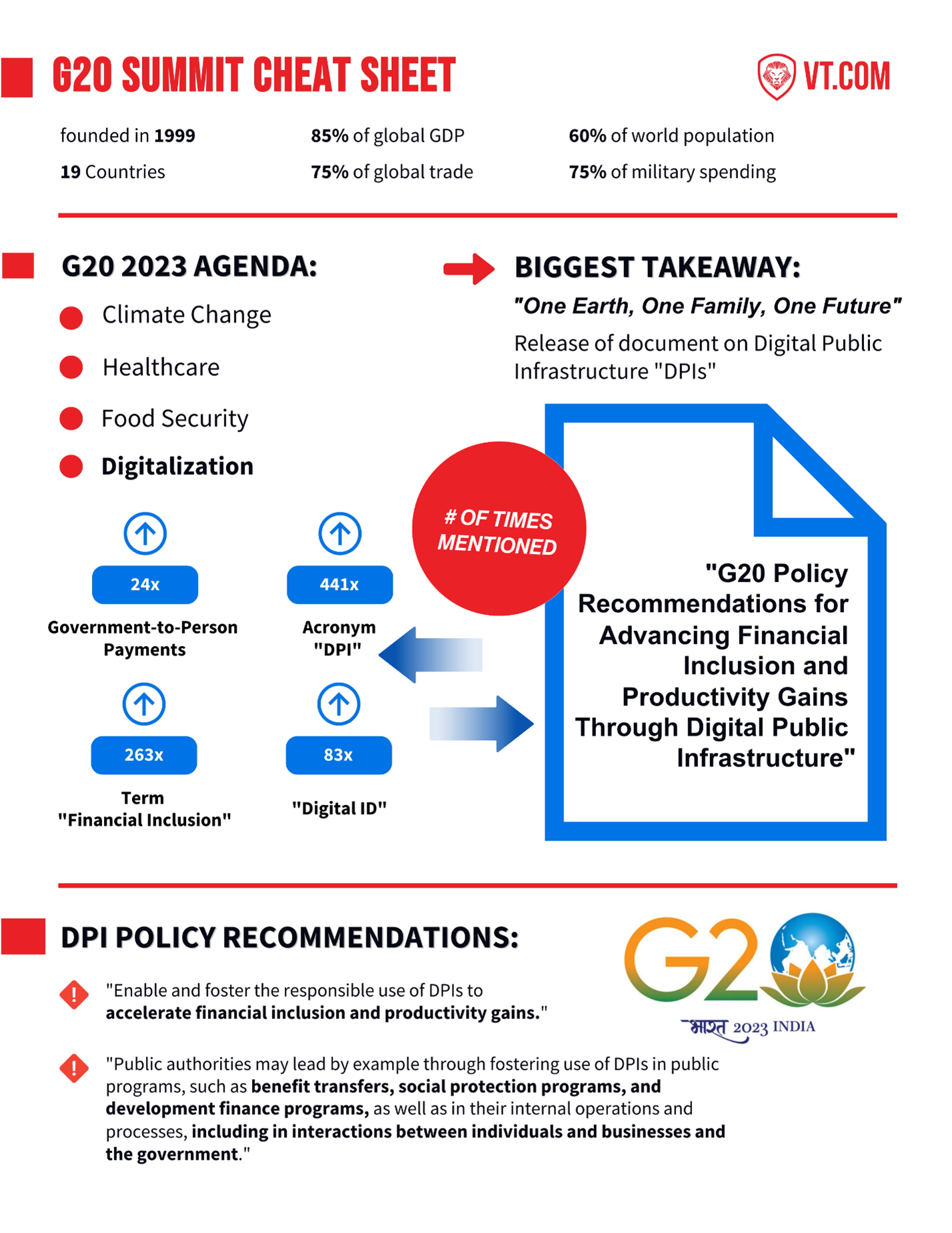

Patrick Bet-David exposes the G20’s hidden agenda by diving into what the G20 summit is, the nations involved, and what the forum plans to do in the very near future. PBD also covers the policy changes proposed during the 2023 summit, which included digitalization, CBDC initiatives, and the implementation of digital IDs.

What is the G20?

The G20 Summit is held annually. Each year, a different member nation hosts it, and is referred to as the “President” for that year. This year’s President was India. Next year, the G20 will be held in Brazil.

It is comprised of the European Union and 19 countries: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Türkiye, United Kingdom and United States.

Perhaps unsurprisingly, Russia and China skipped out on this year’s G20.

In 2023, the G20 also invited Bangladesh, Egypt, Mauritius, the Netherlands, Nigeria, Oman, Singapore, Spain, and the United Arab Emirates (UAE), and non-governmental organizations (NGOs) like the United Nations (UN), International Monetary Fund (IMF), World Health Organization (WHO), World Trade Organization (WTO), International Labour Organization (ILO), Financial Stability Board (FSB), and Organisation for Economic Co-Operation and Development (OECD).

Here are some startling facts about the G20 (when all members are present) and its power:

- The G20 accounts for about 85% of the world’s GDP and 75% of global trade.

- The G20 countries are home to about 60% of the world’s population.

- The G20 countries have a combined population of over 6 billion people.

- The G20 countries have a combined GDP of over $150 trillion.

- The G20 countries emit about 80% of the world’s greenhouse gases.

- The G20 countries are responsible for about 75% of the world’s military spending.

- The G20 countries are home to some of the world’s richest and poorest

- The G20 countries are home to some of the world’s most corrupt and least corrupt governments.

- The G20 has been criticized for its lack of transparency and accountability.

- The G20 has also been criticized for its inability to reach consensus on important issues.

- Despite these criticisms, the G20 remains an important forum for international cooperation on economic issues.

History

The G20 was created in 1999 after the Asian financial crisis as a forum for Finance Ministers and Central Bank Governors to discuss the global economy. The crisis began in Thailand in July 1997, when the Thai baht was devalued. This led to a wave of currency devaluations and financial collapses in other Asian countries, including Indonesia, South Korea, and Malaysia. The crisis had a devastating impact on the economies of the affected countries. The first meeting was held in Berlin, Germany to discuss how the global economy could be made more stable.

In 2007, the G20 was upgraded to the level of Heads of State/Government in the wake of the financial crisis that year. In 2009, G20 was labeled the “premier forum for international economic cooperation.”

At first, G20 conferences solely discussed economics and finance. But as time went on, its discussions broadened to encompass energy, sustainable development, climate change, and health.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

G20 2023 and Digitalization

G20 2023 was hosted by India and met under the theme “One Earth, One Family, One Future.” Its discussion points were climate change, health care, food security, and digitalization. The last agenda item, which advocated for a global digital identification system, was the most novel and surprising.

Following the conference, G20 leadership released a 78-page document called “G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains Through Digital Public Infrastructure (DPI).” The report was written by the Global Partnership for Financial Inclusion (GPFI) under the guidance of the 2023 G20 India Presidency.

In it, the G20 rolled out its vision for an international digital ID system to replace cash. The acronym DPI was used 441 times, the term “financial inclusion” 263 times, “Digital ID” 83 times, and Government to Person Payments 24 times.

(Read the full text of the document here)

DPI is defined by G20 as “interoperable, open, and accessible infrastructure supported by technology to provide essential, society-wide, public and private services digitally such as identification, payments, and data exchange.” The publication says DPI can be understood as “a core set of foundational systems that enable intensive use and provision of digital services across a range of economic and social interactions and actors.”

The G20 encourages countries to “enable and foster the responsible use of DPIs to accelerate financial inclusion and productivity gains.”

(RELATED: G20 Proposes a Global Digital Currency and ID System)

The G20 publication justifies the advancement of a digital ID system on the grounds that it is already a global trend. It boasts that government-to-person (G2P) payments—including government salaries, pensions, and welfare or “social assistance payments”—have increased significantly in scale since 2020 and especially in developing countries.

It goes on to claim G2P payment programs will be good for “financial inclusion” (teaching more people to open financial accounts with banks), female empowerment, and the development of the “digital ecosystem.” COVID allowed governments to quickly get money into the pockets of the poor, and this was a good thing, it claims. It says moving onto an ID system and moving away from cash will “reduce total overhead costs for governments and substantially improve controls,” naming “reducing leakage and eliminating other forms of misbehavior/corruption” as key gains from a cashless society. As if they needed to spell it out anymore, transition to a cashless society will grant world governments more control over the population and over their own lower-ranking members.

European Commission president Ursula von der Leyen called for the introduction of digital IDs modeled after the EU’s COVID-19 vaccination passports in a speech she delivered at the Summit.

While this is the first time a digital ID system has been announced by an international cohort of this size, it is not the first time such a thing has been suggested by world leaders. Bill Gates has been a proponent of the concept, as have the World Economic Forum (WEF) and the World Trade Organization (WTO).

Established in 1930, the Bank for International Settlements’ (BIS) is a coalition of 63 central banks, representing countries that together make up about 95% of world GDP.

The Bank for International Settlements’ (BIS) most recent CBDC survey, covered a record 81 central banks, representing close to 76 percent of the world’s population and 94 percent of global economic output (BIS 2022).

The survey found that nine out of 10 central banks are now exploring CBDCs, half developing or running concrete experiments. The survey also showed that more than two-thirds of central banks are likely to issue a retail CBDC in the short or medium term (within the next six years).

The Atlantic Council (2023) separately tracks CBDC developments in 119 countries and indicates similar results. Furthermore, over 40 countries have approached the IMF to request assistance with CBDC capacity development.

Add comment