In his latest video for Valuetainment, Patrick Bet-David explains the new concept of Buy Now, Pay Later (BNPL) and how it has become a popular way to buy things in today’s society.

It may be tempting for people, but these products cost a lot more than you think, and they can actually be more difficult to pay off than credit card debt.

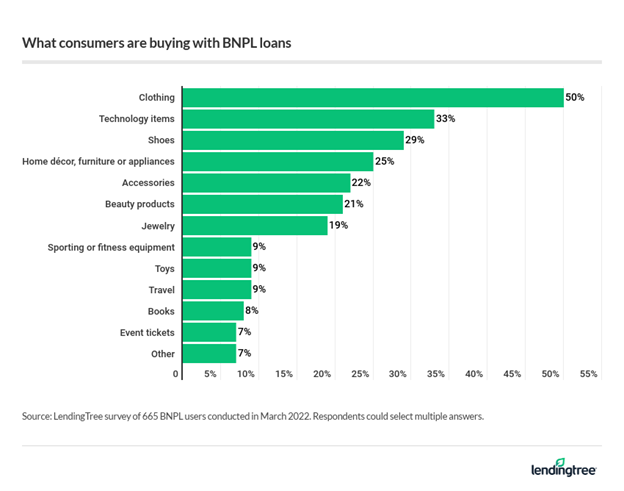

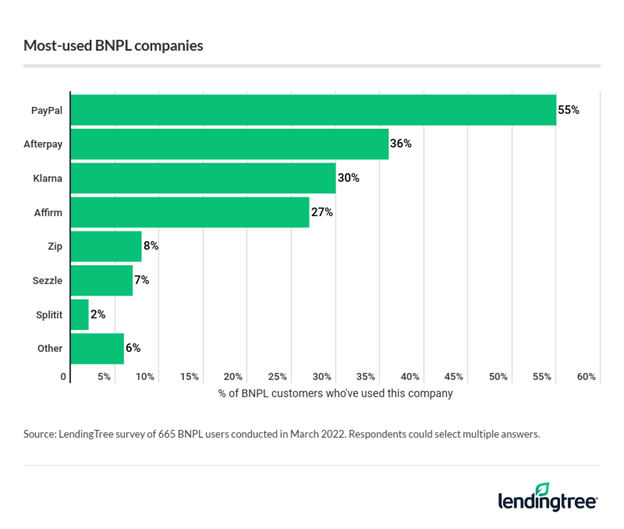

You may have heard of the several companies that offer “Buy Now, Pay Later”: Klarna, Affirm, Apple Pay, and Paypal. It allows people to pay small down payments on consumer goods and pay the rest off over a period of time — basically like a mortgage for a commodity (they have BNPL options for clothes, furniture, and even food like pizza).

The problem is, these apps usually charge astronomical interest rates (as high as 30 percent if not higher) and send delinquent buyers into far more debt than they signed up for. These companies, like Klarna, are getting paid 2-8 percent from the company selling the product.

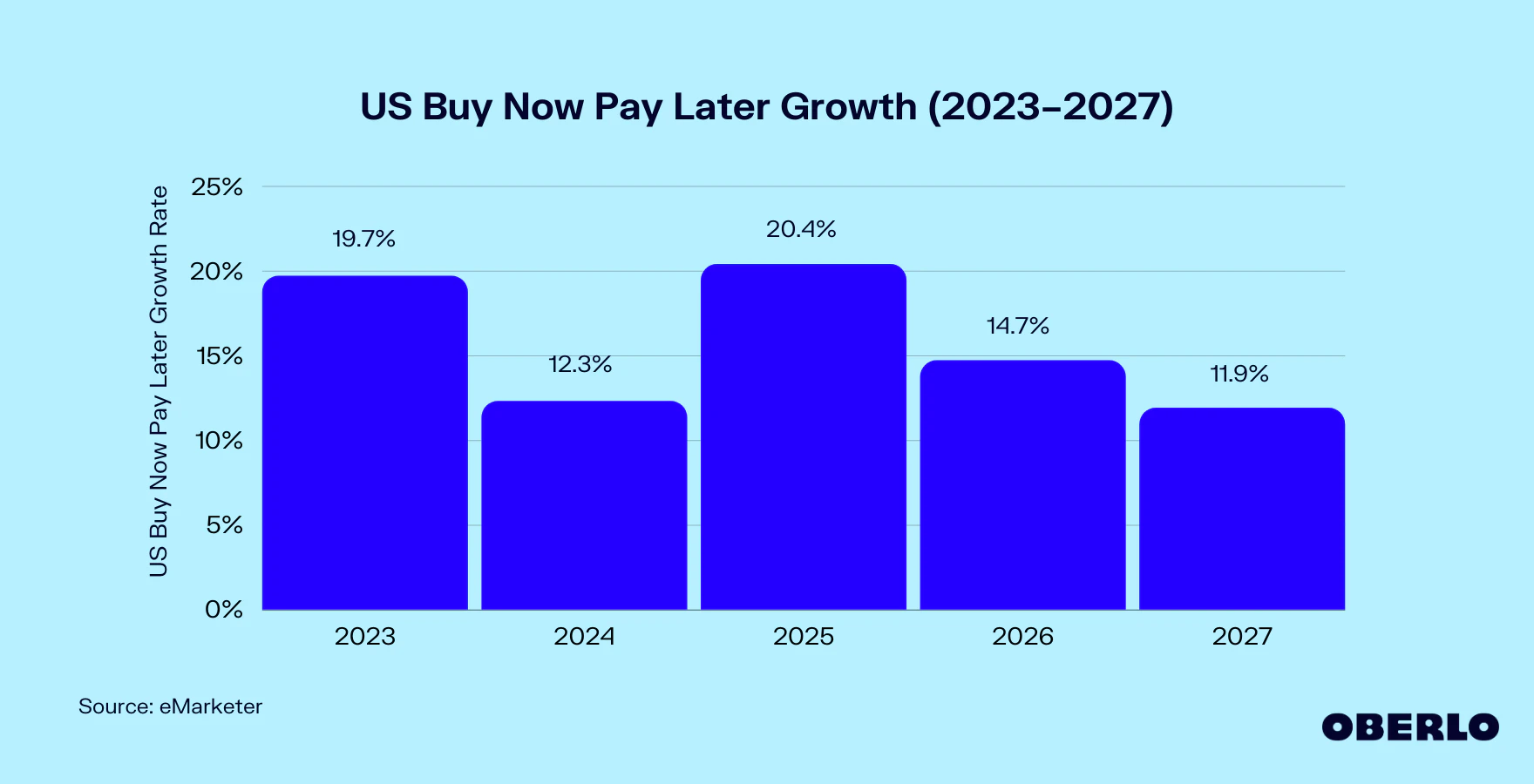

More than four in 10 Americans who have taken out a BNPL plan have made a late payment on their loan, according to a 2022 study by LendingTree. Additionally, the number of Americans who use BNPL plans has increased every year since 2021 and is projected to continue to rise into 2026, swelling to over 100 million, according to eMarketer.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

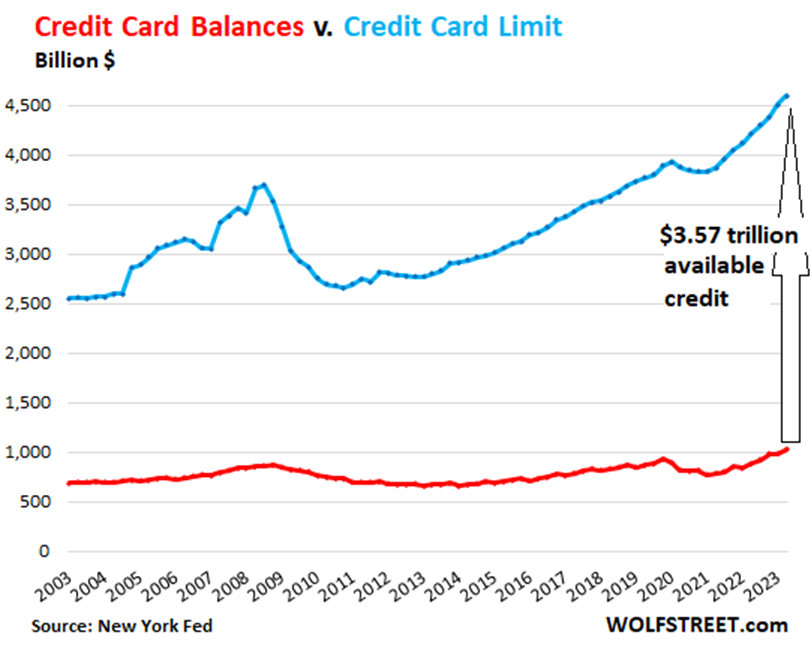

Meanwhile, credit card companies have near-universally increased their credit limits to the highest they have ever been. According to statistics from the New York Federal Reserve, the total credit available to users now stands at $3.57 trillion. As The Wall Street Journal reported in Sept. 2023, the largest banks in America have raised limits on 18.4 million credit card accounts in Q1 2023, a 22 percent increase from where they were in Q1 2019. This seems to have caused the desired effect of higher spending, with consumers using eight percent of available credit. Furthermore, banks reportedly opened a record $89 billion worth of new credit card accounts in Q1 2023 (all of this according to data from the Philadelphia Federal Reserve).

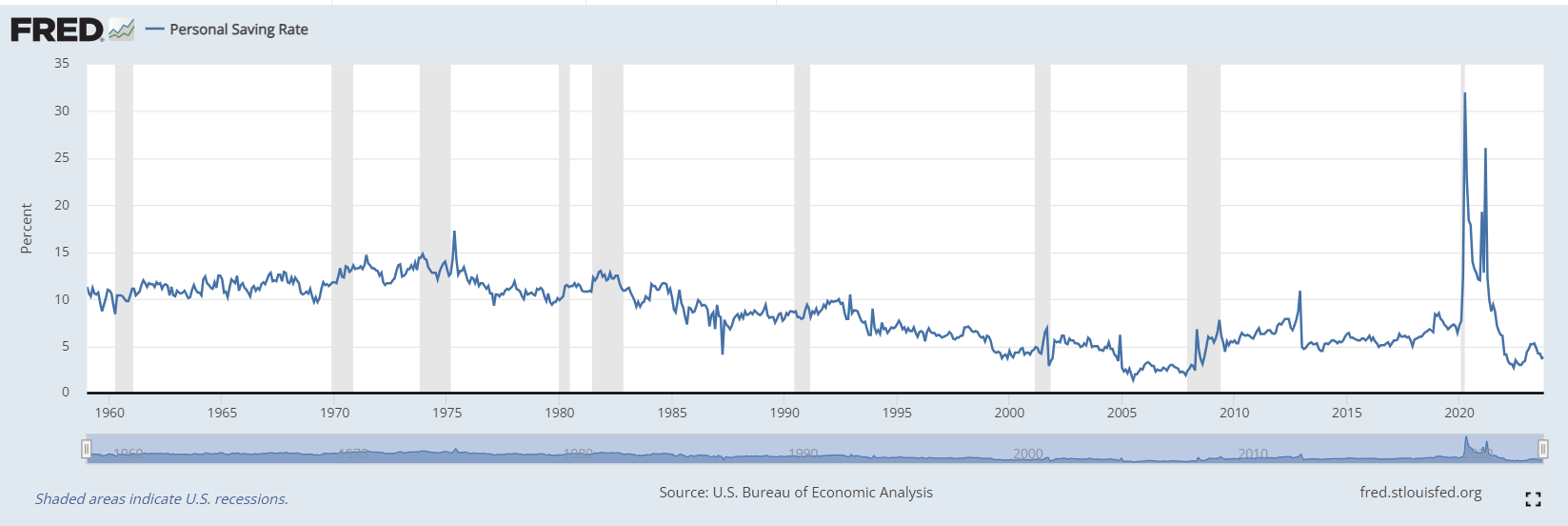

Some 70 percent of America’s gross domestic product (GDP) is derived from consumer spending. American spending is out the window today, with personal saving rates at a record low. This is caused not least by 5 percent high interest rate and a surge in the cost of living.

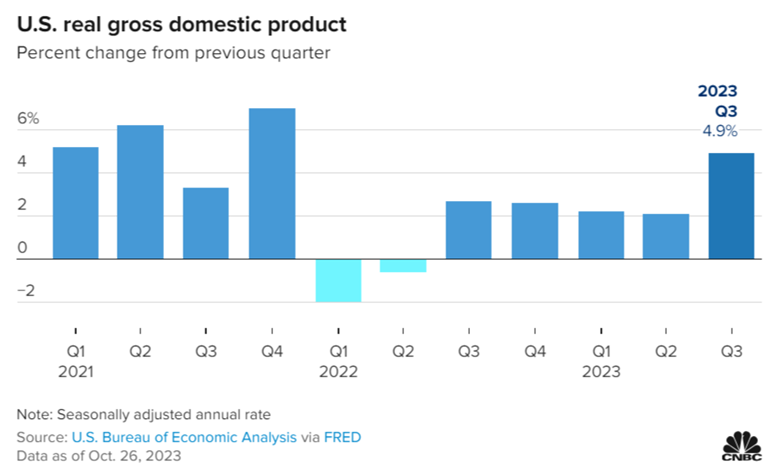

While this may be bad for the American consumer, it is great for the government and the plutocrats that enjoy the fruits of a high GDP. In Q3 2023, the GDP increased by 4.9 percent according to data from the St. Louis Federal Reserve. As PBD puts it, in the same way that oil equates to revenue for Saudi Arabia, consuming equates to revenue for the United States.

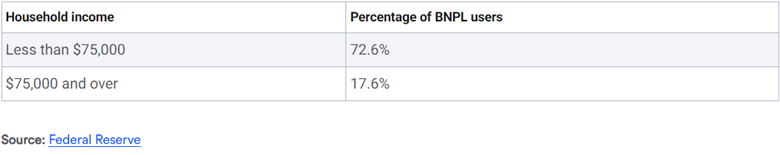

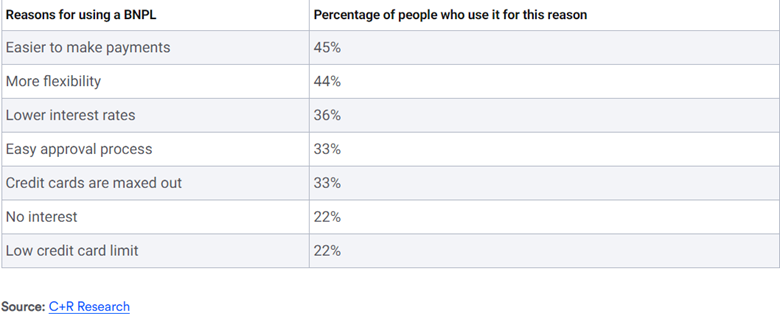

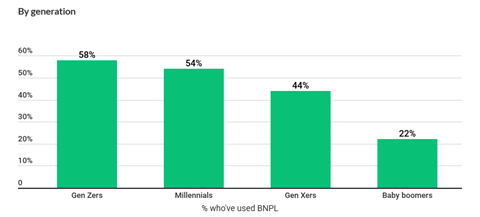

Here are some stats about who is using this and for what:

And here are the worst offenders:

The various negative consequences of BNPL include: being charged interest on missed payments, having your account turned over to a collections agency, a damaged credit score, and difficulty in making returns.

Watch the rest of the video to hear Patrick’s thoughts on credit card debt.

Add comment