Patrick Bet-David explains the complex and often misunderstood concept of a reverse market crash. While traditional market crashes are characterized by rapid declines in asset values, a reverse market crash involves an excessively rapid rise in market values, leading to potentially dangerous economic consequences.

Patrick begins by explaining the concept in simple terms: a sudden ballooning in the market that leads to the rich getting richer and the poor getting poorer.

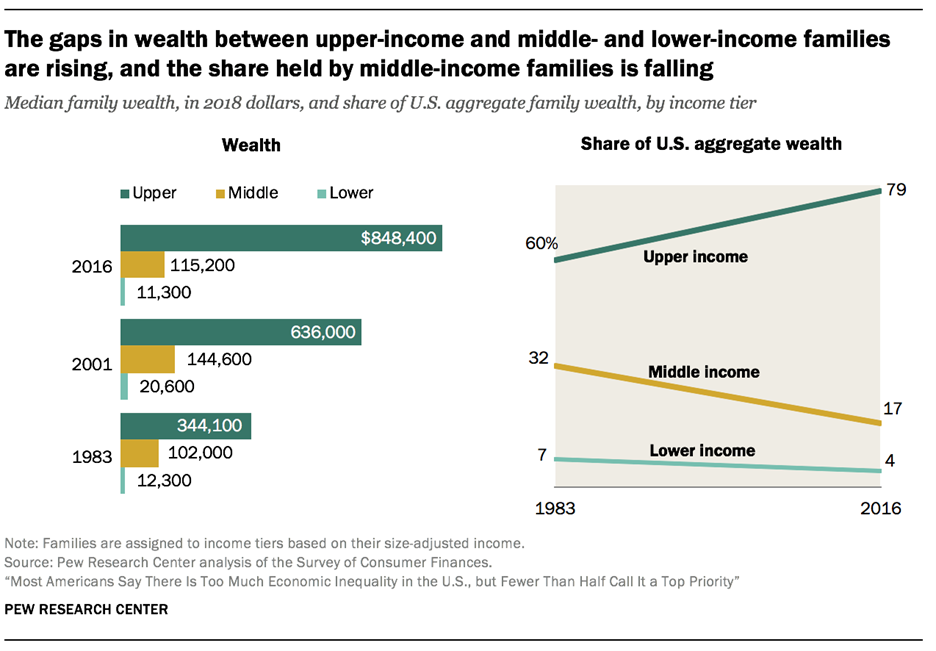

According to Pew Research Center, people in the upper income bracket have increased their share of America’s aggregate wealth from 60 percent to a whopping 79 percent between 1983 and 2016. Conversely, people in the middle-income bracket have seen their share decline from 32 percent to 17 percent in that time, while the lower income bracket went from 7 percent to just 4 percent.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

When the government makes available welfare funds to low and middle income families, like what it did during the COVID-19 pandemic with both stimulus checks and unemployment benefits, that money eventually flows up to the top. Corporations will ultimately be receiving the welfare checks because the lower and middle income families typically don’t invest and instead consume corporate products.

That after all is why they were called “stimulus” checks, because they were designed to “stimulate” the economy and prevent corporations from falling. Sprees of government spending, which are done in the name of helping the middle and lower classes, invariably do the opposite.

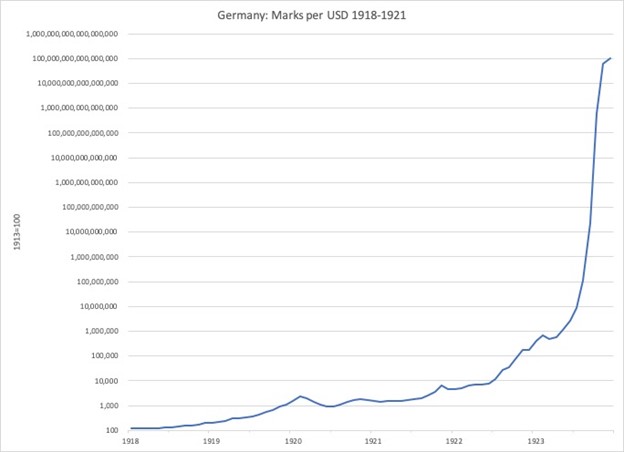

In 1914, four German marks equaled one U.S. dollar. By 1923, it took one trillion marks to equal one U.S. dollar.

This was caused by a variety of factors, but most essentially this rampant inflation was spurred on by the German government (at that time known as “the Weimar Republic”) being forced to print money to meet the massive reparation costs incurred by the Treaty of Versailles, which ended World War One.

By 1922, German prices had risen by 700 percent. This phenomena is termed “hyperinflation,” when government printing of currency causes the a nation’s currency to become virtually useless. The same phenomena happened to Argentina, Zimbabwe, Turkey, and Venezuela.

Although it differs from case to case, hyperinflation is caused by 1) quantitative easing (printing money), 2) excessive intervention in the free market, and 3) price controls (especially oil and other energy costs). These actions are usually pursued by politicians seeking favor from the masses through welfare policies that are popular in the short-term but lead to long-term disaster.

To see Patrick’s historical case studies on the inflation process in those countries, and to see his analysis of where America currently stands on the trajectory toward hyperinflation, watch the rest of the video here.

Add comment