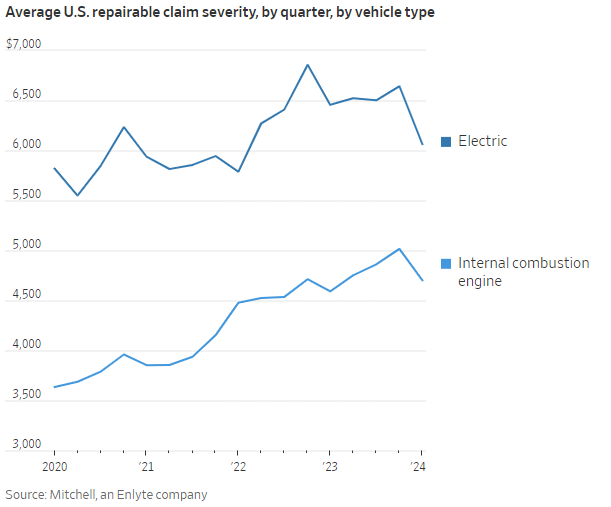

A new study from tech research firm Mitchell found that electric vehicles (EVs) are more difficult to insure, adding to the burden of motorists already lamenting expensive coverage. The study found the average severity of a claim for a repairable EV in the US was $6,066 in the first quarter, almost 30 percent more than internal-combustion-engine (ICE) vehicles. Mitchell supplies major auto insurance groups and collision-repair companies with data and software.

This cost can be attributed to the greater work involved, such as the need to de-energize electric vehicles prior to removing their high-voltage batteries to avoid incurring damage when the vehicles get repaired. New EVs are often more expensive than gas-powered cars and typically cost more to repair, leading to larger claims.

Learn the benefits of becoming a Valuetainment Member and subscribe today!

In January, car rental company Hertz announced it was reversing its 2021 decision to buy 100,000 Teslas, citing “damage expense associated with EVs” as it sold a third of its EV arsenal. Their initial purchase drove up the stock prices of Tesla as well as their own.

EVs on average have more torque, meaning they can accelerate faster through superior power-to-transmission channels. This worries some insurers that they can get into traffic accidents more easily, although critics say EVs are involved in fewer insurance claims.

An analysis in May by Insurify, using data from its online insurance comparison platform, compared quotes for 13 popular EV models to their gas-powered equivalents. The study found that the average monthly premium for EVs was 12 percent higher on average. To make matters worse, the research focused on drivers with clean records and relatively new vehicles.

The increase in insurance costs reflects a trend in the industry. According to Fitch Ratings, the combined ratio for U.S. personal auto insurers was 112 percent in 2022 and 105 percent in 2023. This ratio indicates that insurers paid out more in claims and expenses than they received in premiums, suggesting an underwriting loss.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Shane Devine is a writer covering politics and business for VT and a regular guest on The Unusual Suspects. Follow Shane’s work here.

Add comment