Americans have felt the impact of inflation rates these last couple of years but according to recent data, average families are achieving a millionaire status.

According to the Federal Reserve’s latest authoritative survey of consumer finances, the mean net worth of the average American household, even adjusting for inflation, was $1.06 million last year.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Compared with 2019, that figure was up 23 percent, increased due to a rise on home prices and a surging stock market SPX. However, the median net worth of the typical American household is $192,900. This figure still shows an “after-inflation gain” of 37 percent over the three years but is more aligned with what everyday experience suggests.

To simplify terms for those unaware, the median household refers to the group in the middle of rankings. The average (mean) gets boosted by entrepreneurs like Elon Musk and Jeff Bezos. According to the Federal Reserve, American households by income in the 10 percent have an average net worth of $6.63 million.

These results showcase the importance of home ownership creating wealth for families. Those who own properties have an average new worth of $1.53 million, compared to just $155,000 for renters.

According to a summer report from MarketWatch, a $1 million-dollar household doesn’t make much of a dent, nowadays. A Charles Schwab Modern Wealth survey revealed its takes $2.2 million to consider Americans wealthy.

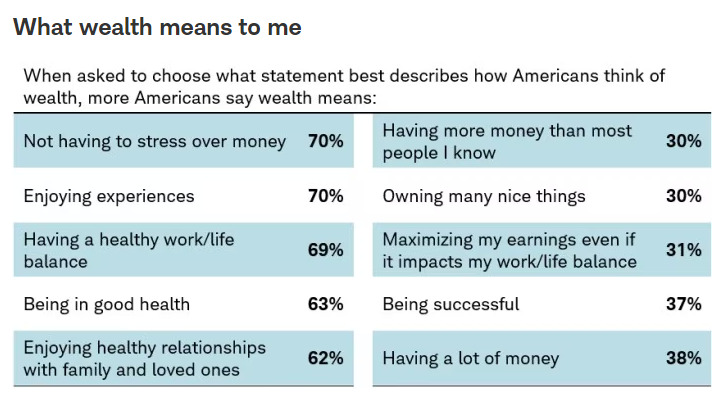

In three of the surveys, Schwab has asked respondents to finish the sentence, “To me, wealth means… .” In 2017 and 2022, “money” was the most popular answer. But this year, the No. 1 answer for what wealth means was “well-being.”

Add comment