Lenders with less than $250 billion in assets account for 80% of commercial real estate lending according to a report by Goldman Sachs economists Manuel Abecasis and David Mericle.

“Our economists assumed that small banks with a low share of FDIC-covered deposits reduce new lending by 40%”

(Source)

Stress Among Small Banks is Likely to Slow the US Economy (goldmansachs.com)

Commercial property prices could fall as much as 40% “rivaling the decline during the 2008 financial crisis,” forecast Morgan Stanley analysts.

(Source)

Morgan Stanley commercial real estate report predicts steep price drop (usatoday.com)

John Kerschner, head of U.S. securitized products at Janus Henderson Investors said his rough guess is that about 10% to 20% of office buildings will need to be turned over to lenders in the coming years. Prices of commercial mortgage securities with office exposure, in his view, generally still have room to fall farther.

“What we’re doing is being patient, staying away from all but the obvious trades and then just waiting for the distress to come to us, because it will happen,”

(Source)

Office Vacancies Send Real-Estate Investors to the Exits – WSJ

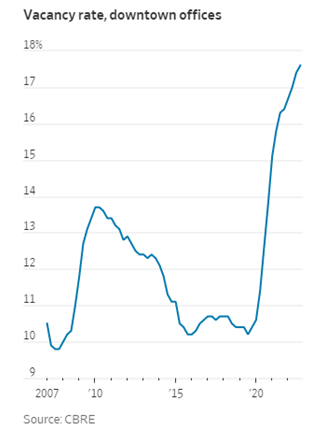

In downtown areas, the office vacancy rate reached 17.6% in the last three months of 2022, up from 13.8% two years earlier, according to the real-estate services firm CBRE.

Regarding office loans since 2021, 44% more were in delinquency by volume.

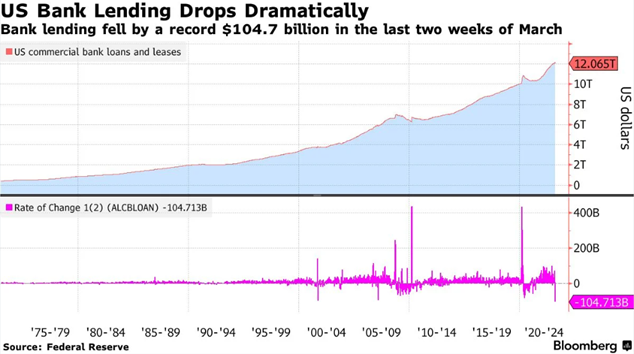

During the last two weeks of March, the biggest decline of U.S. bank lending in History took place!

There’s NOTHING more deflationary for the economy than the reduction of commercial bank lending. It’s directly correlated with the amount of money in the economy. When the Fed does QE it’s basically giving commercial banks excess reserves to lend more if they want to. The Fed cannot inject money directly into the economy, the commercial banks serve as a middleman.

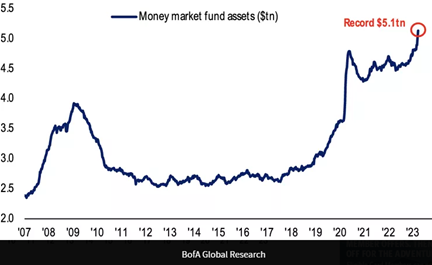

The biggest reason for the contraction in bank loans is that withdrawals have been increasing, withdrawals have been increasing because a record amount of money has been getting moved to money market accounts. Money Markets are paying roughly 5% interest while banks are paying 0% interest, so anybody with a shred of common sense is going to move their savings into a Money Market account instead of getting a 0% return.

These bank lending cuts are likely the final nail in the coffin for the economy, EVERYTHING will start falling apart if that continues.

Buckle up, things are about to get crazy! I would not be surprised if the S&P drops to 2,500 this year.

Sincerely,

Brandon

Add comment