In this episode of The Biz Doc, Tom Ellsworth looks into the effects of inflation with price hikes in housing, concert tickets, and even girl scout cookies, before he turns to Apple’s downward trend for a case study.

To listen to his full analysis, watch the video below. This article will focus on his Apple analysis.

If one has not been paying attention to Apple, they might be surprised to find a series of recent negative headlines about the biggest company by market cap in the world. Market cap is short for market capitalization, which is the total dollar market value of a company’s shares including outstanding shares.

Several articles from the Wall Street Journal have indicated the tech giant is dealing with myriad problems due to its relationship with China fraying.

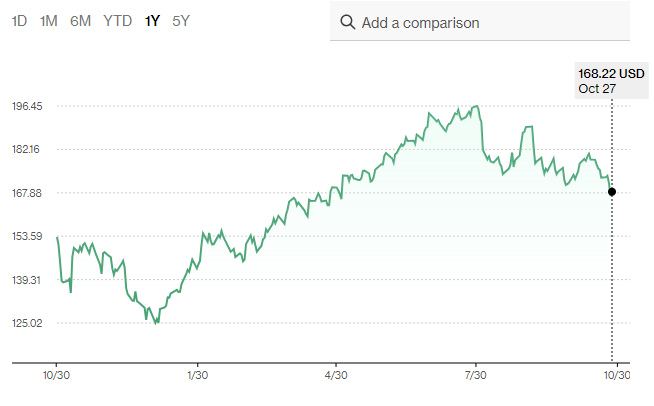

Apple stock is down 10 percent in four months (-320 billion of market cap).

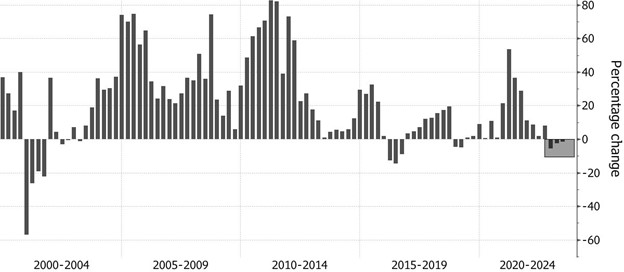

In November, Apple will likely announce that its sales are flat or down year-over-year, meaning it has had four quarters of negative growth—a trend that has not happened since 2002.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

The iPhone 15 Pro and Pro Max was overheating upon release (which are said to have been solved by a new iOS update).

Apple’s sales in China are down, and it is over-reliant on Chinese companies like Luxshare Precision, a coveted manufacturer that designs its AirPods, Apple Watch, and the iPhone 15.

Apple’s free cash flow is only at 3.6 percent, versus its 10-year average of 6.4 percent.

Its stock is trading at 26x—above the historical average, which means it’s a bit overinflated. Analysts are rating Apple as the lowest of the mega (multi-trillion) caps, or companies with the highest market capitalization.

Apple is having trouble answering the question, “Where’s the New Thing?”

VisionPro is not drawing the masses. Apple Card is not all that it was cracked up to be, and despite there being six million card holders in the U.S. the program’s future is uncertain. Apple TV successfully secured Soccer star Lionel Messi but just had to cancel comedian Jon Stewart’s exclusive Apple show over political differences.

Biz Doc’s lessons: Riding product success is fine, but trust the data when it tells you the product is old and needs new features. Denial is a powerful drug, and don’t let your confirmation biases blind you to a competitor outpacing you. Plan and invest in the future: don’t allow your company to become stale. There’s many companies out there that tried to ride a successful product forever only to eventually crash and burn. Be rational and strategic about investment, and make sure you always maintain a forward-going momentum. Finally, cautious boldness is a good thing in a tough market. Even Apple can have burps and bumps in the road, but it can bet on the fact that it’s not going anywhere.

Add comment