Step into the world of sneakers with the latest Biz Doc episode, where we dissect the surprising turns with Nike and its deals with the stars. Tiger Woods takes the spotlight as we uncover the setbacks and notable departures in the iconic Swoosh’s athlete agreements.

In early January, it was announced that Tiger Woods was ending his 27-year partnership with clothing company Nike. This is a transition for Tiger’s career—he was not fired nor did he simply leave without reason.

But what is happening on Nike’s end?

In 1998, Nike started a partnership with Woods to pursue advertising for their various items and to sponsor others with their signature logo.

Fewer “Flagship” Athlete Deals

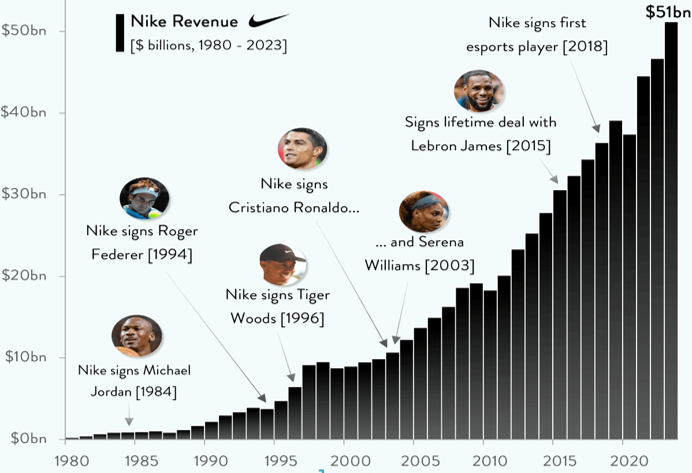

Now, Nike has announced they are doing fewer “flagship” athlete deals—fewer “lifers,” fewer deals with all-star athletes. Examples of Nike’s past endeavors with this business model include Roger Federer, Serena Williams, Lebron James, and Cristiano Ronaldo.

Michael Jordans’ Air Jordans redefined the game in this industry, but at that time there were fewer influencers in general. Now in the age of social media, there are far more “celebrities” for young kids to pay attention to, and the big athletes named previously are all close to retirement. Also, flagship partnerships are expensive, and Nike is looking to cut costs: there has been talk about layoffs—“spending less on more”—and the COVID pandemic has caused them to react to different consumption habits.

Nike is looking to attract a new generation as well as keep its older generations. To attract new audiences, it must embrace new tastes and new styles. It must avoid being too “woke”—but it also has to avoid not being woke enough, to ensure it captures all target audiences. Think about their campaign with Colin Kaepernick: it helped them among some audiences and hurt them among others.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Revenue vs. Profit

Let’s take a look at revenue growth. The company in 1980 had not yet breached a billion. It hit a billion around the time it signed Jordan in 1984 (if you want to learn more about this, watch the movie “Air”—a Hollywood movie, but one that everyone involved says is more or less accurate). Then it pursued one flagship athlete in each sport: it picked Federer in 1994 and Woods in 1996. Its revenue had reached around $10 billion by the time it acquired Woods.

Nike both learned and profited an immense amount from the “Air Jordans” line. It taught them they could make multiple flagship partnerships and copy what they did with Jordan, selling golf clothes with Wood’s name on it.

Ronald and Williams were both acquired in 2003. Twelve years later, they formed a lifetime deal with James. In 2018, Nike formed its first deal with an esports player.

In all cases, they didn’t want the ‘number two,’ -three, or -four athletes in a given sport—they wanted to pay top dollar to get the number one athlete, and nothing less.

Nike’s revenue went from roughly $11 billion in 2003 to $51 billion in 2023.

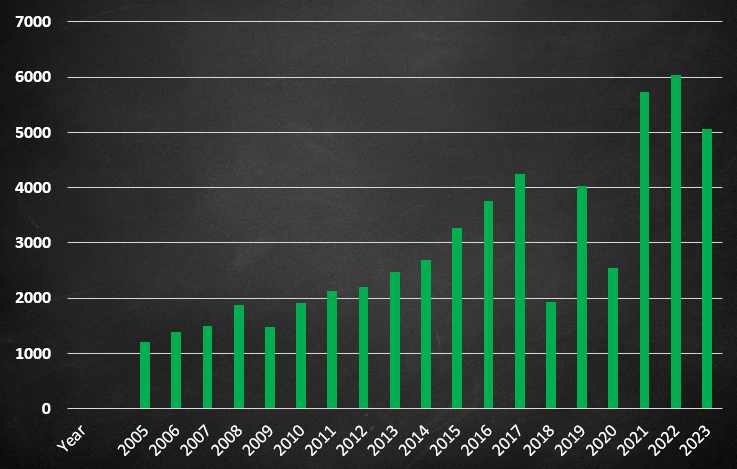

But let’s look at net income growth.

There was a drop in 2018, then the COVID drop in 2020, and then another drop in 2023.

What’s going on? Their revenue is going to the moon, but their costs are also going to the moon.

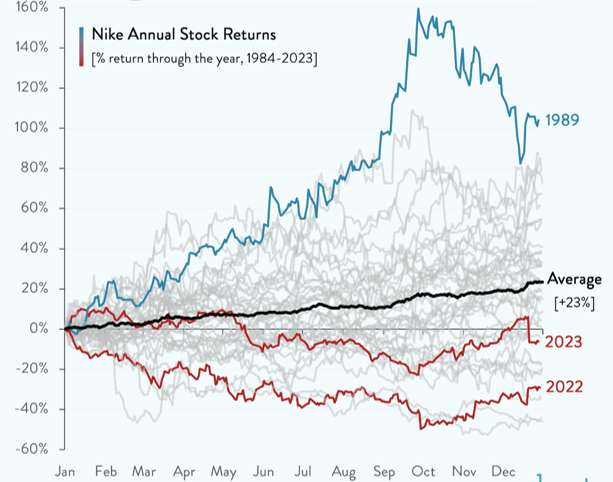

Nike is also on the stock market. If you see something like this, what do you think is going on between 2015 and 2023?

At $105 a share, Nike is up 45,578 percent. (If you had $1 worth of Nike stock in 1980, you would have $45,000 today.) But let’s take a closer look.

From 2018 to 2023, Nike stock has only gone up by 30.59 percent. Even if Nike has $50 billion in revenue, all the market cares about is profit.

They have not been able to manage their costs-to-revenue ratio even after COVID. Revenue is elusive. Profit is not.

If we look at returns, the negative trends for 2022 and 2023 are even more obvious.

Watch the rest of the Biz Doc’s case study to hear his predictions for Nike as well as his business takeaways.

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment