Nvidia stock hit all-time highs this week, trading above a $3 trillion dollar valuation on Thursday morning, thereby surpassing Apple and making it the second-largest company in the US behind Microsoft.

A Yahoo Finance article noted that recent data showing the labor market cooling is likely leading investors to count on the Federal Reserve to cut interest rates soon. Expected rate cuts lead to optimism in stock performance, which may have triggered the broader gains in tech stocks in the latter half of the week.

While rate cuts may be positive news for stock investors, they are not without negative consequences. Low rates have been known to exacerbate the effects of inflation, and lead to the proliferation of “Zombie Companies.”

Nvidia has been the darling of tech investors due to the quality of its semiconductors and Graphics Processing Units (GPUs) used by artificial intelligence (AI) companies. Since the release of ChatGPT by OpenAI, investors have been optimistic about the explosive growth of the AI sector, boosting Nvidia’s prospects.

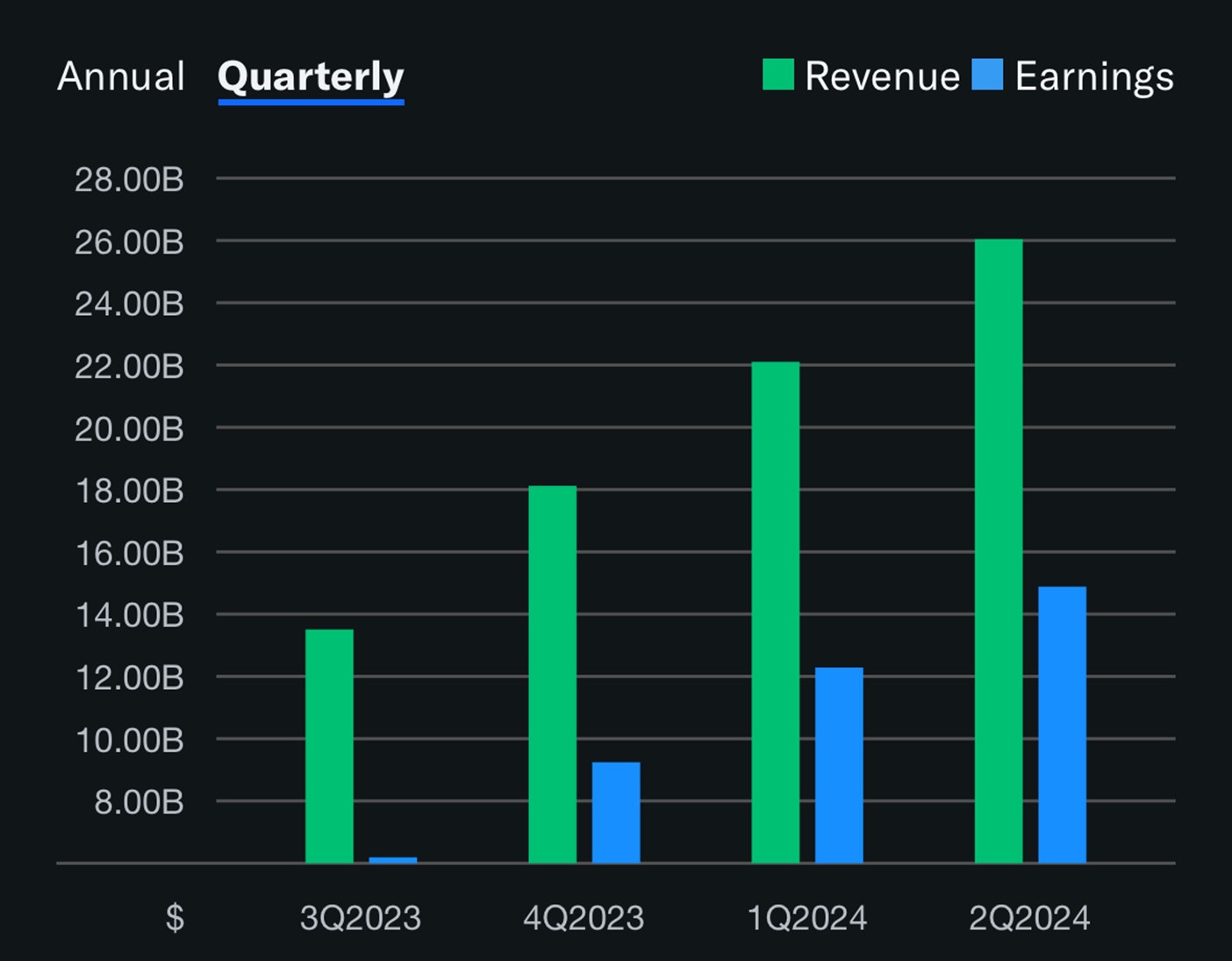

From the 3rd quarter of 2023 to the 2nd quarter of 2024, Nvidia has seen explosive growth in both revenue and earnings. Revenue nearly doubled from $13.51 billion to $26.04 billion, and their profit margin increased from 45.8 percent to 57.1 percent.

Nvidia retreated off of the all-time high on Thursday and closed trading on Friday at $1,208.88 per share.

Though the company has seen incredible financial performance recently, it is trading at a 70.74 price-to-earnings (PE) ratio, meaning the company would need to maintain its current profit levels for almost 71 years to produce total profits equal to their market valuation. Microsoft is currently trading around a 36.57 PE ratio, and Apple is trading at a 30.24 PE ratio.

In May, the company announced a 10-1 stock split, which would make shares more affordable for retail investors. A few months ago, Nvidia announced the next generation of their chips designed for AI, which will be four times faster than their flagship H100 chip.

Add comment