In the latest episode of The Biz Doc Podcast, Tom Ellsworth gets into a topic frequently suggested by our audience: the correlation between fed rates and interest rates, specifically in regard to mortgage rates.

Biz Doc kicks off with an in-depth analysis of fed rates, offering insights into the Federal Reserve’s recent actions. Then, he presents a case study on mortgage rates, providing valuable projections for the upcoming year. Tune in to gain a comprehensive understanding of these crucial economic indicators.

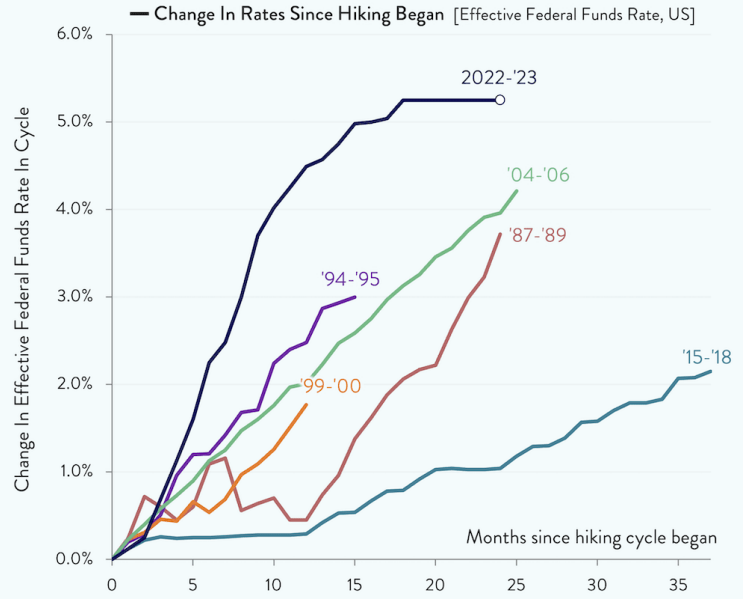

As Biz Doc shows, the 2022-2023 Federal Reserve interest rate hike has been the steepest and most dramatic hike in the last 35 years. Not only did it occur at a more rapid clip than any other beside the 87 hike, but it also jumped higher too, up to 5 percentage points.

The lesson here is that we are living in unprecedented highs. Everyone is waiting for the rates to quickly drop, and that just isn’t going to happen. We need to keep this in mind as we go into the mortgage rate case study.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

In the last Federal Reserve meeting, the regulators told the public that it is open to perhaps three more rate hikes before it stops. The Fed is set to announce its next plan around April 30th and May 1st. But unless the economy hits a radical downturn, in which the government will want to drop rates to allow businesses to borrow money super cheap to preserve jobs, then we can expect they will not announce any sizeable rate cuts.

But the headlines don’t reflect this. According to CNBC on March 20th, the “Weekly mortgage demand drops as interest rates rise again, but Fed announcement will be key for spring market.” Bankrate also signaled uncertainty with the confusing March 27th headline, “Mortgage rates rise dip, still about 7%.”

National Mortgage News told its readers that mortgage rates will stay high due to inflation on March 25th, and two days later reported that weekly purchase applications are down 15 percent compared to last year.

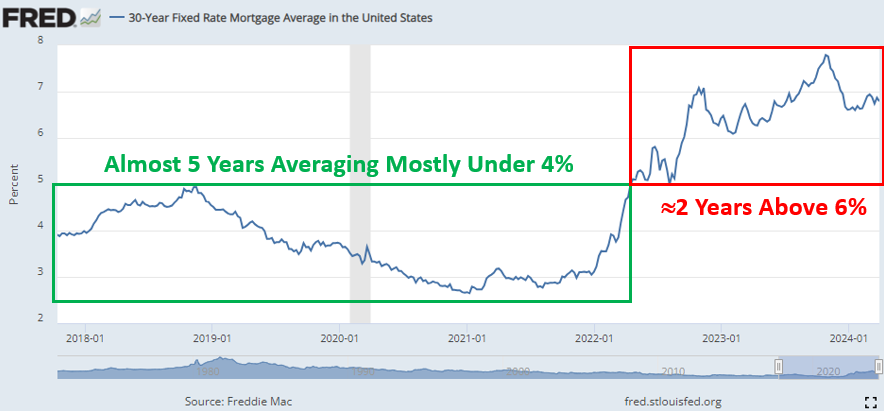

After nearly 5 years of 30-Year fixed mortgage rates hovering around 4 percent, toward the end of 2022 they went above 6 percent and have not come down since.

If one wants to get a 30-year mortgage for a $450,000 home and is able to give a down payment of $90,000 at a 4 percent interest rate, they needed an income of $58,000 to qualify. Now, if one wants the same mortgage with the same down payment, they need to have an income $82,000. The former mortgage requires a $1,719 monthly payment for both principal and interest; the latter requires $2,395.

It’s not the Federal Reserve alone that is driving this, but that’s a big part of it.

The key drivers include:

- Federal Reserve Rate – Bank borrowing cost

- Inflation – Impacts buyers ability to afford payments

- Economy – Unemployment raises risk of buyers losing jobs

- The Loan Market – More buyers = more competition for banks

- The Bond Market – Mortgages are “packaged” into bonds.

The mortgage bonds % is compared to other debt such as US treasury bonds or corporate bonds, the so-called “The debt market.”

“Spread” Represents Risk – Mortgages are More Risky.

2005 to 2019:

- Mortgages were 1.72% above 10-year Treasury

- In normal times investors are willing to invest in mortgage debt at 1.70% – 1.75% above treasury debt (assumed to be risk free)

2019 to 2022:

- COVID crushed the economy

- Fed dramatically raised rates in 2022 to fight inflation

2023:

- HIGH market uncertainty drove the spread to 4.89%

2024:

- Uncertainty is less & rate cuts are anticipated, the spread is 2.90%

There are risks to investors who hold mortgages. Prepayment risk: investors “LOSE” future income when homeowners refinance high-rate mortgages as soon as rates drop.

There is also the factor of Low Demand: there’s less demand for mortgage-debt in the Debt Market so the spread is higher to attract investors (more profitable debt).

- FED Cuts Rates

– BUT only .75% expected in 2024 – 3 cuts of .25 starting in Mid June - Stable Economy

– Inflation, unemployment, GDP growth all can help ease rates - On the Other Hand… a Recession

– Rates follow the economy to it’s a BAD News / GOOD News story.

Watch the end of the Biz Doc case study to see what he recommends for the next two years.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Add comment