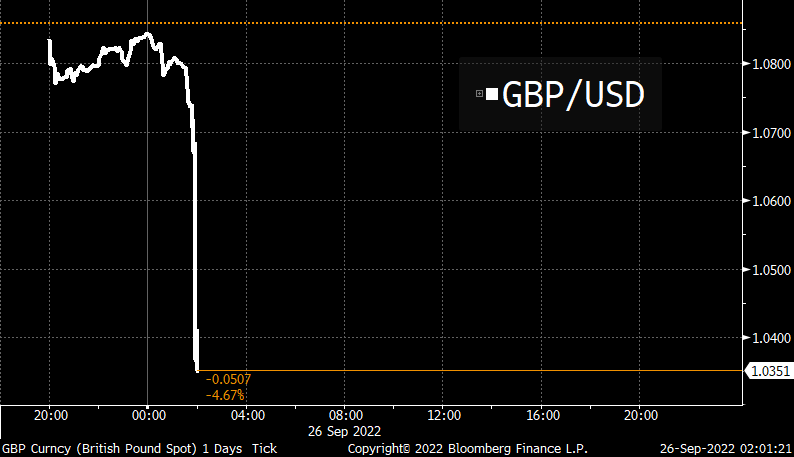

The British Pound has fallen to its lowest record in history.

The pound has hit an all-time low after the bonanza of tax cuts and spending measures in Kwasi Kwarteng’s mini-budget threatened to undermine confidence in the UK.

The new Prime Minister, Liz Truss, is also planning to further increase immigration to “fill job vacancies” and “boost economic growth.”

Buckle up for the week ahead on financial markets — the British Pound is absolutely crashing tonight, mostly because Boris Johnson was even worse than Biden… pic.twitter.com/LQN3ROEaEw

— Steve Cortes (@CortesSteve) September 26, 2022

The pound plunged nearly 5% at one point to $1.0327, breaking below 1985 lows as belief in Britain’s economic management and assets evaporated. Even after stumbling back to $1.05, the currency was down 7% in two sessions.

Amidst the Asia-Pacific markets opening on Monday, Ray Attrill, the head of the currency strategy at National Australia Bank says, “It’s a case of shoot first and ask questions later, as far as UK assets are concerned.”

Chris Weston, the head of research at the brokerage firm Pepperstone, says the pound is “the whipping boy” of the G10 foreign exchange market, while the UK bond market was “getting smoked” thanks to Kwarteng’s £45bn debt-financed tax-cutting package.

“Investors are searching out a response from the Bank of England. They’re saying this is not sustainable when you’ve got deteriorating growth and a twin deficit.”

“The funding requirement needed to pay for the mini-budget means either we need to see far better growth or higher bond yields to incentive capital inflows,” Weston said.

The price of easy fiscal policy was laid bare by the market,” said Sanjay Raja, chief UK economist at Deutsche Bank. He said Kwarteng’s tax cuts were adding to medium-term inflationary pressures and were “raising the risk of a near-term balance of payments crisis”

This isn’t a shitcoin.

It’s the British Pound. pic.twitter.com/dScog60C59

— Chairman (@WSBChairman) September 26, 2022

There is an inverse relationship between interest rates and bonds.

The British pound fell 3.5% against the dollar on Friday after the new U.K. government announced an extreme economic plan with the hopes to boost growth.

Investors dumped UK assets, which caused bonds to fall and the pound to a 37-year low. This was as a result of an increse in expected government debt. Paul Johnson, director of the Institute for Fiscal Studies, said markets appeared “spooked” by the scale of the “fiscal giveaway,” and said it represented the highest level of tax cuts in half a century.

The yield on 10-year bonds jumped 35 basis points, the biggest increase in history after Chancellor of the Exchequer Kwasi Kwarteng outlined tax cuts and spending plans.

The Federal Reserve raised interest rates for the third time in a row last week.

On Wednesday, the Federal Reserve raised its benchmark interest rates by 0.75 basis points. Jerome Powell says that the US housing market needs a “difficult correction” in order to lower the costs of homes.

“For the longer term what we need is supply and demand to get better aligned, so that housing prices go up at a reasonable level, at a reasonable pace, and that people can afford houses again,” Powell said on Wednesday. “We probably in the housing market have to go through a correction to get back to that place.”

“From a sort of business cycle standpoint, this difficult correction should put the housing market back into better balance.”

Interest rates are expected to climb for some time, which means that bonds will continue to take a deep nose dive.

Better keep an eye on those pensions… 👀

Looks like the bond market bubble has burst. The value of global bonds has plunged by another $1.2tn this week, bringing the total loss from ATH to $12.2tn. pic.twitter.com/JMBAGhdDlZ

— Holger Zschaepitz (@Schuldensuehner) September 25, 2022

Not a promising start to the week for sterling in Asian trading: a new low versus the dollar below $1.0770, down about 0.8% from Friday pic.twitter.com/WjvElpLipN

— David Milliken (@david_milliken) September 25, 2022

Many are saying the crash is also due to growing recession fears, but WE ARE ALREADY IN A RECESSION.

A recession is defined as two consecutive quarters of decline in gross domestic product (GDP).

People can’t even properly define and agree upon the right definition of a recession. There seems to be nothing our modern world can agree on, which is very alarming to say the least.

At this point, we are heading for (a global) depression if things don’t start to shape up soon.

A depression is characterized as a dramatic downturn in economic activity in conjunction with a sharp fall in growth, employment, and production. Depressions are often identified as recessions lasting longer than three years or resulting in a drop in annual GDP of at least 10%.

Add comment