In this episode of The Biz Doc Podcast, Tom Ellsworth dives deep into the past, present, and future of Burger King, providing some key takeaways that can be implemented in your business.

In the first part of the episode, Tom also brings attention to an important report on homelessness that was swept under the rug by the government and mainstream media. He explores its root causes and discovers factors that might have a correlation to the leaders that we elect.

In mid-January, it was announced that Burger King was buying out its largest franchisee, Carrols Restaurant Group, for $1 billion in cash, as first reported by Bloomberg. Burger King’s holding group, Restaurant Brands International, plans to spend another $500 million to remodel 600 of Carrols’ more than 1,000 stores.

What is going on here? Are they doing okay? Where did they get a billion dollars from? Corporate clearly thinks the franchisee is in trouble and wants to rescue it…but why?

Let’s go back to the beginning.

Burger King was founded by James McLamore and David Edgerton, who opened the first location on July 23rd, 1953 in Jacksonville, Florida. At that time, it was called “Instant Burger King” and featured the motto “Home of the Whopper.” They were inspired by the McDonald brothers in San Bernardino, California.

In the 1960s, the Burger King founders sold the company to Pillsbury. The owners of Chart House, a steakhouse chain, bought a Burger King franchise in 1963. By 1970, they had 350 locations. The company was on a tear. Franchisees were highly driven and pushed Pillsbury hard–so hard, in fact, that in 1978-1979, the two controlling companies began fighting over the brand, leading to Pillsbury suing Chart House in 1984 and then buying out the franchisee for $390 million.

In the 1980s, a company called Grand Metropolitan bought Pillsbury.

In 1992, Hurricane Andrew destroyed Burger King’s headquarters in Miami. It was time to rebuild and redo things.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

In 1997, Grand Met merged with Guinness and created “Diageo.” If you know the alcohol and spirits industry, you know that name.

In the 2000s, Diageo decided to only focus on beverages and sold Burger King to TPG and Bain for $1.5 billion. That deal was finalized in 2002, and the fast food chain IPO’d in 2006 with the stock symbol “BKC.”

In the 2010s, 3G Capital of Brazil acquired the majority stake for $3.26 billion. $1.5 billion to almost $6 billion in less than a decade—not too bad.

It IPO’d again in 2012 (3G had taken the company private after buying it), this time under the symbol “BKW.”

Burger King then merged with Canadian coffee chain Tim Hortons in 2014 and renamed itself the Restaurant Brands International (RBI). It closed 250 “low volume” locations.

So what does this tell us?

Clearly, the history of Burger King was not at all like McDonald’s, which instantly soared after Ray Kroc bought it and took it public. Instead, Burger King was passed around over and over again, going through multiple IPOs and mergers. It was a long bumpy history, like an individual who has divorced several times.

In the early 2020s, a report showed Burger King was absolutely behind Wendy’s by virtually every metric. Burger King then brought back the slogan “Have It Your Way,” which went viral on TikTok among a young generation who hadn’t seen it before. It also changed its logo back to the original, reviving the retro look and ditching the blue ring.

In the first quarter of fiscal year 2023, a 90-unit franchisee and a 115-unit franchisee filed for bankruptcy. Then in November 2023, a 172-unit franchisee filed for bankruptcy. And then they bought Carrols, where this story began.

What is the idea behind changing a logo? It’s usually what a marketing team does when they first acquire a company, but the Biz Doc doesn’t see what a logo change will do to up their revenue.

Working on the food quality and service is what brings in customers, not printing on a bag and changing a sign. Logo changes are often invoked as “new visions,” but are typically MUCH less productive than focusing on driving sales and operations.

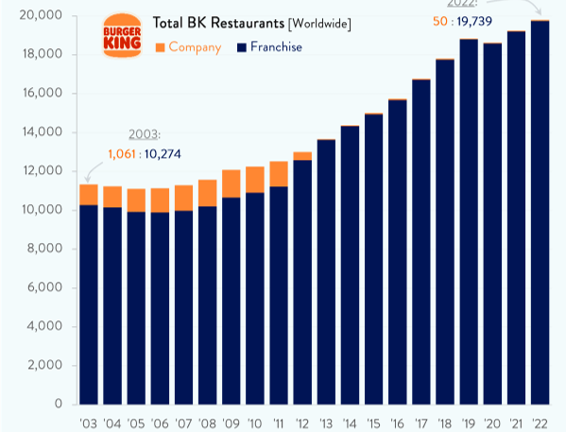

Burger King’s strategy is to take control of their store inventory. Going back 20 years, we can see a steep rise in stores but a decrease in company-owned stores: they sold most to franchisees in early 2010. Then they attribute a slump in store count in the early 2020s to a lack of company control over stores.

But that is not what caused the slump!

That was caused by COVID-19, subsequent labor resignations, and other factors.

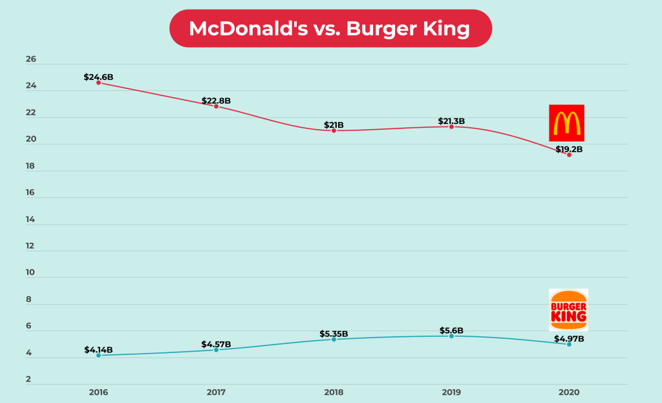

Another factor is the American consumer choosing to reject fast food, especially the least healthy options. If we compare them to McDonald’s, which is the number one chain by far, we can see the drop more dramatically.

Biz Doc’s Takeaways

If Burger King wants to see growth, they have to copy chains like Chik-fil-A that promise great food and great service. Not a logo change or some store purchases. If they were to follow a Product Market Fit (PMF) scheme—realizing they aren’t trying to create a salad chain necessarily, but identifying key ways to improve their actual product like reducing sugar, sodium, calories, and carcinogens and increasing quality controls—they would see much greater returns. Today’s changing consumers are what they should consider. Common sense often gets lost in the corporate shuffle.

Finally, be Quantitative: Systems, Processes, People ($ Spent < $ Sales). If all these are in check, including product, you are on the path to glory and can be less concerned about logos.

Business is war—especially sales. If you have a firm that makes cold calls, you can’t do without Nextiva—a cloud phone system that we have used to great success. Purchase through Biz Doc’s promo and get 50% off.

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Shane Devine is a writer covering politics, economics, and culture for Valuetainment. Follow Shane on X (Twitter).

Add comment