BlackRock, State Street, and several other wealth management firms are closing environmental, social, and governance (ESG) funds they spent years setting up, according to a new Bloomberg report.

The two firms, along with Columbia Threadneedle Investments, Janus Henderson Group Plc, and Hartford Fund Management Group Inc. and others, closed over 20 ESG funds this year, according to data from Morningstar by way of Bloomberg. BlackRock said two “sustainable emerging-market” bond funds it closed had assets of around $55 million.

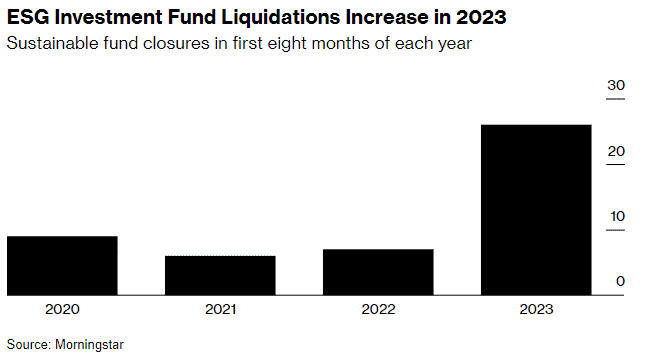

In June, there were 656 “sustainable funds” in the U.S., but year over year this proves to be a decline: more sustainable funds have closed in 2023 than the last three years put together and investors pulled out from the funds more than they put in during the first half 2023.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

According to Alyssa Stankiewicz, sustainability researcher at Morningstar, a noticeable demand for sustainable funds and other ESG initiatives has decreased in 2022 and 2023. Some failed to gather assets, others represented companies that flopped on growth promises.

This follows comments made by BlackRock CEO Larry Fink, who in June 2023 said the firm was worried about the backlash it was getting for being affiliated with the ESG term. He said he had stopped using the ESG label, saying it had become “weaponized.”

Having initially established these funds to attempt to capitalize on perceived interest among progressives for environmentally- and socially-conscious investing, the firms are now backing away from the movement after waves of center-right and right-of-center retaliation, as well as skepticism from investors and shareholders. Interest in investing in ESG funds rose in 2020 and 2021, with managers adding new ESG funds or renaming existing funds to capture more investor dollars. Republicans began a pressure campaign against the trend, claiming among other things that it hurt the fossil fuel industry in Texas, West Virginia, and other states.

However, Fink explicitly stated his firm has not changed its stance on the issues the ESG movement represents. While BlackRock is closing two mutual funds that screen out issuers with more than 5 percent of revenue from coal and oil, it is also launching two ESG ETFs with roughly $9 million in total assets, as well as an environmental solutions ETF with $3.7 million and a sustainable global equity mutual fund with roughly $10 million.

Additionally, BlackRock started a “climate conscious” fund with billions of dollars in assets in conjunction with Finnish pension company Ilmarinen. It was formed when money from an ESG fund was transferred out in June.

BlackRock’s statement concerning these moves was wishy-washy. “We continually evaluate our product range to ensure clients have options available to meet different investment objectives,” a spokesperson said. It would seem they are attempting to pander to all sides: get the conservatives off their backs, and continue to fund ESG under different names.

The same goes for some of the other firms. For instance, Hartford Funds closed an ESG ETF this year but merely dropped the name “sustainable” from a $195 million asset fund and claims to commit it to “strategy” instead.

Add comment