The last two years have expressed financial difficulties for middle-class Americans as food, gas, car, home, and energy prices have remained at an all-time high in the last 41 years.

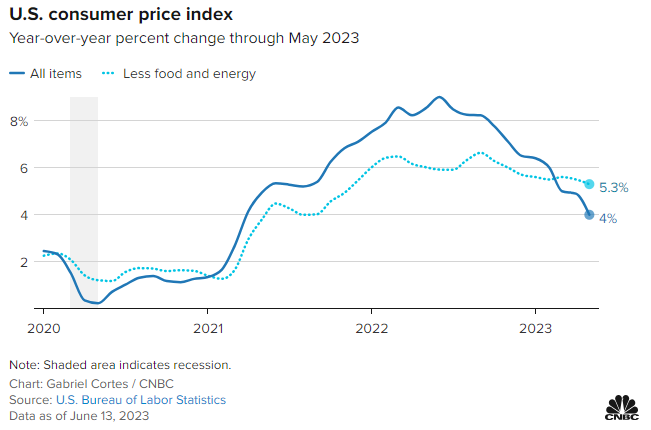

The consumer price index, which measures changes in a multitude of goods and services, increased a measly 0.1% for the month, bringing the annual level down to 4%.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

Not to mention this drop excludes food and energy prices. Rent prices are still skyrocketing, so does this slight decrease make an actual dent?

USA Today posted an article presenting a quandary for a Federal Reserve that’s “expected to pause its 14-month campaign of aggressive interest rate hikes aimed at corralling inflation to assess their economic impact.” The Fed remains concerned about the elevated core inflation.

“The encouraging trend in consumer prices will provide the Fed some leeway to keep rates unchanged this month and if the trend continues, the Fed will not likely hike for the rest of the year,” said Jeffrey Roach, chief economist at LPL Financial.

Since March 2022, the Fed has increased its benchmark interest rate 10 consecutive times aiming to bring down historically high levels of inflation.

Gas prices are averaging $3.59 a gallon nationally, up from one month ago but significantly down from a peak of $5 last June.

According to CNBC:

- Food prices are still up 6.7% from a year ago

- Shelter prices have risen 8%

- Transportation services are up 10.2%

- Airline fares have declined 13.4% after surging in the early days of the economic recovery

Add comment