On Monday, “coworking” office space sharing company WeWork filed for bankruptcy following a months-long struggle to meet basic interest payments.

The bankruptcy affects its locations in the U.S. and Canada. According to its filing, WeWork had debts of $18 billion. The majority of its equity holdings were in the Cayman Islands, a prominent tax haven for corporations.

In its announcement that it filed for Chapter 11, WeWork claimed it has retained the support of its financial stakeholders and entered into a restructuring agreement with them. It said “global operations are expected to continue as usual” while it reconsiders its commercial office lease portfolio.

As part of its rescue plan, WeWork is going to exercise its right to “reject the leases of certain locations” which “are largely non-operational” and whose users have received notice. It said WeWork locations outside of America and Canada will not be affected by the filed bankruptcy or by the proceedings.

The company went from a $47 billion valuation in January 2019 to an unsuccessful IPO later that year. The decline and fall was captured in a documentary called WeWork: Or the Making and Breaking of a $47 Billion Unicorn, available on Hulu, as well as WeCrashed for AppleTV.

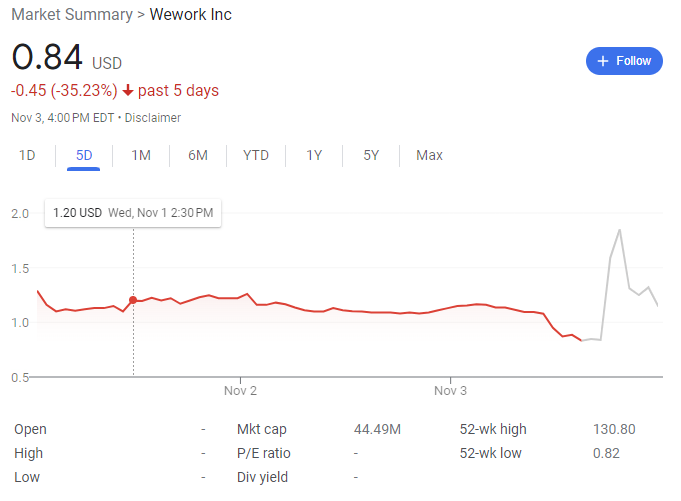

When news broke last week that the company was planning to declare bankruptcy, its stocks plummeted to an all-time low of $0.84. Since then, the ticker has stopped tracking its stock altogether.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

While the New York Times portrayed Neumann as a boy-genius, not unsimilar to the way the media praised Sam Bankman-Fried, Neumann is known to others for his track record of eccentricity.

In 2016, he announced to WeWork staff that they were getting laid off and just before hosting a surprise concert by a Run-DMC member. “Workers danced to the 1980s hit “It’s Tricky” as the tequila trays made more rounds; some others, still focused on the firings, say they were stunned and confused,” the Wall Street Journal reported in an article titled “This is Not the Way Everybody Behaves.”

In 2019, months before his company was to be valued, Neumann was kicked off a flight to Israel for smuggling weed (on a different occasion in 2021 he smoked so much on a private jet that the crew had to put on oxygen masks).

Neumann also trademarked the word “We” and sold it back to his company for $5.9 million in stock, before reversing the decision following outcry from shareholders.

Then, he left the company in September 2019 after critics pointed out the amount of conflicts of interest buried in his filed IPO, including Neumann leasing his properties back to the company and borrowing against his own stock. They were also wary about the company’s general atmosphere of hard partying and near-delusional thinking, like Neumann believing he could discover the technology to live forever.

But he walked away with significant stake in his company—although what that number was has been disputed by a successor WeWork Chairman.

SoftBank is said to have paid Neumann roughly $480 million for half of his remaining stake in WeWork in 2021. Neumann also obtained $185 million in a non-compete agreement and $106 in a settlement. Then, when WeWork went public later that year, Neumann was reported to still have $722 million stake in the company. It is not clear if Neumann retained that stake or sold it since then.

While his company was suffering its downward spiral, Neumann was busy starting a new venture called Flow, which aims to help renters build equity in their homes. Neumann successfully convinced venture capital firm Andreesen Horowitz to give him $350 million for it, and brought the company valuation up to $1 billion.

In an October interview with CNBC, Neumann commented on his former company’s coming bankruptcy. “The WeWork journey was an amazing one,” Neumann said. “When I think of the WeWork story, I think of the unbelievable team we had […] I think WeWork’s opportunity today, its product market fit, is even greater than ever before, in a world where leasing is as difficult as it has been, and office occupancy is at all-time lows, and companies are not sure if they are hybrid work or full-time work, so it’s been difficult to observe from the side and see what’s happening.”

But he was optimistic about Flow. “Flow is another iteration of the same story, which is: when people live in community, when people live together, when people obviously have differences,” Neumann said, “there’s always a common ground.”

Add comment