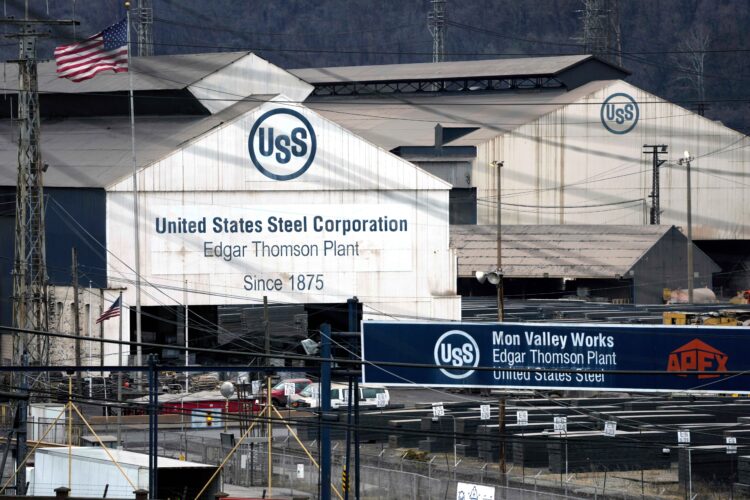

The U.S. Steel Corporation, the historic Pittsburgh-based manufacturer that led the nation’s industrialization in the early 20th century, will be bought out by Japanese competitor Nippon Steel for nearly $15 billion, the two companies announced on Monday.

The lucrative acquisition, which will make Nippon the world’s third-largest steel producer, also triggered a significant stock surge for both companies — but American lawmakers were less than enthusiastic about the deal.

According to an announcement published by U.S. Steel on Monday, Nippon will acquire the company’s stock for $55.00 per share, for a total of $14.9 billion, to be paid in cash. This total includes the assumption of debt, and more than doubles competing offers made to U.S Steel since it put itself up for sale earlier this year. The per-stock offer represents a 40 percent premium over the company’s trading price at Friday’s close.

Upon the announcement of the merger, U.S. Steel share prices rose about 27 percent in premarket trading.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Under the terms of the new agreement, the company will retain its name and headquarters in Pittsburgh, Pennsylvania, where it has operated since it was founded by J.P. Morgan in 1901. U.S. Steel will now function as a subsidiary of Nippon, which expects to move its new acquisition towards 100 million tons of global crude steel capacity.

The agreement must now be approved by the Committee on Foreign Investment before it can take effect. However, the merger is being contested by United Steelworkers International, which pushed for keeping “this iconic American company domestically owned and operated.”

The union had backed a previous deal between U.S. Steel and Cleveland-Cliffs, which was rejected earlier this year.

Another unexpected source of criticism was Pennsylvania Senator John Fetterman, who blasted the foreign takeover as “absolutely outrageous.”

“Steel is always about security,” Fetterman said. “And I am committed to anything I can do, from using my platform or my position, in order to block this.”

“I’m going to fight for the steelworkers and their union way of life here as well, too.”

The acquisition of @U_S_Steel by a foreign company is wrong for workers and wrong for Pennsylvania. I’m gonna do everything I can to block it. pic.twitter.com/9EqohwRhRJ

— U.S. Senator John Fetterman (@SenFettermanPA) December 18, 2023

Add comment