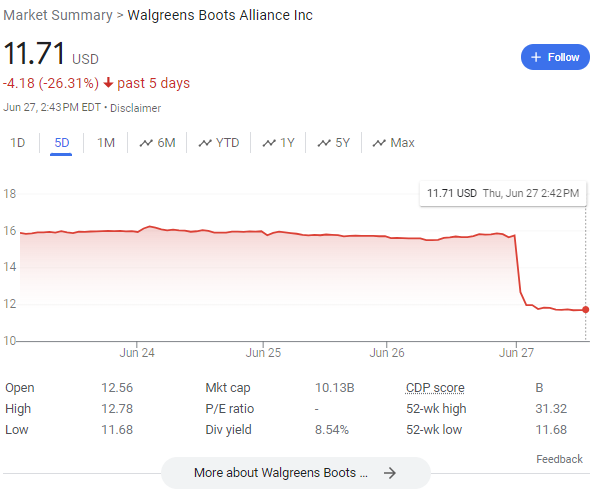

Shares for convenience and pharmacy chain Walgreens plummeted over 20 percent on Thursday following an earnings report that indicated lackluster revenue. Company spokespeople pointed to a “challenging” consuming environment as the culprit, citing high prices which have “absolutely stunned” American shoppers.

The third-quarter earnings report did not meet projections and instead resulted in the company having to cancel its full-year profit expectations, from $3.20-$3.35 per share to $2.80-$2.95 per share.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

“We assumed … in the second half that the consumer would get somewhat stronger” but “that is not the case,” said Walgreens CEO Tim Wentworth.

“The consumer is absolutely stunned by the absolute prices of things, and the fact that some of them may not be inflating doesn’t actually change their resistance to the current pricing,” he added. “So we’ve had to get really keen, particularly in discretionary things.”

Walgreens was already trying to cut costs after a difficult 2023, experiencing low reimbursement rates for its pharmacies and a declining demand in COVID vaccines and treatment products, which its profits had relied on. This coincided with a difficult economic situation for its lower and middle class customers. On Friday, Walgreens said it will be closing stores and reducing the size of its US healthcare inventory.

“Seventy-five percent of our stores drive 100% of our profitability today,” Wentworth said. “What that means is the others we take a hard look at, we are going to finalize a number that we will close.”

Yet the company’s healthcare division was able to pull a strong revenue, beating expectations for the third quarter. As Valuetainment previously reported, the company is attempting to move beyond retail and enter into the health business. This strategy is also being pursued by CVS, which acquired Aetna Insurance for a total of $78 billion in 2018.

Walgreens lost half of its stock value under former CEO Rosalind Brewer as it attempted to push into the healthcare industry. Brewer’s strategy was perceived to be strong by analysts, but did not win over the confidence of investors. During her tenure, she was known for putting $5.2 billion into primary care provider Village MD in order to create more doctors’ offices in Walgreens stores.

After two and a half years, Brewer left the company suddenly at the end of August. In response, Walgreens had said they would be seeking a new CEO with “deep healthcare experience.” Then, in October, they announced Cigna executive Tim Wentworth would be serving as the new CEO of its parent company, Walgreens Boots Alliance.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Add comment