BlackRock is reportedly scaling back its support for shareholder proposals that push Environmental, Social, and Governance (ESG) regulations in a shocking move that indicates the anti-ESG movement might actually be working.

Environmental, Social, and Governance policies stem from a widespread investment strategy that accounts for a company’s support for environmental causes, involvement in social justice issues, and compliance with governmental ordinances. The ESG agenda has been spearheaded by investment firms and asset management groups—and BlackRock, the largest money manager in the world, has been its biggest proponent. In recent years, these policies have become the driving force for left-wing agendas in corporate culture, responsible for racial bias training, diversity, equity, and inclusion audits, and carbon emission caps.

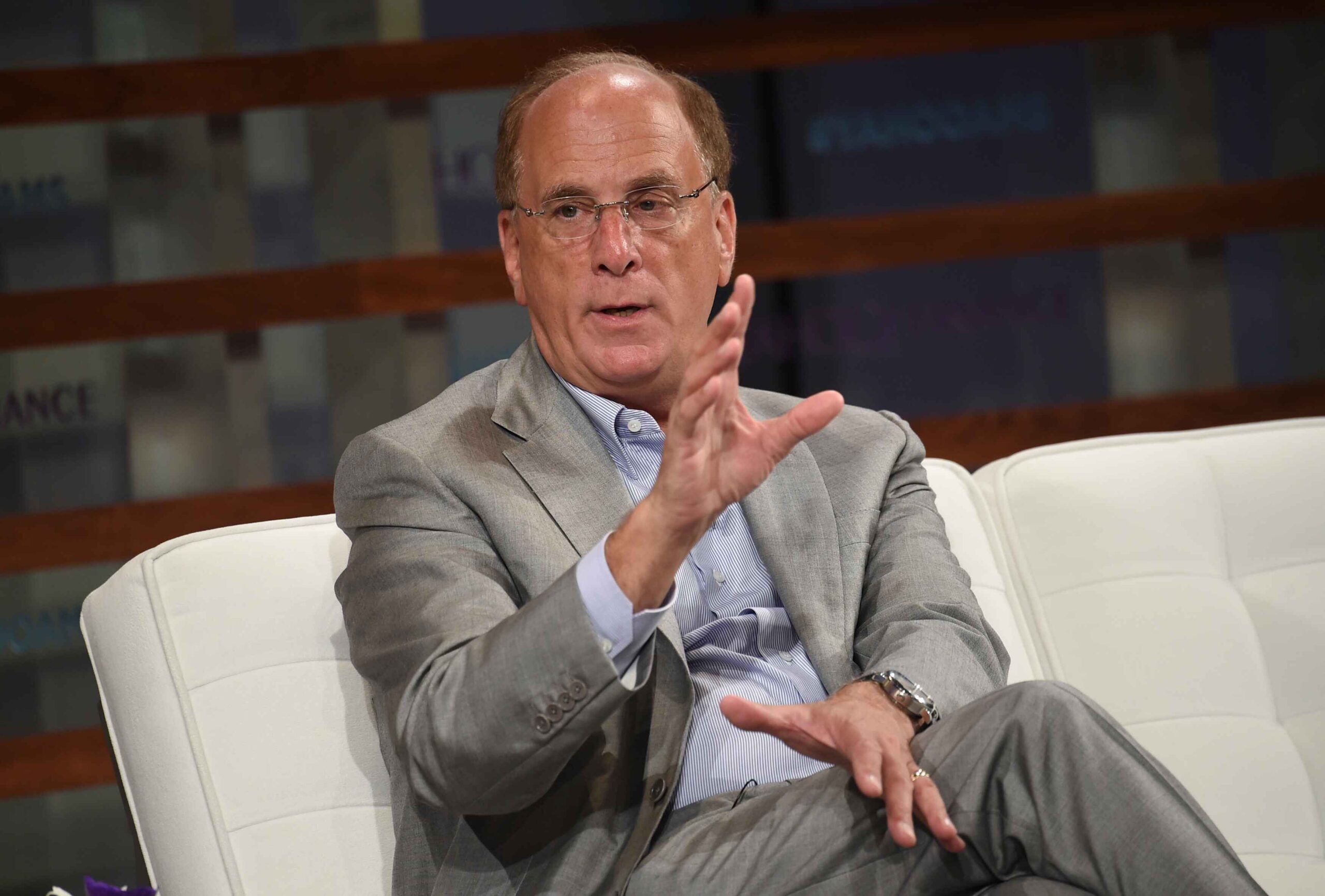

However, in the last year, public backlash against the effects of ESG investing has intensified as Republican lawmakers zero in on the agenda. This has led to significant cracks developing in the ESG push, including the purging of the acronym from corporate websites and banking strategies, as well as the S&P dropping the ESG scale from its debt rating system. In another notable instance, BlackRock CEO Larry Fink, known by many as “the most powerful man on Wall Street,” omitted reference to ESG from an annual company letter sent out in March.

However, while overt references to ESG have steadily disappeared, the agenda behind it has very much remained in place in banking and investing, and BlackRock has remained dedicated to pursuing the same goal…but apparently, that’s starting to change.

According to an annual company report, BlackRock supported just 7% of the nearly 400 shareholder proposals that involved environmental and social matters in the last year. For reference, previous cycles have seen the company support between 25% and 47% of such proposals in the past.

Check out the keynote speakers and details for The Vault 2023 and secure your tickets!

The report indicates that this major shift comes from a renewed focus on providing maximized value to shareholders—a duty it has long been accused of neglecting in the pursuit of ESG. Despite a reported 30% increase in ESG proposals, the company has made efforts to massively reduce its involvement. “Because so many proposals were over-reaching, lacking economic merit, or simply redundant, they were unlikely to help promote long-term shareholder value and received less support from shareholders, including BlackRock, than in years past,” the report said.

As the pushback against ESG continues, BlackRock will likely find itself facing even more scrutiny. Earlier this month, a group of Republican financial officials from 15 different states sent a letter to the firm demanding its mutual fund directors provide transparent answers about “potential conflicts of interest” in its investing. Additionally, the House Select Committee on the Chinese Communist Party launched an investigation into BlackRock’s ties to China, accusing the company of profiting from efforts to undermine American values and national security.

With anti-ESG efforts even appearing as policy platforms for Republican presidential candidates, it’s clear that people are still willing to fight against these policies.

But as Patrick Bet-David explained in this recent video, the ESG agenda is a $66 TRILLION weapon aimed directly at corporate America, meaning this battle is far from over.

Add comment