Patrick Bet-David explains why the Florida insurance market has gone up 900% and how BlackRock is likely the cause behind it.

Florida’s market is experiencing some problems. Home insurance premiums have tripled in Florida in the past five years. Florida averages more than $4,200 per year, while the national average is $1,700, according to Triple I.

Some insurance premiums have risen about nine times from what they were in 2022, according to the Chief Executive of NSI Insurance Group. Construction costs have also risen by 40 percent since 2017.

Insurance premiums in Florida have exploded, reaching up to 900 percent in some areas.

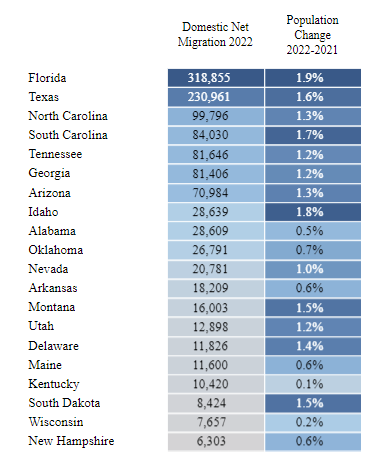

According to the Census Bureau, about 275,000 people left Florida in 2022 for states like Georgia, North Carolina, Tennessee, South Carolina, and Texas.

But 343,000 left California, 299,000 left New York, and 141,000 left Illinois. Florida received by far the most of these migrants, receiving 318,000 in 2022 compared to Texas’ 230,961.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Further, since 2017 eleven property and casualty companies offering homeowners insurance in Florida liquidated. Five of them liquated last year, and one liquated this year.

Factors contributing includes storms and other weather-related reasons, but also insurance fraud driven by fraudulent roofing claims. Florida makes up only 9 percent of America’s home insurance claims but 79 percent of its home insurance lawsuits.

In response to this, Gov. Ron DeSantis has proposed and signed a series of bills such as Senate Bill 2D, signed in May 2022, which enacted pro-consumer measures to help alleviate rising insurance costs by cracking down on frivolous lawsuits and increasing claim transparency.

Some of his proposed bills include:

Many of the companies engaging in malpractice are obscure groups no one has heard of, and so their choice to pull out of Florida isn’t a big deal. But Farmers Insurance, which became the latest insurance company to pull out of Florida, is very well known, and is also thought to be contributing to the rise of insurance premiums.

Florida is not the only state Florida has left. It does not do business with Alaska, Delaware, Hawaii, Maine, New Hampshire, Rhode Island, Vermont, or West Virginia. Many of these have coasts, and Farmers is stricter with what they insure in states like California.

Farmers has been accused of being the “Bud Light” of insurance by Florida state CFO Jimmy Patronis based on how much they follow ESG standards.

“Farmers is committed to operating in a way that positively impacts our customers, our employees and communities by incorporating environmental, social and governance (ESG) considerations into our business,” said then-CEO of Farmers Insurance Group Jeff Dailey in 2022. “We are honored to become the first US-based insurer to sign the Principles for Sustainable Insurance (PSI) and hope to amplify the impact of our efforts by inspiring others in the insurance industry to follow our example.”

The United Nations (UN) openly celebrates Farmers Insurance’s adherence to ESG and PSI goals on its website.

For Pat’s full breakdown of Farmers and the way companies fall to ESG regulations set by the UN, BlackRock, and other powerful entities, watch the full video below:

Add comment