to continue, as inflation and the economy rank as the top issue among likely 2024 election voters.

Add comment