In this week’s case study from the Biz Doc Podcast, Tom Ellsworth gives a masterclass on the mortgage market, talks about product life cycles applied to the music industry, and how Nintendo needs a new product to revamp its sales.

This episode is filled with useful information that you can apply right now!

The Biz Doc sought to get behind the spin surrounding the current American mortgages and housing situation and began with a history lesson:

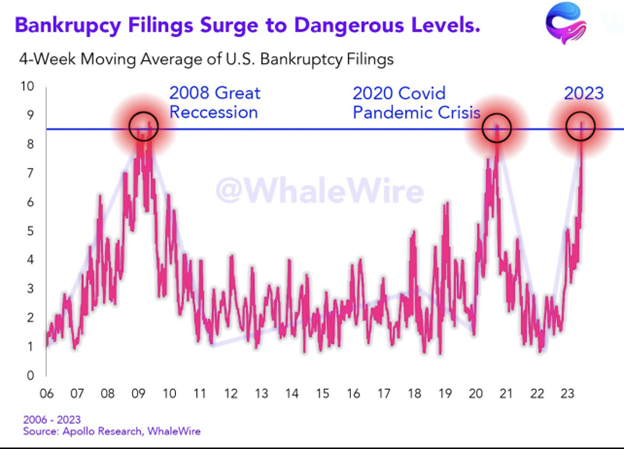

Whale Wire, a financial news social media channel, compiled data recently from Apollo Research about bankruptcy filings since 2006.

They show that bankruptcy filings are currently at a high, matched only by the 2008 Great Recession and the 2020 COVID pandemic. And on top of that, processing of filings is backed up, meaning there are more to come.

Ellsworth expressed concern that this could mean the economy will not have the “soft landing” after the pandemic that many have hoped for. He recommended that business owners keep their general contractors on a short leash and keep their personal expenses low, as the Federal Reserve will not be lowering interest rates any time soon.

After discussing the decline of Nintendo sales, cited as an indication of consumers cutting back on spending, the Biz Doc turned to mortgages.

The bankrate during the great housing crisis of 2008 was only 6 percent. Now, it’s shot up to 7.75 percent. “It is back with a vengeance, and it is higher than it’s been since 2000,” Tom exclaimed.

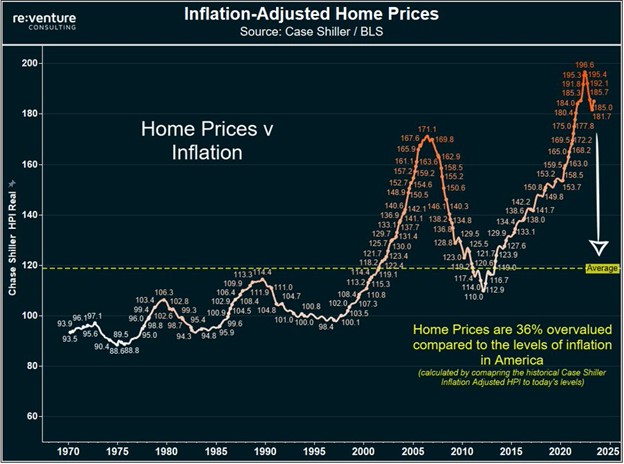

Further, home prices have reached higher levels than they did after the ’08 crash. According to data from Bureau of Labor Statistics computed by Case Shiller, home prices are 36 percent overvalued compared to the levels of inflation in America.

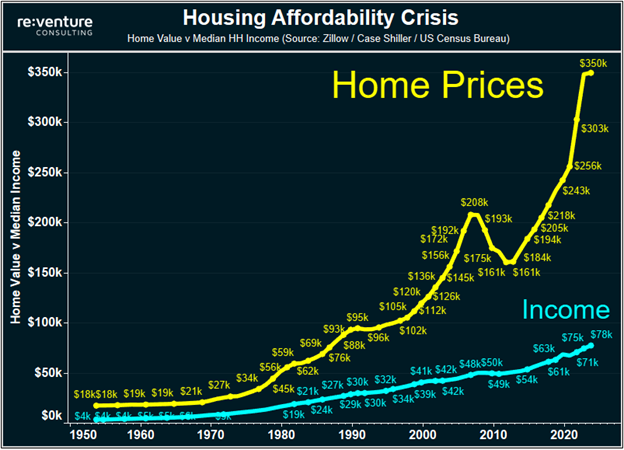

The same is true for personal incomes. Home prices have skyrocketed to an average of $350,000 today, versus a median household income of $78,000. That ratio is far wider than it was in 2008.

“You’re not crazy, it’s incredibly unaffordable,” Tom said.

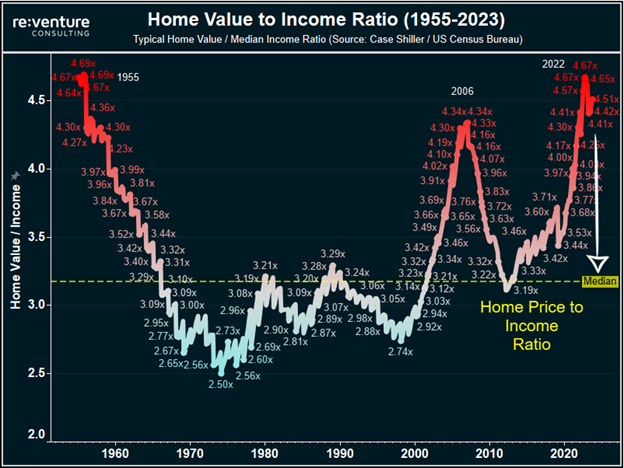

The affordability ratio of homes to income is far higher than it was in 2006 (pre-crash). The home value to income ratio is higher than it has ever been since 1955.

“When we printed all that money and devalued the dollar, it helped drive asset prices and that’s where we are today.”

But what’s with the short supply of homes? Why can’t I find houses to buy even when I look in areas that usually have less demand? Answer: people don’t want to sell their homes.

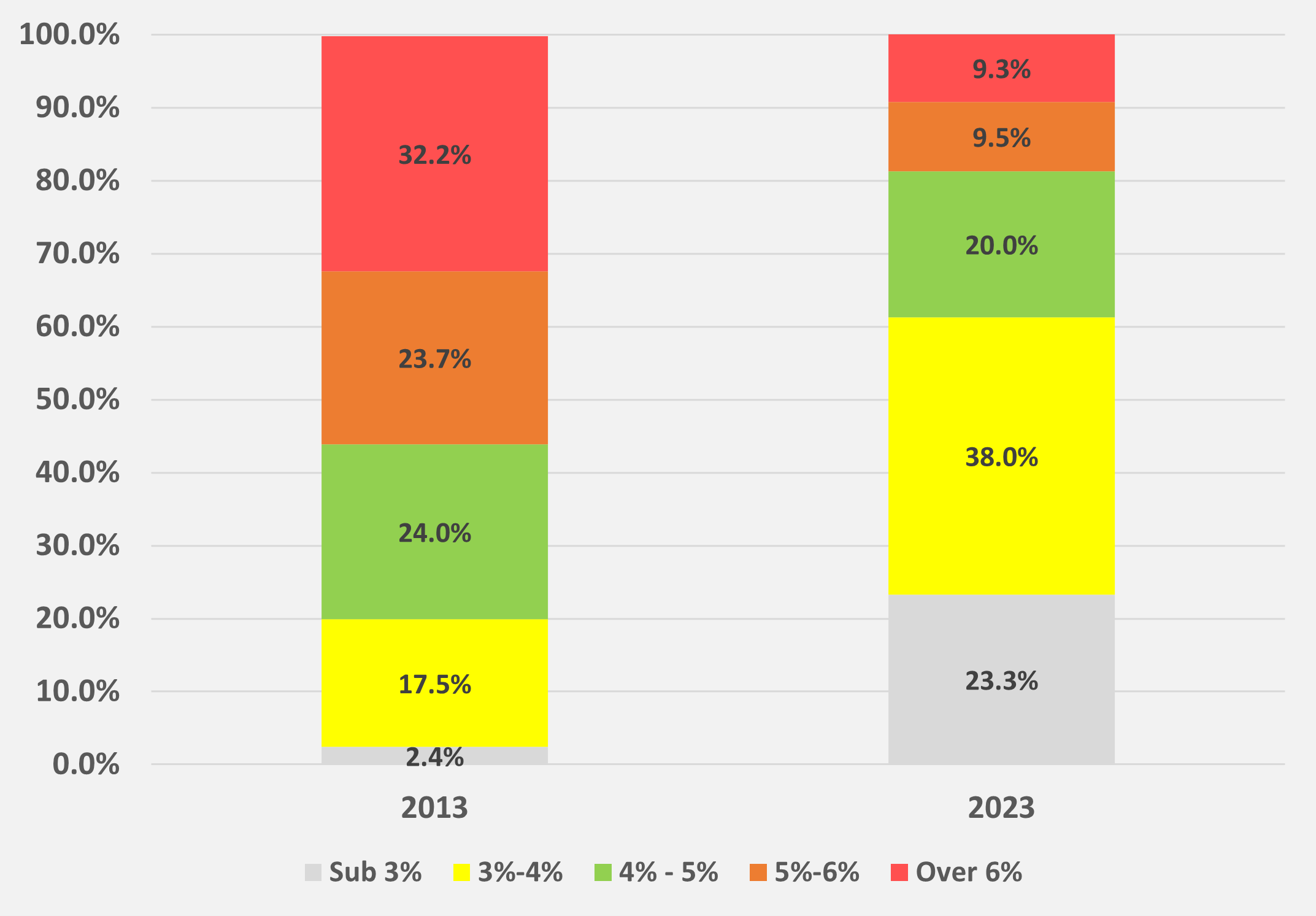

There was a race to refinance ever since 2020 when people heard interest rates could be increasing. Now, however, the refinance rate is flattening. This goes for sub-3 percent interest rate mortgages, 3-4 cent interest rate mortgages (which makes up 61 percent of all mortgages), and 4-5% interest rate mortgages. People are getting locked in with their current homes. Half of the mortgages in America are HALF of where current interest rates are. And here come higher property taxes…

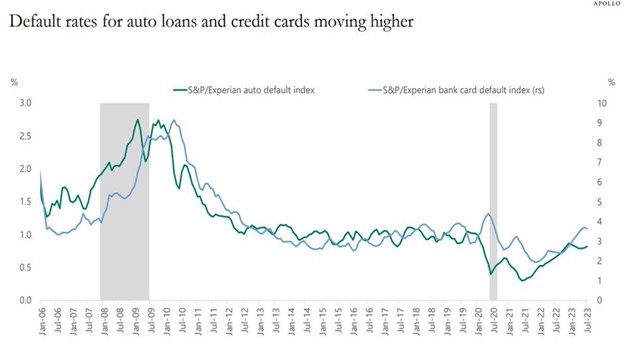

The next chapter may be starting: inflation is pinching people and they cannot afford auto loans or credit cards anymore. Defaults for these borrowers are increasing, according to S&P and Experian.

What happens when you can’t pay back what you borrowed? Bankruptcy, as we discussed with the Whale Wire graph from earlier. We are reaching the 2008 level of bankruptcies now and today’s rate has even more momentum than back then.

“It is time for personal financial conservatism. Lots of grim pictures are being painted by real estate organizations.”

- Up to 50 percent of buyers are all cash

- Mortgage rates stretch qualifications for many

- And high prices are also raising property tax and insurance.

Biz Doc recommends: rent for now and wait for rates and supply to calm down. History repeats itself, and the trend lines will come back. Remain vigilant of things, and manage yourself with prudence. And don’t be depressed that you cannot get a house. Sit back, let it play out. The last thing you want is to stretch yourself thin by getting a house and having something come up, like loss of a job or some kind of emergency. The best thing to do is to be content with where you are, find the best lifestyle you can, save your money, and reduce your lifestyle a bit.

Leave a comment on Biz Doc’s YouTube video if you want him to discuss a topic that interests you!

Add comment