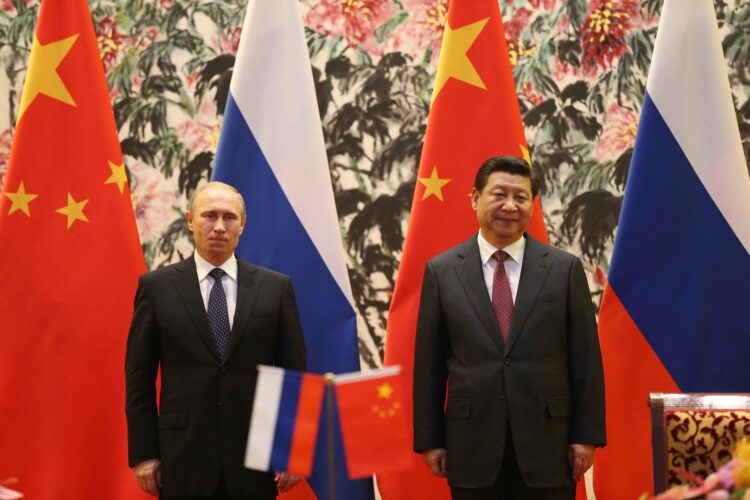

As the Western pushback against Russia in the wake of the Ukraine invasion continues, the strategic and economic alliance between Russia and China is deepening. Lenders from four of China’s largest financial institutions have extended billions of dollars to Russian banks, filling the void left by Western institutions in an effort to replace the US dollar as a global currency.

The leading edge of China’s ongoing challenge to the United States as an economic superpower is the effort to substitute the American dollar for the Chinese renminbi (the basic unit of which is the yuan). In recent months, multiple countries around the world, most notably China’s partners in the BRICS bloc, have moved away from using the dollar as a reserve currency, lessening American influence in their economies.

Since Russia’s invasion of Ukraine began last year, Western banks have been pulling out of Russia over pressure from regulators and the general public. At the same time, international sanctions against Russia have made it increasingly difficult for the country to do business. However, this void has provided an ideal opportunity for China to advance its own interests.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

As reported by the Financial Times, the Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank of China increased their combined exposure to Russia from $2.2 billion to $9.7 billion leading up to March of this year, according to Russian central bank data, with ICBC and Bank of China accounting for $8.8 billion of the assets between them.

This increased investment came as a welcome change for Russia, which has committed itself to adopting the renminbi as a replacement for the dollar and euro. This economic pivot comes after Russia and China reached a record $185 billion in trade in 2022.

However, despite the rising economic threat China poses, some experts are suggesting that the country is headed for an economic disaster long before it can replace the US. Patrick Bet-David breaks down China’s over-leveraged real estate market, its youth unemployment problem, and the economic bubble that might be about to burst:

Add comment