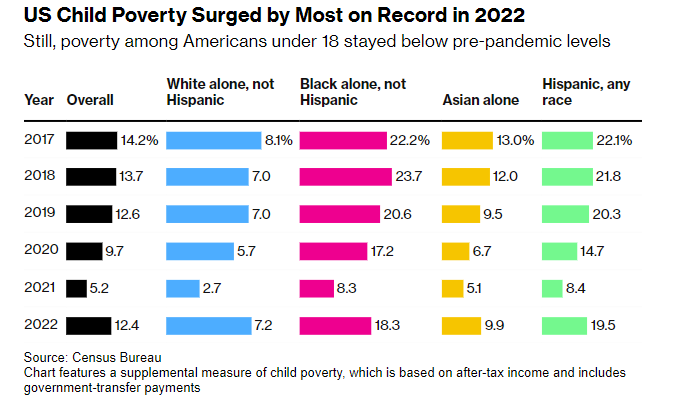

The expiration of COVID pandemic-era child welfare programs caused the child poverty rate to jump from 5.2 percent in 2021 to 12.4 percent in 2022, according to a Bloomberg report on newly released Census Bureau data. The study measured after-tax income and factored in welfare and other entitlements like stimulus checks.

While the metric increased compared to pandemic-era levels, it is actually still lower than the child poverty rate before the pandemic. However, the year over year change was the most drastic surge upward on record. The question is whether people have been and will be able to adapt to the post-pandemic world.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

If they have become too reliant on welfare, the continuous shocks caused by the closing up of the pandemic spending spree may cause financial ruin in some. COVID-era welfare programs on food (through Supplemental Nutrition Assistance Program, or SNAP) and a $24 billion injection to child-care programs have also recently expired. Allegedly, a sharp spike (37.6 percent) in homelessness among families with children occurred in 20 of America’s largest cities between January 2022 and January 2023.

The latest shock is the return of college debt payments and interest on college debt, which restarted this month and will challenge millions of Americans who have been living beyond their means in a high-inflation economy. “But ultimately, even with those expenses paring down, the rising costs that have been happening in conjunction with this reinstitution of the loans, it is pretty terrifying,” one college grad told NBC.

It would seem that the only solution governments can come up with is more spending, or at least incentivizing poverty without any aim of encouraging better behavior. Eleven states have created or expanded on a fully refundable child tax credit from 2021 that enabled families to get up to $3,600 per child.

One of Patrick Bet-David’s key policy recommendations from his hypothetical presidential platform is to incentivize parents to stay with the same spouse and discourage having children out of wedlock. He argues this can be accomplished by reforming the tax credit system so that those who remain married to the parent of their child get rewarded while people who have children out of wedlock or get divorced lose out on all child-related tax credits. He believes this is crucial for repairing American society, in the belief that the family unit is its bedrock. He also advocates for diminishing our entitlement programs in general to discourage dependence on government and increase work ethic in the population.

Watch him walk through his tough but honest list of 8 presidential policies below:

Add comment