Exxon Mobil is set to close a deal to purchase shale driller Pioneer Natural Resources for roughly $60 billion. The deal would transform the U.S. oil industry and represents the biggest purchase by Exxon since its 1999 merger with Mobil.

Exxon is paying for the deal with the surplus it came into in 2022 following a record annual profit of $55.7 billion. Only Apple and Microsoft surpassed it. Exxon with its $436 billion market cap is intending to advance on West Texas shale industry, particularly its Permian Basin, as well as New Mexico which Exxon said is central to its growth strategy.

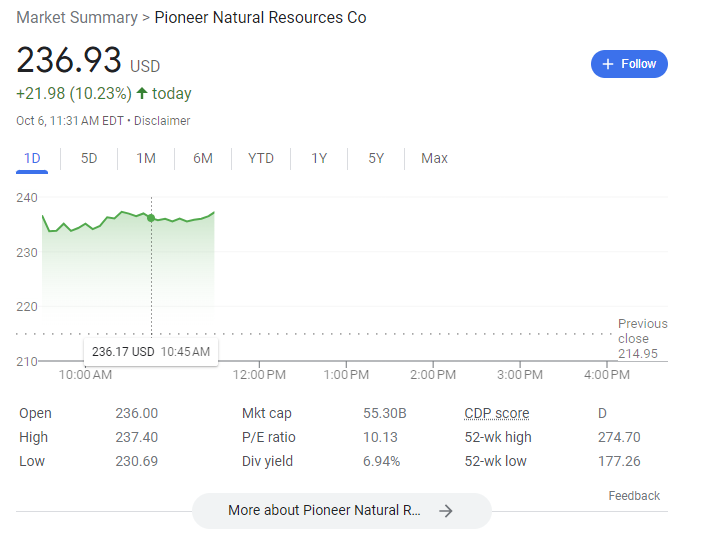

Pioneer has a market cap around $50 billion. In response to news of the deal, Exxon Mobil (XOM) stock took a slight dip Friday morning (-2.9 percent) while Pioneer Natural Resources (PXD) jumped up 10 percent.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Due to oil demand sharply declining during the pandemic, shale companies like Chesapeake Energy Corp. and Whiting Petroleum filed for bankruptcy along many others.

Breaking: Exxon is close to a deal to buy shale giant Pioneer Natural Resources, a blockbuster takeover that could be worth roughly $60 billion https://t.co/qfUeYMh5CE https://t.co/qfUeYMh5CE

— The Wall Street Journal (@WSJ) October 6, 2023

This deal follows and surpasses Occidental Petroleum’s acquisition of Anadarko Petroleum for $38 billion in 2019, and Exxon’s $30 billion purchase of XTO Energy in 2010.

Exxon’s current CEO, Darren Woods, ascended to the role on promises to dramatically grow Exxon production. He hit a snag with the pandemic, seeing the company’s first annual loss in recent history with a drop of $22 billion. Luckily for him, Exxon saw the aforementioned $55 billion renaissance in 2022, and with this new purchase Woods is set to solidify his reputation and legacy. Woods also conducted Exxon’s purchase of the CO2 pipeline operator Denbury for $4.9 billion in July.

Add comment