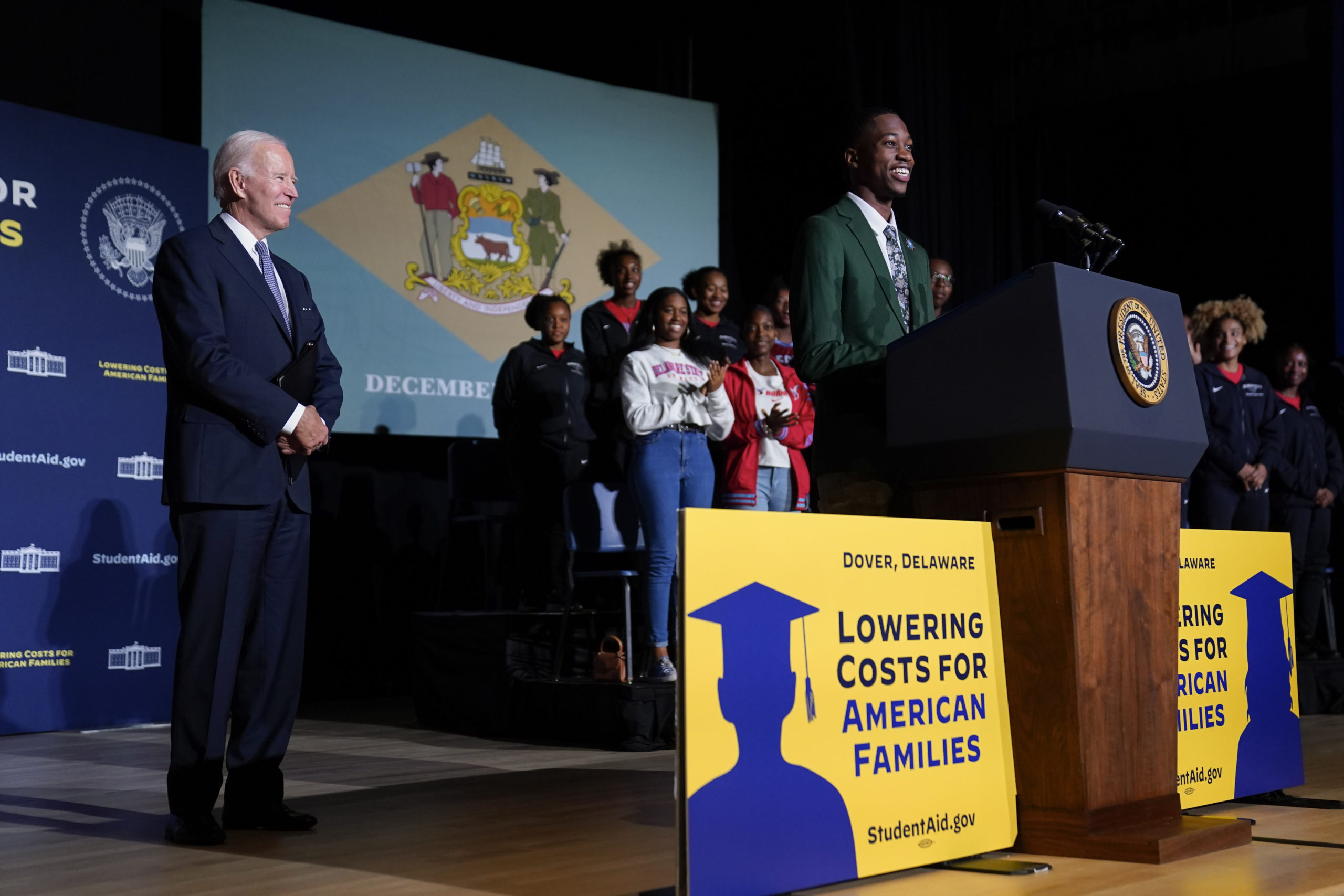

The hope to relieve some of the $1.75 trillion student loan debt owed collectively in the U.S. is now on hold. A Texas judge recently struck down President Biden’s student loan forgiveness plan. Shortly after the decision, the announcement came that applications for the student loan debt relief program are no longer being accepted. The Biden administration also announced its promise to continue to push for the program.

According to numbers by Nerdwallet, an estimated 20 million borrowers would have had their debt completely wiped away. According to the most recent consumer index report, inflation is lower, but not by significant amounts. This means the forty-five million Americans who owe student debt may fall further behind. According to Nerdwallet, of those 45 million people, the age group 25 to 34 is most likely to hold student loan debt. However, the greatest amount is owed by the age group 35 to 49. Among these borrowers, women borrow the most, and black students borrow more significant amounts more often.

What happens next is a long waiting game. The pause on student loan payments was first initiated during the start of the pandemic. That freeze will end on December 31st. So far, it has yet to be said if President Biden plans to extend the pause on payments. The student debt relief plan was already on hold because of another lawsuit filed by six states. The Republican-led states argue relief would hurt their states’ tax revenues. Both cases could take months to decide.

Add comment