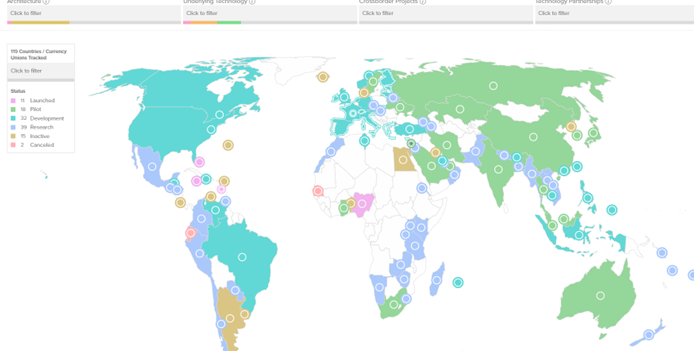

Momentum for a Central Bank Digital Currency has been increasing around the world. Currently 114 countries are exploring a CBDC. Equaling 95 percent of global GDP. The pace has escalated rapidly, according to AtlanticCouncil.org in May 2020, only 35 countries were considering a CBDC. Currently, 60 countries are in the advanced phases of exploring Central Bank Digital Currencies, while in the last 2 years 11 countries have launched a digital currency into full operation.

From AtlanticCouncil.org:

The 11 countries that have launched a CBDC are Nigeria, Bahamas, Anguilla, Dominica, Grenada, Saint Lucia, Montserrat, Saint Vincent / Grenadines Saint, Kitts / Nevis, and most recently Jamaica.

Obviously, these are very small countries with low GDPs, but all G7 economies have now entered the development stage of a CBDC, and China’s Pilot is set to be rolled out to most of the country this year.

Additionally, 18 of the G20 countries are now in the advanced stage of CBDC development and nearly every G20 country has invested a significant amount of time and resources into these projects over the past six months.

Several factors are responsible for the increased pace of the CBDC programs. First is the fact that governments care deeply about being in control of the movement of money. That is why the government always has a very close relationship with the large banks. The world governments realize they will lose a great deal of control if they do not get ahead of this.

The second reason is that the governments would love to implement a centralized banking system for all depositors. Imagine the amount of control that would allow them to have over the economy. For example, it would make it very easy to stimulate or tighten the economy. All they would need to do is send direct deposits to account holders to stimulate and set spending limits to tighten.

This is a terrifying notion to consider, but that is exactly what it would look like. For example, China puts an expiration date on its Digital Yuan when it wants people to spend money.

Additionally, this is exactly how the government can implement the social credit score and carbon tax that they’ve been talking about.

Some experts argue that the Government CBDC programs are just for optics and that they aren’t anywhere close to having the ability to implement this system.

Even if they were able to pull this off from an infrastructure standpoint it would be very difficult to gain public support for it. The only way I can see them pulling that off is in the scenario that a financial crisis takes place, and they sell the public on the CBDC being the solution to bring stability.

This is a very deep topic and there’s much more to unpack, consider this the tip of the iceberg for diving down this rabbit hole.

Sincerely,

Brandon

Add comment