In this video, Patrick Bet-David provides an insightful analysis of China’s economy and the impact of state policies on freedom of speech and investment trends. In China, the Ministry of State Security has banned the right to speak negatively about the economy, affecting public discourse and the real estate market, allowing PBD to uncover startling insights about China’s millionaire migration, its real estate sector challenges, and the peculiar saving habits of its citizens.

In June 2023, three financial commentators with 4.7 million followers on Weibo (a major Chinese social media platform) were blocked for “hyping up the unemployment rate, spreading negative information … [and] smearing the development of the securities market.” The Weibo Finance oversight account pointed to its policy against any posts “that bad-mouth the economy.”

Weibo then told many other financial commentators to post less about the national economy so as to “avoid crossing red lines.” Weibo refused to answer The Guardian’s request for comment.

On December 12th, China’s Ministry of State quietly published a statement on the need “to sing the bright theory of China’s economy.” It went on: “Various cliches intended to denigrate China’s economy continue to appear. Their essence is to use false narratives to construct a ‘discourse trap’ and ‘cognitive trap’ of China’s decline, in order to cast doubt on the system and path of socialism with Chinese characteristics.”

Why is China, with its ostensibly mighty economy and industrial base, so afraid of words?

Because for the first time in 25 years, China’s foreign direct investment (FDI) went negative in the third quarter of 2023—by $11.8 billion.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

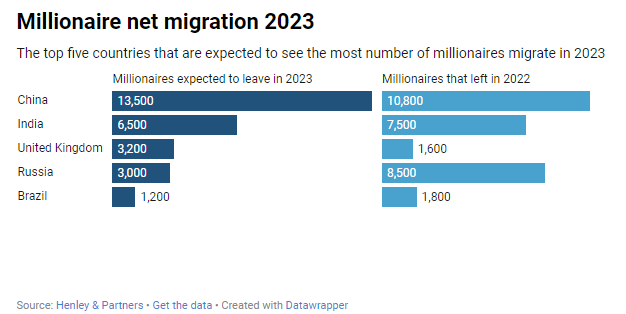

But that is not the only money being taken out of China. According to data from Henley & Partners, China saw an estimated 13,500 millionaires flee its shores in 2023. At the same time, 10,800 new ones emigrated in 2022. Some of the richest people in China are smuggling money out of the country as they relocate primarily to the U.S., Canada, and Australia.

China faces myriad economic problems. Its real estate sector, which is 30 percent of its GDP, is seeing 40 percent of its home sales being linked to companies that have defaulted since 2021, according to JP Morgan.

New home prices in China dropped in November, and investment in properties for the first 11 months of the year fell by 9.4 percent year on year, according to the National Bureau of Statistics.

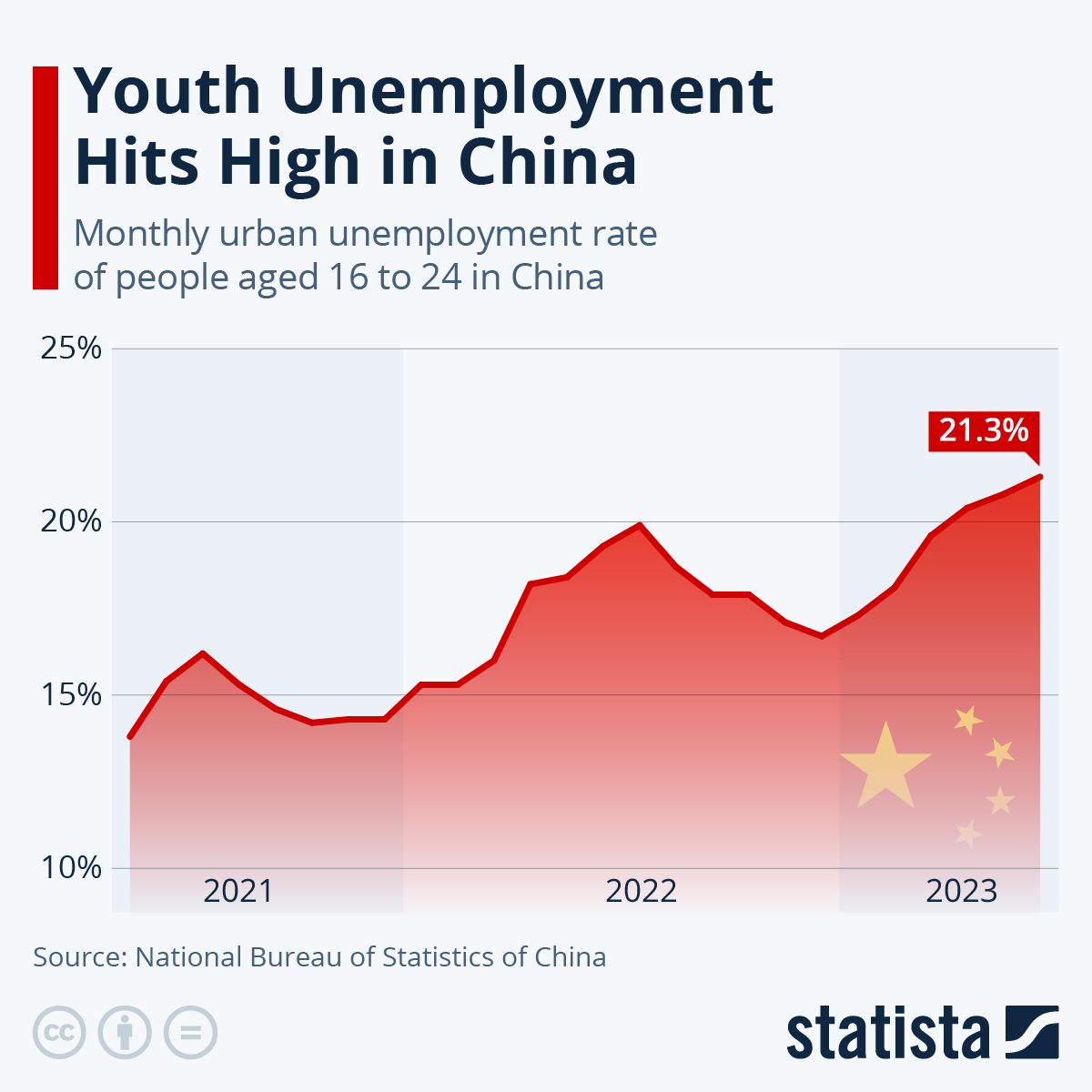

The monthly youth unemployment rate in China’s cities has reached a high of 21.3 percent. It has been increasing since 2021.

In the midst of these economic troubles, Chinese citizens are living cautiously. The nation’s household savings continue to increase, threatening a recession.

China lost 45 of its billionaires from 2022 to 2023—that’s 7.5 percent of their total billionaires. Like preventing a good player from leaving a team, countries have to provide incentives to keep their wealth-producing individuals. The number of billionaires in the world over that period decreased by 0.2 percent, and America’s billionaires only flatlined.

No wonder they want to silence more bad press about their economy.

Protect yourself against CBDC control with American Hartford Gold: https://bit.ly/3T56IqR.

Hartford promises a 100 percent free IRA rollover, a hassle-free process to buy back your gold and silver with no fees, privacy for your information, and up to $5,000 in free silver depending on the purchase.

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment