As the nationwide pushback against Environmental, Social, and Governance policies in the corporate world continues, financial insiders are beginning to move away from ESG branding—but the agenda behind it is still very much in place. According to a survey from Bloomberg, bankers and other members of the finance industry are continuing to implement the ESG strategy even while recognizing that the acronym is becoming increasingly toxic for business.

Environmental, Social, and Governance policies stem from an investment strategy that prioritizes environmental causes, social justice issues, and governmental compliance. Backed by asset management groups like BlackRock, these policies became the driving force for left-wing agendas in corporate culture—which has now prompted an enormous cultural backlash. In recent weeks, S&P Global, one of the world’s largest raters of corporate debt, announced it will no longer include corporate ESG scores in its debt ratings. Similarly, companies like McDonald’s have begun purging all references to the agenda from their corporate websites.

However, even though the offending letters are being removed, the agenda they represent is still in effect almost everywhere.

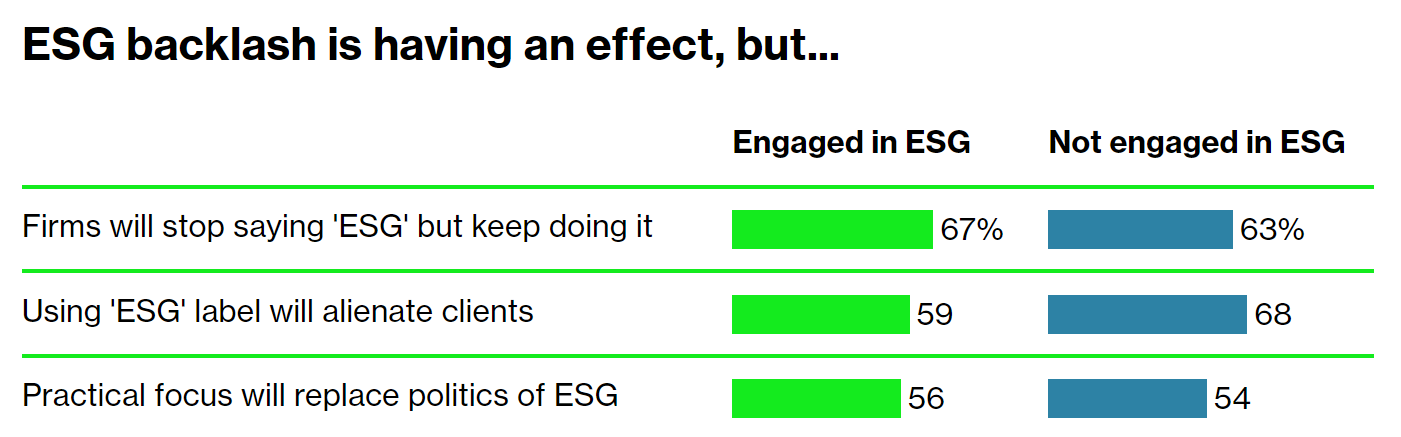

A new Bloomberg study revealed that two-thirds of the nearly 300 global money managers surveyed will stop using the ESG acronym when interacting with clients but will continue using the metrics behind closed doors.

“People don’t want to talk about [ESG] as much because of the news flow from the US,” said Alex Bibani, a senior portfolio manager at Allianz Global Investors in London. “But from an investment perspective and what we do internally, it has never been more important.”

Check out the keynote speakers and details for The Vault 2023 and secure your tickets!

For nearly two years, conservative and right-wing politicians across the United States have taken steps to ban “woke” policies from the finance industry, threatening asset management groups with litigation and, in the case of Florida Governor Ron DeSantis, banning ESG criteria in debt sales. But while this has gradually begun changing the language, it has yet to produce a lasting change in policy. The Bloomberg survey reveals that only 18% of respondents will stop considering things like climate change when conducting business.

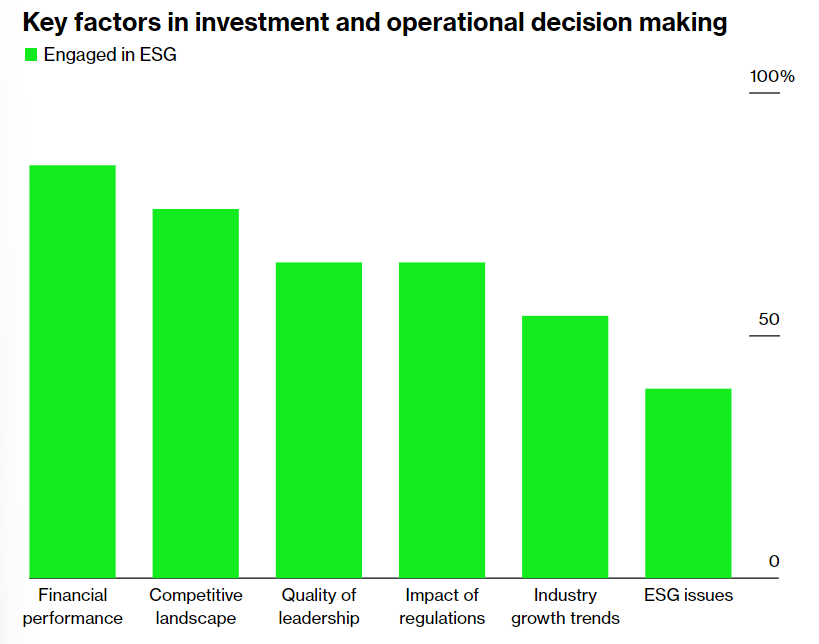

More importantly, the survey shows that the anti-ESG efforts have not removed the financial incentives of engaging in the policies. 85% of the respondents that use ESG guidelines said financial performance is the most important factor when investing, meaning that ESG is still profitable despite the pushback.

At this point, it is unclear when or if this trend will reverse, but an overwhelming majority of survey-takers—both those that use ESG and those that don’t—believe that the government should stay out of private investments.

Patrick Bet-David explains how ESG policies rapidly became a $66 trillion dollar weapon used to control corporate America. Watch it HERE to learn more:

Add comment