In August, Chinese real estate developer Country Garden Holdings failed to make two debt payments totaling $22.5 million and in turn received a 30-day grace period to pay. Then, it narrowly avoided default during the grace period by making interest payments in early September. Why is the largest company in the entire Chinese real estate industry struggling to make such a simple payment?

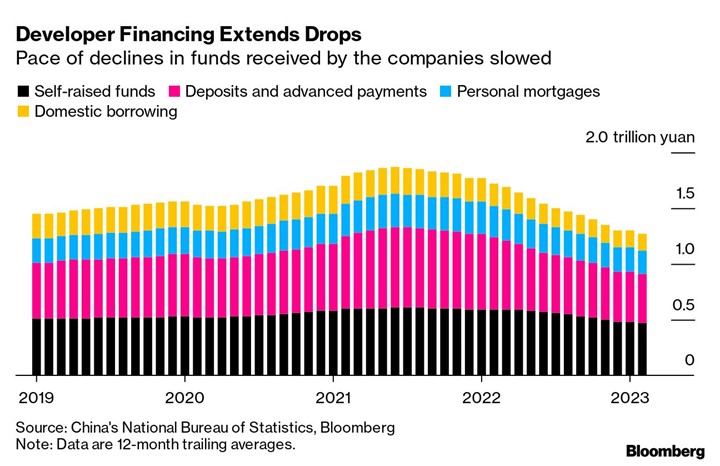

Country Garden said it will see a net loss of 45 to 55 billion yuan ($6.24-$7.63 billion) over the first six months of 2023, compared to the profit of 1.91 billion yuan (roughly $260 million) it saw during the same timeframe last year. In July, new home sales by China’s 100 biggest real estate developers fell 33% from a year before, according to data from the China Real Estate Information Corp reported by The New York Times. According to Bloomberg, China’s developers are experiencing a precipitous decline in financing since June 2021.

China’s Real Estate Market

This matters because in China, real estate companies are allowed to sell mortgages to homes before they are built, and people need to make their mortgage payments prior to moving in. More than 85 percent of Chinese homes are sold this way, up from 50 percent in 2005. In October 2022, there was a mass boycott in Shanghai where Chinese citizens refused to make their mortgage payments to protest a developer’s repeated delays in the providing apartments they were paying for.

In China, the real estate industry accounts for 25-30% of the country’s GDP, whereas in America it accounts for about 17%. In China, only around 7% of the population own stocks, while roughly 90% are homeowners, while in the U.S. roughly 53% of the country owns stocks and 65% of Americans own real estate. More than 20% of Chinese households own more than one home, as many see it as a highly lucrative investment asset. Most of these second or multiple homes are vacant to preserve value: anywhere from 65 to 90 million of the housing units in China are estimated to lie empty.

This means that China heavily relies on its real estate market, and a collapse in that sector would affect their economy even more heavily than it would in the U.S.

Even as there are so many homes in China and so many are empty, housing is four times more expensive in major Chinese cities (Beijing, Hong Kong, Shanghai, Shenzhen) compared to New York City and San Francisco, cities which are seen to have astronomical housing prices in the eyes of most Americans.

Social Pressure

To make matters worse, there is a high degree of social pressure to own these difficult-to-get homes. In China, there is additional stress for the men already competing to find a mate (there are 33.59 million more men than women in China due to the one-child policy in place from 1980 to 2016) to obtain homes because of the unwritten “mother-in-law economy,” or the social stigma against men seeking to become husbands who do not own a home.

Growing Too Fast

Why is this happening? We can apply what is happening in China to a hypothetical business. Why might a business be missing payments and failing to provide its product to customers who have put in orders for it? There are two ways a company can go out of business: it grows too slow, or it grows too fast. China’s rapid urbanization, or the process by which large numbers of people become permanently concentrated in relatively small areas leading to the formation of bigger cities, has occurred at a pace unheard of in human history. In 1980, an estimated 19.39% of China’s population lived in urban areas. That number jumped by nearly 30 percent in forty years, and has risen steadily to 65.22% in 2022.

This massive rise in urbanization led to accelerated urban real estate development, and as all Chinese urban land is owned by the government with residents merely leasing it from them, all of this developing was intimately bound up with the public economy and the government’s regulatory standards and measures.

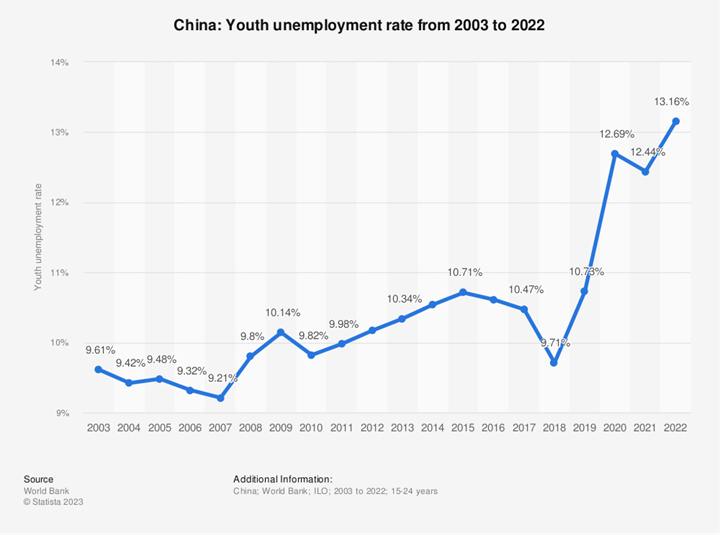

This combined with other factors has caused to experience a period of deflation. This has caused 1) consumption to go down 2) businesses to cut prices 3) consumers to expect prices to go down and thus hold off on purchases, and 4) businesses to lay off employees.

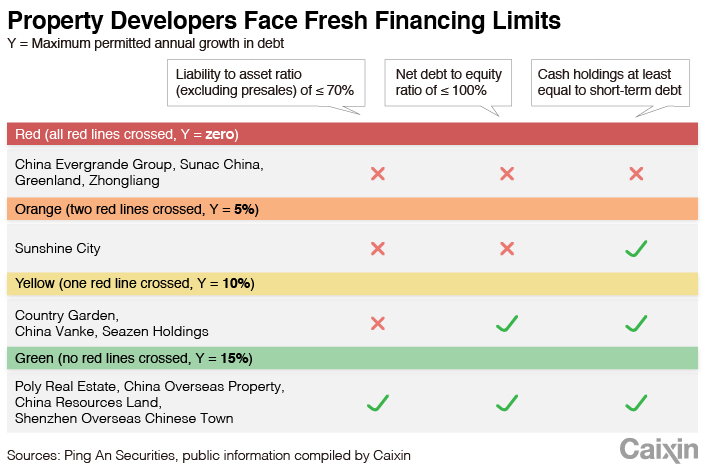

To try to get a handle on all this, the Chinese government has started to crackdown on real estate developers, hitting them with strict financing limitations.

All this is starting to catch up. China is experiencing its largest exodus of millionaires and billionaires, with some 10,800 “high-net-worth individuals” leaving in 2022 and another 13,500 expected to leave in 2023, according to CNBC.

When governments regulate the economy, and when developers engage in get-rich quick schemes like creating tons of homes to inflate real estate values, reality eventually catches up with the numbers and the trends come crashing down. It would be wise for entrepreneurs and investors alike to keep an eye on the situation unfolding in China and how it might affect the global economy.

Add comment