“Although inflation has moved down from its peak, a welcome development, it remains too high,” he said. Powell said he sees it as the Fed’s job to bring down inflation to their goal of 2%. The latest report on U.S. inflation shows a rate of 3.2%. Powell stated the Fed is committed to pursuing a restrictive fiscal policy until that goal is achieved.

Powell and his Federal Reserve team have raised interest rates to a 22-year high in what the Wall Street Journal described as “the most aggressive sequence of rate increases in 40 years.”

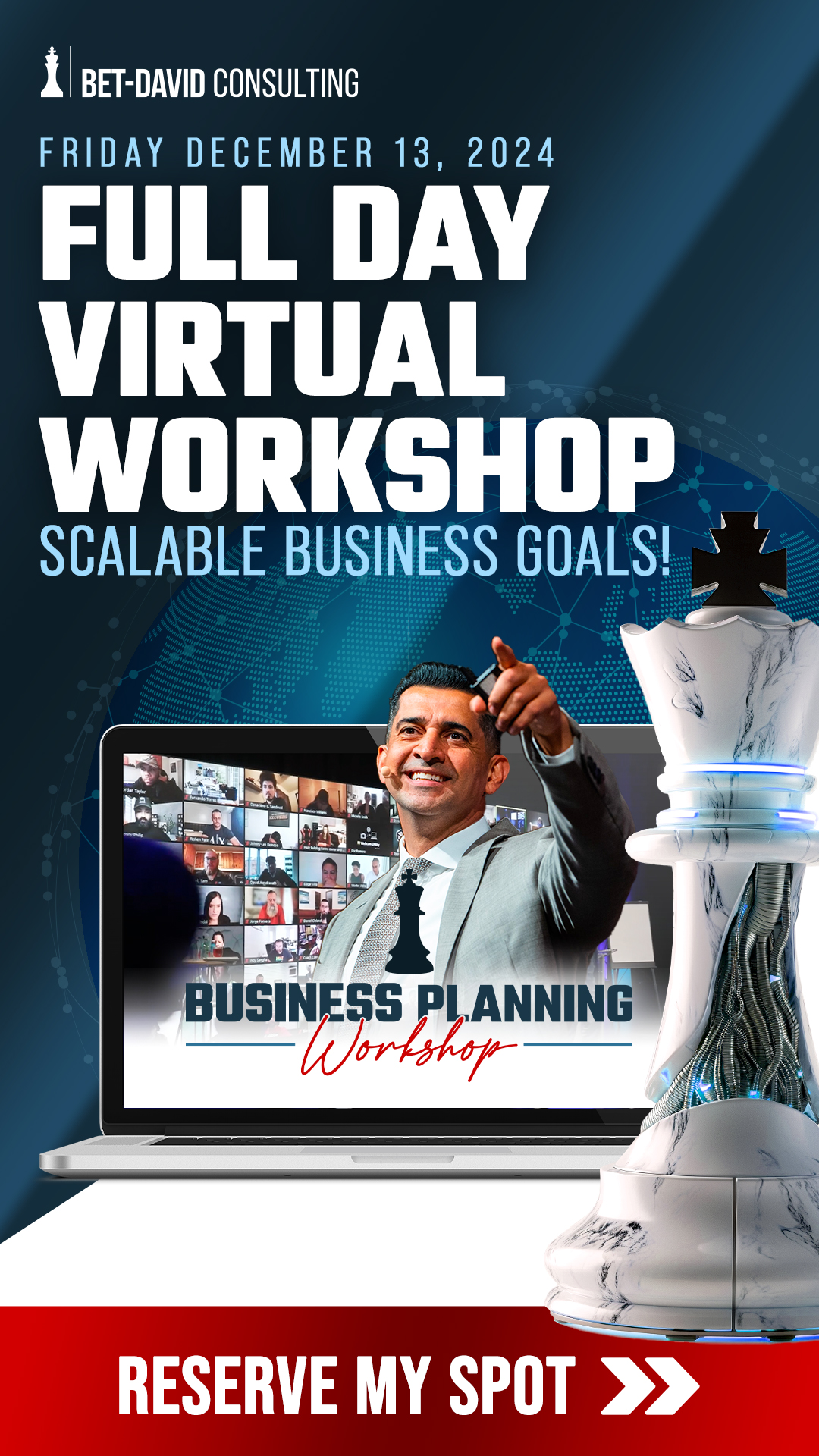

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Powell covered the measures that the Fed has engaged in since 2022’s symposium, such as raising the policy rate by 300 basis points and substantially reducing its security holdings. The fact that there has been “lag” in inflation rates adjusting to these moves made him suggest more such measures may be needed.

Powell affirmed that the Federal Reserve is prepared to raise interest rates if needed. He narrated the story of U.S. inflation since the gargantuan public spending undertaken by the federal government during the COVID-19 pandemic, and noted the Core Inflation Rate (costs of food, fuel, housing, and other necessities) reached its peak in February 2022.

RELATED: Patrick Bet-David and “the Biz Doc” Thomas Ellsworth React to Fed Raising Interest Rates

The Federal Reserve will be watching the housing market closely for signals of rising or falling market rent growth, hoping that it declines to its pre-pandemic level, he said.

Powell stated further progress in reducing inflation for non-housing goods will be essential to Fed policy, as these were affected by things like “supply chain bottlenecks.” Powell happily noted that recent reports on consumer spending have looked robust and that labor supply has improved.

He recognized that doing too much could harm the labor market and the American economy in general. He then reaffirmed his commitment to fixing the problem for all sides. “Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all. And we will keep at it until the job is done,” he concluded.

Watch the full speech here:

Add comment