In Patrick Bet-David’s latest video, he exposes the hollowness of the “Tax the Rich” slogan pushed by figures like Robert Reich, Rep. Alexandria Ocasio-Cortez, and Sen. Elizabeth Warren by analyzing the amount the top one percent of wealth-holding individuals already pay in taxes.

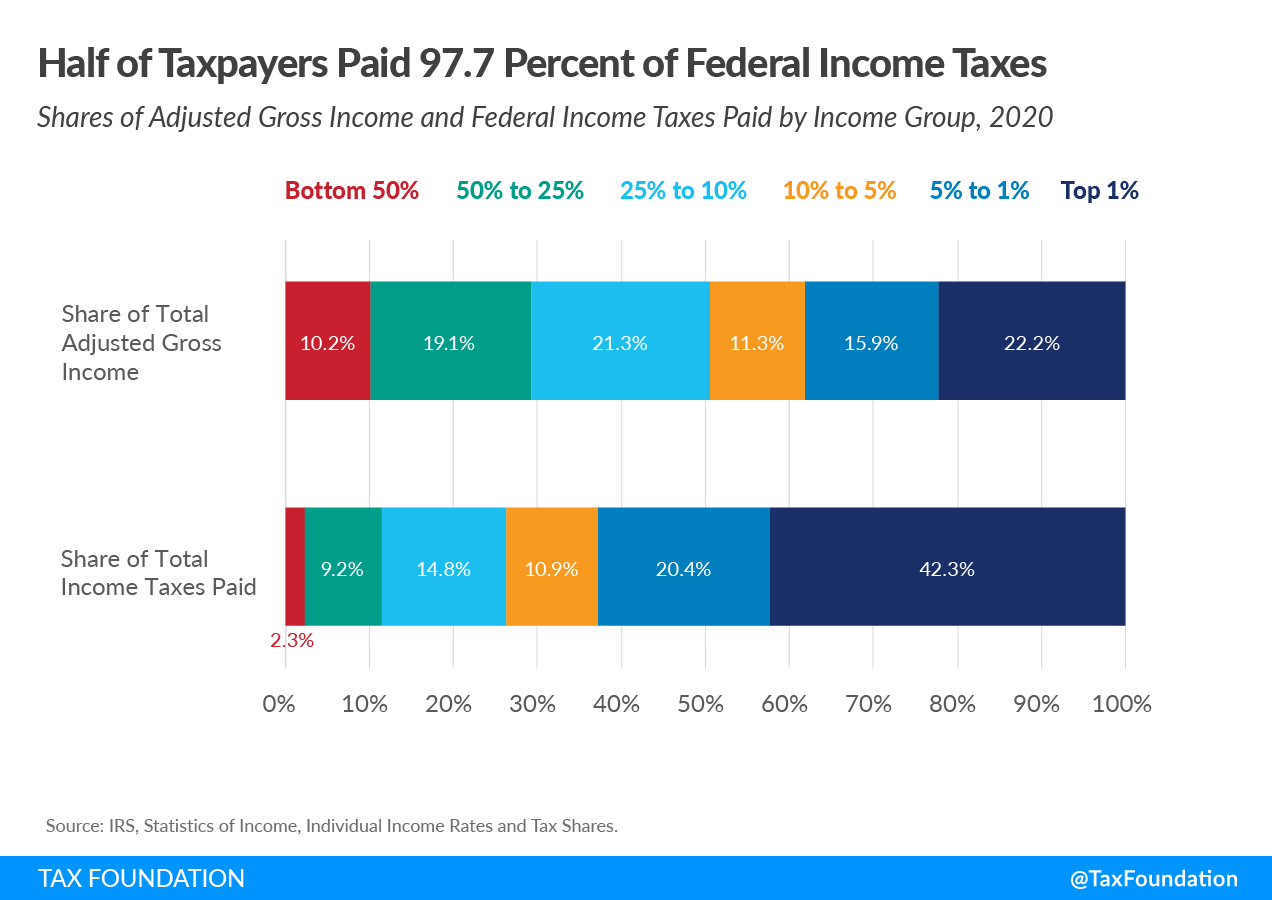

The top 1 percent make 22 percent of all income in America, but pay 44 percent of all taxes. By contrast, the bottom 50 percent share a total of 10.2 percent of national income while contributing only 2.3 percent in taxes.

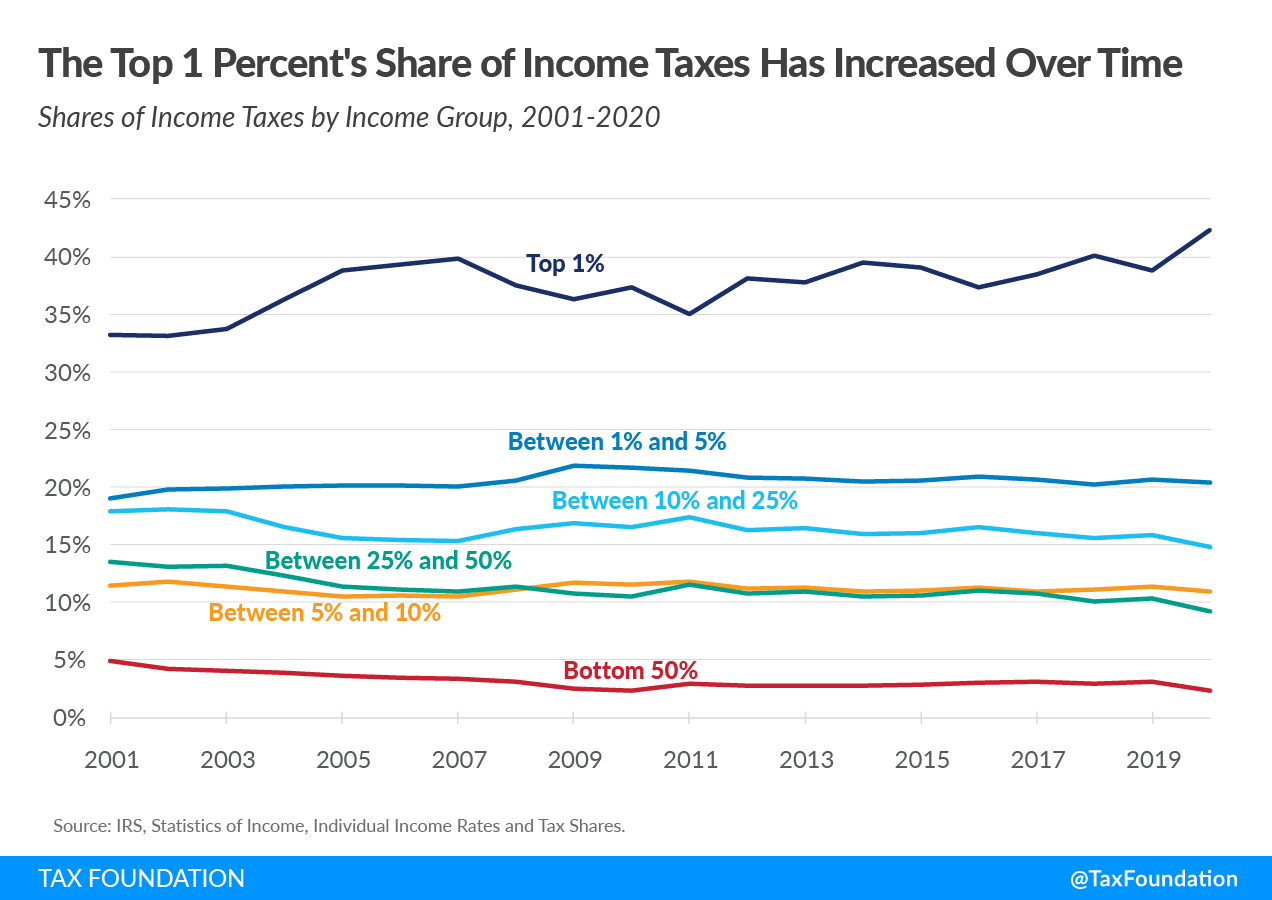

The top 1 percent’s share of income taxes has actually increased over time, from 35 percent in 2001 to 43 percent in 2019.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Meanwhile, the bottom 50 percent’s taxes keep getting lower and lower. Those between 25 percent and 50 percent have declined as well.

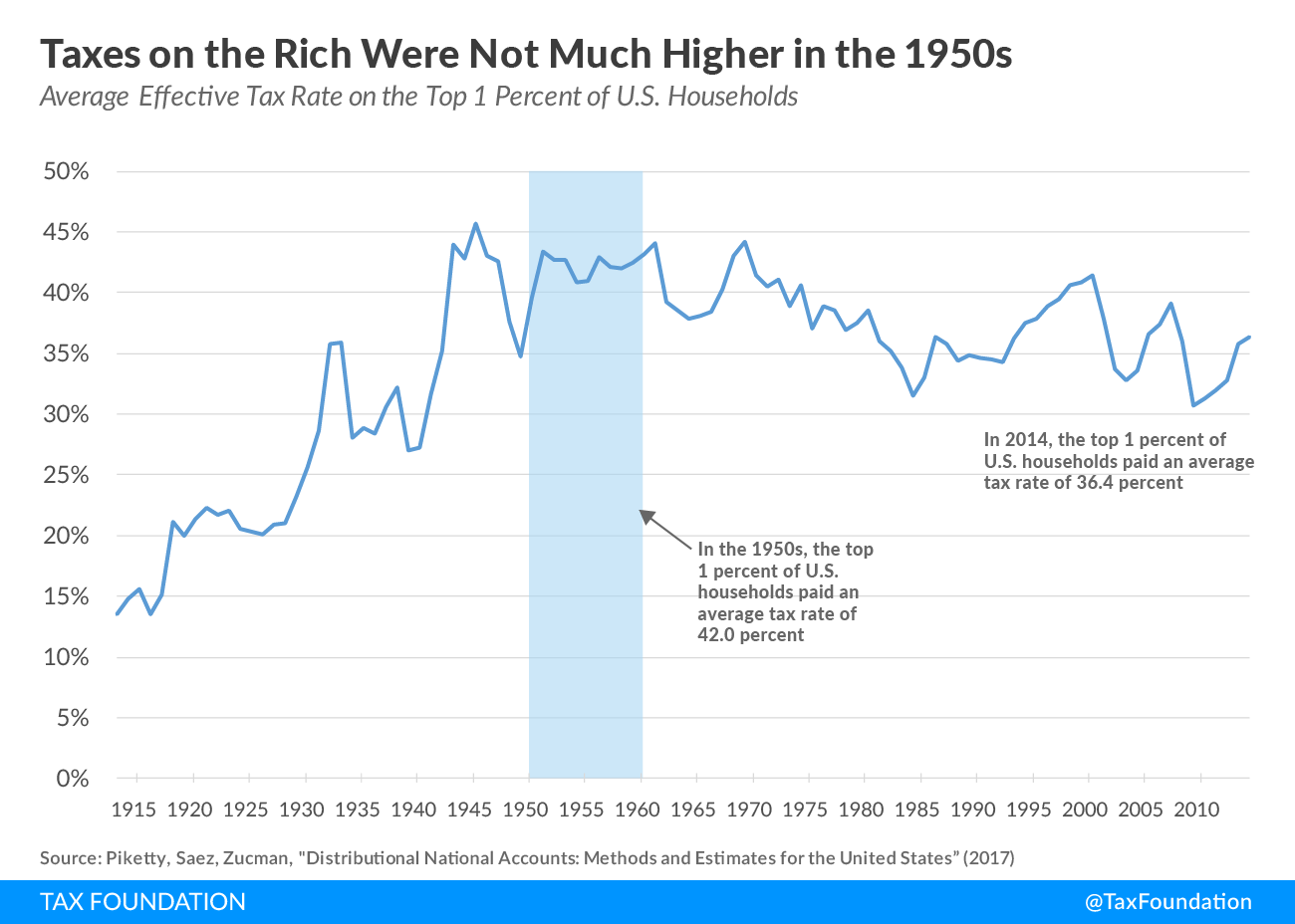

What about the talking point that taxes were far higher for the rich under President Eisenhower in the 1950s? The marginal tax rate, they point out, was 94 percent in 1945 and after, while they dropped to 30 percent in 1980 with Ronald Reagan.

But some argue that nobody actually paid these high taxes back then. Additionally, in real terms, taxes were not much higher in the ‘50s than they are now.

Watch the rest of Patrick’s video to see just how much misinformation is packed into these common “Democratic Socialist” talking points.

Add comment