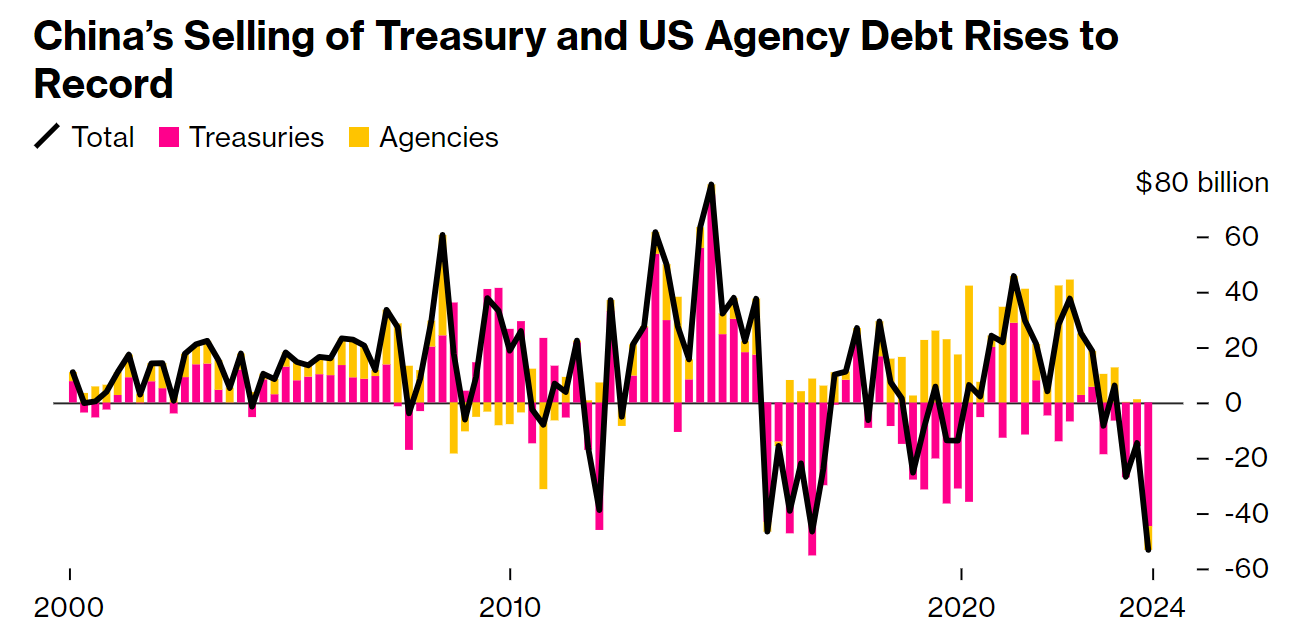

China is selling off US debt at record levels amidst growing domestic economic challenges in both countries.

This debt sale takes the form of both US Treasury bonds and Agency debt.

Treasury bonds are financial instruments that allow buyers to loan money to the US government in exchange for a fixed interest rate, to be repaid in full over a fixed time period (commonly 10, 20, or 30 years). The majority of the US federal debt is from US Treasury bonds.

Agency debt refers to debt issued by federal agencies or government-sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

The levels of sell-off in the chart above are similar to those leading up to 2018-2019. During this period, China was facing immense financial troubles and bailed out several of its banks. A congressional report provides additional context on this matter.

Though China’s Q1 2024 GDP growth beat forecasts at 5.3 percent, they are facing significant economic challenges.

- In January of 2024, Evergrande, a major Chinese real estate company, was ordered to be liquidated. At the time, it held $240 billion in assets.

- The Chinese real estate sector is viewed as overinvested.

- The property market has crashed.

- The Red Sea shipping crisis gives external supply chain pressure. Shipping prices from Asia to Europe have increased nearly five times.

- Long-term challenges from large debt levels in China restrain their monetary policy options moving forward.

US leaders are attempting to balance difficulties with inflation in a manner that avoids market crashes. This struggle comes in the midst of sagging demand for treasury bonds.

A country’s yield on its treasury bonds reflects how risky investors think their investment would be in that country. In this sense, they are an important metric to evaluate the status of a nation’s economy.

Though US President Joe Biden has referred to the current American economy as “the envy of the world,” international investors seem to disagree. Since Biden took office, yields on 10-year treasury bonds have risen about 140 percent, going from a 1.8 percent return to a now 4.37 percent return.

I inherited an economy from Donald Trump that was on the brink.

Now, our economy is the envy of the world. pic.twitter.com/crS9TRiNOw

— Joe Biden (@JoeBiden) March 8, 2024

While lowering interest rates in the US would increase demand for Treasury bonds, it can also worsen the effects of inflation. Prolonged low-interest-rate environments also lead to the prevalence of ‘Zombie Companies.’

Add comment