Patrick Bet-David explains why the stock market has not crashed yet, even though interest rates have gone up at the fastest pace in recent history. PBD also shares data that will tell you when the market is most likely to crash and the reason behind it.

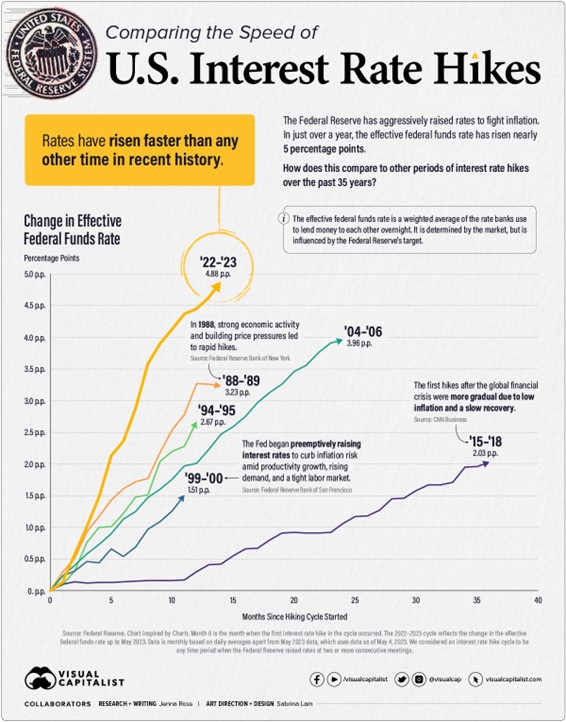

Here’s U.S. interest rate hikes over history. We have never raised 4.88 percentage points as quickly as we did over the last two years. The slowest rate was between 2015 and 2018 when we raised 2 points. Second slowest was between 1999 and 2000 when we raised 1.51 points. The second fastest was between 1988 and 1989 for 3.23 points. But nothing comes close to what we’re going through now.

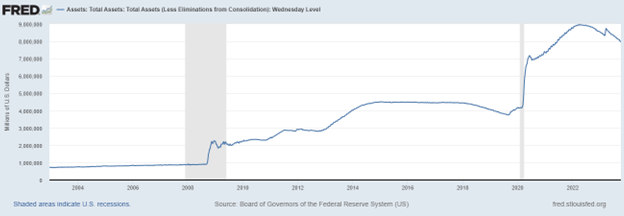

If we look at how many bonds the Federal Reserve is buying (top chart), we see it is increasing. If we look at how much money is circulating in the U.S. economy (bottom chart), we see that is increasing as well.

If you look at the 2020 point, we see a sharp increase compared to before and after: we fed the market with trillions of dollars. And we have no historical case study for what will happen.

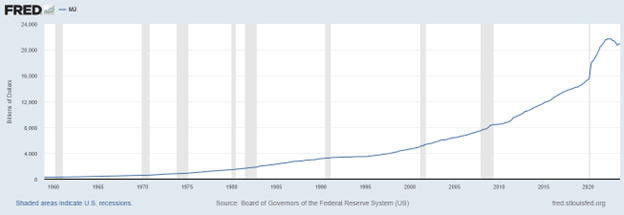

What’s next for the U.S. economy? The New York Federal Reserve conducted a survey with Goldman Sachs Investment Research, Bank of America and other organizations to gauge where people think the economy is going. They found that 0 percent of Fed staff think a recession is coming, but as for the rest of America, 48 percent of economists, 69 percent of consumers (main street), 15 percent of Goldman Sachs, 35-40 percent of Bank of America, and 84 percent of CEOs think a recession is coming.

What would CEOs know that the rest don’t? They are in charge of their companies’ debt payments. They know their debt interest rates have increased. They might know they won’t be able to pay them back!

Of the 500 biggest companies that make up the American economy (the S&P 500), seven of them make up 28 percent of the pie. These so-called ‘Magnificent 7’ are Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta.

This has never been the case in the history of the S&P 500.

Across the S&P 500, companies have seen a 12.4 percent return in 2023, while the Magnificent 7 have seen a 92 percent return.

If you take these 7 stocks out, the S&P 500 is actually down.

Furthermore, if you compare the exchanges of large cap, mid cap, and small cap companies (S&P 500 ($12.7 billion+), RUSSELL 2000 ($300 million to $2 billion), and MICRO-CAP ($50 million to $300 million)), you will see wildly different results.

S&P 500 is up 18.6 percent, Russell is up 7 percent, while Micro-cap is down 1.85 percent. We cannot fool ourselves that the market is up: the Magnificent 7 is pulling the economy up.

U.S. consumer credit card debt tops $1 trillion, the highest it has been in the history of America.

According to the Fed and shown below, the average credit card interest rate is 21%, up over 6% since the Fed started raising rates.

And now, 30 to 40 million Americans will see their student debt payments return in October after they had been deferred by the Biden administration since the outbreak of the COVID pandemic.

Currently, mortgage rates are well over 7 percent (in some cases at 8 percent), about four or five percent higher than the lowest mortgage rates we had set earlier in 2022.

Despite the sharp increase in rates, the weighted average rate has barely budged. Only people who are buying houses are being affected by the new mortgage rates, and there are not that many home buyers currently. People are not refinancing because of the high rates. And now people are not selling because they don’t want to get rid of their good rate they are locked into.

This is causing a lag effect. According to past data, it takes about eleven months on average after halting interest rate hikes for it to take effect.

How come more corporations aren’t filing for bankruptcy like they were in 2008? Because companies were taking millions and billions from banks, with full approval from the government, during the pandemic to keep themselves afloat. But will they be able to make back their payments when push comes to shove?

(RELATED: WeWork on the Cusp of Default After Skipping $95 Million in Payments)

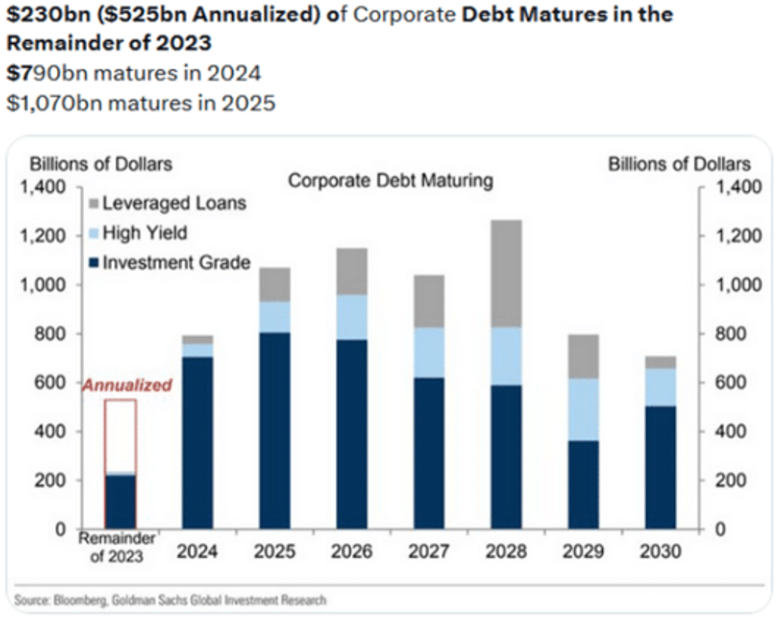

If you look at this chart below, we see an analysis of corporate debt maturation in billions of dollars (source: Bloomberg/Goldman Sachs). For the remainder of 2023, corporations have roughly another $220 billion left to pay.

They are going to end up paying a total of $520 billion for 2023. But in 2024, they are projected to pay roughly $800 billion as the debt matures. In 2025, 1.1 trillion. In 2028, 1.3 trillion.

Maybe THIS is why CEOs are so pessimistic about a recession!

And just like its many college kids, the United States of America owes a lot of money and the payment is coming soon.

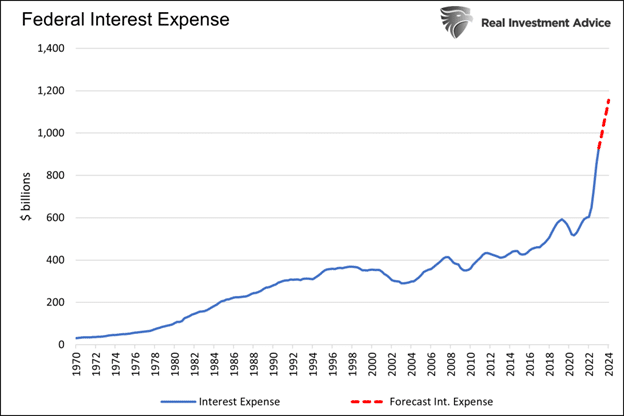

The U.S. roughly owes $33 trillion in national debt. Each 1 percent increase in interest rates pushes the government’s interest up by $320 billion. The costs the government has incurred on interest on the debt alone has skyrocketed since the pandemic and its spending spree began.

Our federal debt is rapidly outpacing its revenue (taxes). And we the taxpayer will get saddled with the costs in the form of increased taxes and prices.

If your tolerance for risk isn’t high, don’t take risks. But for those who are more adventurous, the next year will be a great time to make investment moves that the more conservative won’t be making. And as always, only the paranoid survive.

CONCLUSION:

- There’s a lot of people saying the market will hold up

- A lot of people are surprised that increasing rates has not impacted the market

- According to historical data, it is not surprising that the market has not been impacted yet. But the market will in all likelihood be severely impacted soon.

Add comment