What Defines a Recession?

A recession is defined as two consecutive negative quarters of gross domestic product growth.

The Dating Committee, on the other hand, uses a very general definition for a recession.

They say a recession “involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

We May Already be in a Recession…

The Dating Committee takes its time in addressing when a recession has begun and officially ended.

The committee looks at data on a very wide timeline. The designations often come retroactively, which means the US could currently be in the middle of a recession without anyone officially recognizing it until after the fact.

Inflation is at a 40-year high, the US economy contracted during the 1st quarter of the year, and stock markets are on the cusp of their worst half-year performance since 1932.

There is no expected date for when the committee will meet and determine whether we are in fact, in a recession.

Makes you wonder why it’s not a priority…

It’s Up in The Air…

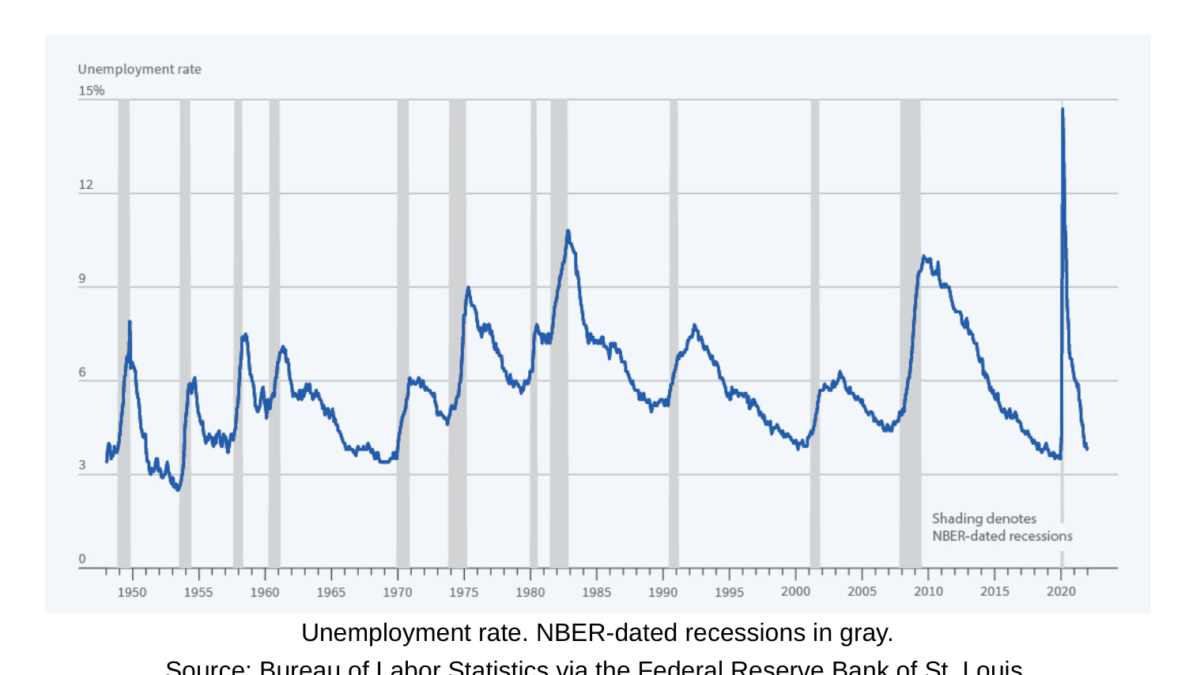

When it comes to determining whether or not we are in fact in a recession, the dating committee claims to perform a large analysis of various economic indicators such as employment numbers, personal consumption expenditures, wholesale retail sales adjusted for price changes, employment as measured by the household survey, and industrial production.

There is no “rule” about which measures they use in their process or how they are weighted in the committee’s decisions.

During the “Covid-induced recession” in 2020, the U.S. economy had one-quarter of negative growth.

According to the committee, they concluded that the “subsequent drop in activity had been so great and so widely diffused throughout the economy that, even if it proved to be quite brief, the downturn should be classified as a recession.”

With so much focus on the state of the economy, and so many official sources looking to one group to determine whether the United States has entered a downturn, NBER has an outsized role in influencing American politics, policy, and financial decision-makers.

“There’s an awful lot of symbolic value attached to whether we’re in a recession,” said Richard Wolff, professor of economics emeritus at the University of Massachusetts, Amherst.

“It is taken seriously up on the Hill and by policymakers across the country, it’s important.”

Wolff finds that even professional economists don’t know where the official recession designation comes from…

“It’s one of those mysteries that aren’t inquired into because people have accepted these things as gospel — the rulings just seem to come down from on high.”

Hear that? It’s a mystery! 🙄

Diversity Matters, According to Janet Yellen

In recent years, critics have said the NBER’s recession and expansion determinations fail to consider the economic state of many Americans.

Janet Yellen, America’s first woman Treasury secretary and its first woman Fed chair, argued that the lack of women and minority economists at the Federal Reserve and the federal government is a top priority.

The lack of diversity skews viewpoints and limits the issues of discussion, according to Yellen.

Read More: 9 Scientific Ways Reading Makes Your Smarter

Add comment