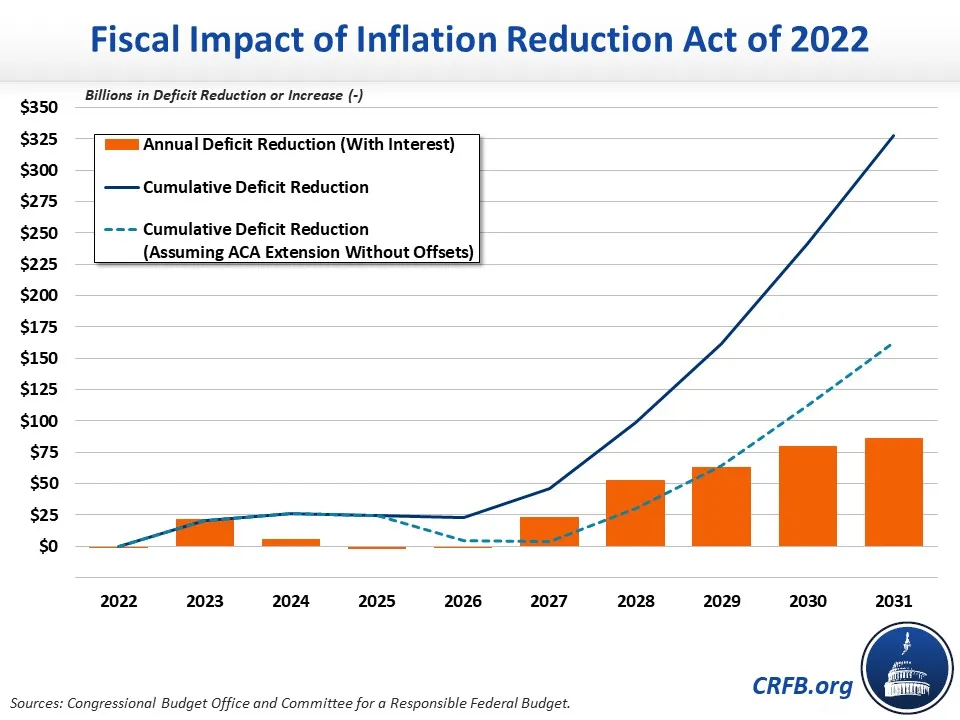

Senate Democrats passed the spending bill in an attempt to tackle climate change, lower the high cost of prescription drugs, and reduce the deficit by roughly $300 billion.

You can read the full, 755-page bill HERE.

Late Saturday night and into Sunday morning, Senators voted on amendments to Democrats’ major spending bill that tackles health care, climate, and taxes.

Not a SINGLE Republican voted for the bill.

The legislation was passed through the budget reconciliation process, meaning, all 50 Democrats and one tie-breaker vote from Vice President Harris were needed since none of the 50 Republican senators voted for the bill.

It also restricts the measures in the bill to those who directly change federal spending and revenue.

Democrats argue the bill will tackle Americans’ economic concerns, calling it the “Inflation Reduction Act.”

On the opposing end, Republicans argue the new spending will WORSEN inflation.

The non-partisan Congressional Budget Office says the bill has a “negligible” effect on inflation in 2022 and into 2023.

The bill is a very scaled-down solution to what many Democrats, including President Biden, had asked for originally.

“This bill is far from perfect. It’s a compromise. But it’s often how progress is made,” Biden said at the White House last month.

“My message to Congress is this: This is the strongest bill you can pass,” says President Biden.

After passage in the Senate, the House plans to take up the bill at the end of the week and then send it to President Biden for his signature.

Climate Change

More than $300 billion would be invested in energy and climate reform, the largest federal clean energy investment in U.S. history.

The bill is supported by many environmental and climate activists but is short of the $555 billion that Democrats had originally anticipated.

This portion of the bill takes on transportation and electricity generation, including a budget of $60 billion.

The money would be allocated towards renewable energy infrastructure and increasing the manufacturing of solar panels and wind turbines.

Electric Vehicles

The bill also includes various tax credits for individuals on things like electric vehicles and making homes more energy efficient.

According to Democrats, the bill would lower greenhouse gas emissions by 40%, based on 2005 levels, by the end of the decade.

The bill does not meet President Biden’s expectations, and is short of the 50% Biden had originally aimed for.

“It puts us within a close enough distance that further executive action, state and local government efforts, and private sector leadership could plausibly get us across the finish line by 2030,” said Jesse Jenkins from Princeton University, who leads the REPEAT Project, analyzing the impact of government climate actions.

Reducing the Cost of Prescription Drugs

The bill supposedly makes prescription drugs more affordable.

The bill includes a historic measure allowing the federal health secretary to negotiate the prices of specific costly drugs each year for Medicare.

Unfortunately, this won’t impact every prescription drug or every patient, and it won’t take effect quickly.

The negotiations will take effect for 10 drugs covered by Medicare in 2026, increasing to 20 drugs in 2029.

The portion of the bill that tried to cap at $35 per month the price of insulin was ruled out of order by the Senate parliamentarian, who ruled the cap could apply to Medicare, a government program, but not to private insurance.

Democrats split the measure between Medicare and private insurance — but Republicans ultimately blocked the measure.

The parliamentarian also ruled that a measure that was in the bill to force drug companies to offer rebates if prescription prices outpaced inflation was not totally in line with the rules for budget reconciliation; she said that it could apply to Medicare patients but not those with private insurers.

The bill puts a cap of $2,000 on out-of-pocket prescription drug costs for people on Medicare, effective in 2025.

There’s also a three-year extension on healthcare subsidies in the Affordable Care Act originally passed in a pandemic relief bill last year, estimated by the government to have kept premiums at $10 per month or lower for the vast majority of people covered through the federal health insurance exchange.

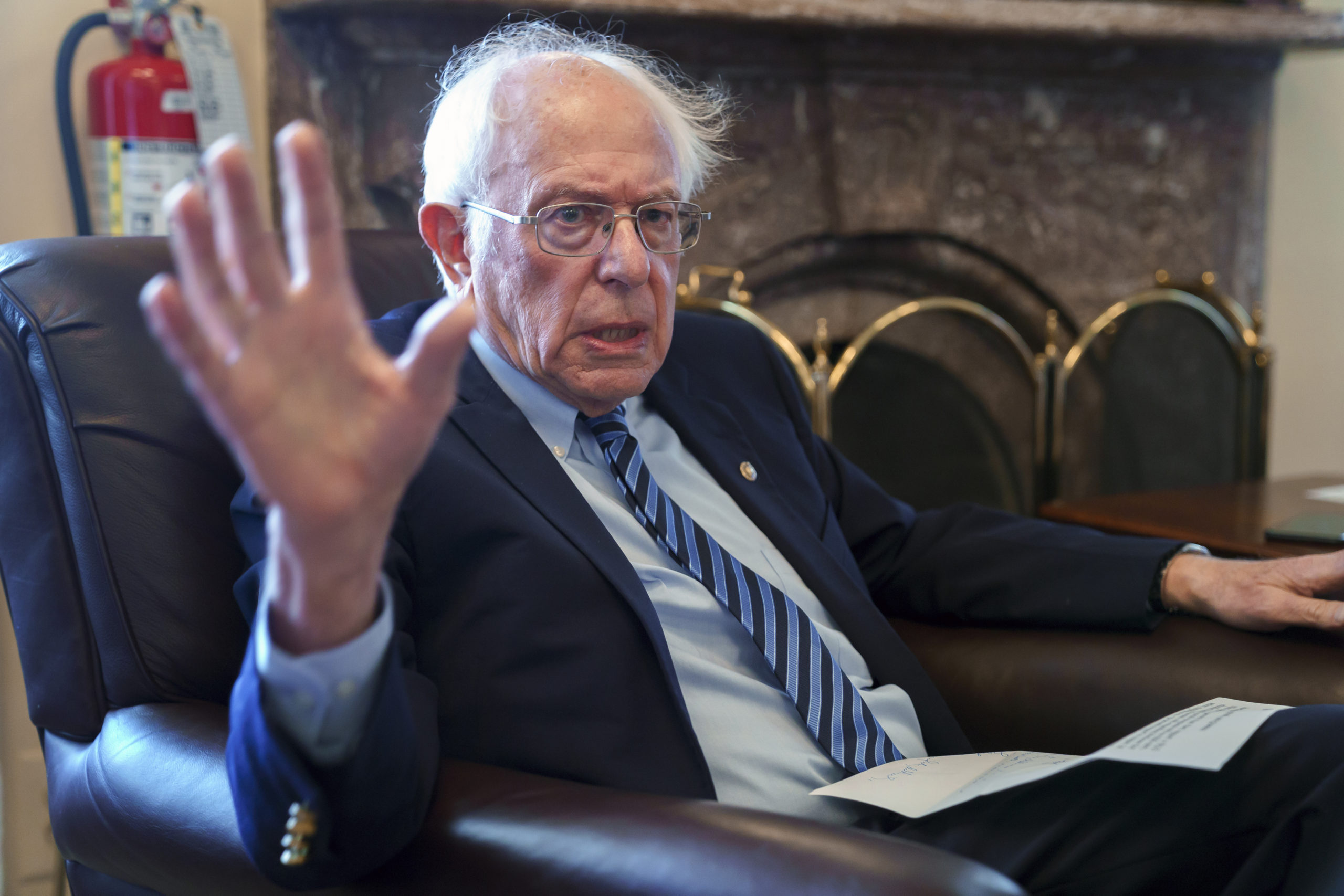

Sen. Bernie Sanders disagrees.

“This bill does nothing to address the systemic dysfunctionality of the American health care system,” he exclaimed on Saturday.

Sen. Bernie Sanders tore the ‘Inflation Reduction Act’ apart for doing little to fight inflation and not enough to help Americans struggling to afford health care, child care, and housing.

Tax Reform

The “Inflation Reduction Act” will implement a 15% minimum tax for corporations making $1 billion or more in income.

This is expected to bring in more than $300 billion in revenue.

This is where “indirect” taxes might come into play, meaning, a corporation with a higher tax bill might pass on those additional costs to employees, in the form of a lower raise. Reduced corporate profits may hurt 401(k) and other investors who own a piece of the company in a mutual fund.

The legislation will not directly increase taxes on households with annual incomes below $400,000, thereby keeping President Joe Biden’s tax pledge intact.

A major portion of the bill that isn’t included, due to opposition from West Virginia Sen. Joe Manchin, is extending the Child Tax Credit. Manchin expressed last year that the cost to extend the credit was too high, but progressives, including Vermont Sen. Bernie Sanders, have continued to push for its inclusion in the bill.

Sanders planned to add it as an amendment to the legislation during the all-night voting process, even without the support he needs to pass it.

Inflation Reduction Act Summary

| Policy | Cost (-)/Savings (2022-2031) |

|---|---|

| Energy and Climate | -$386 billion |

| Clean Electricity Tax Credits | -$161 billion |

| Air Pollution, Hazardous Materials, Transportation and Infrastructure | -$40 billion |

| Individual Clean Energy Incentives | -$37 billion |

| Clean Manufacturing Tax Credits | -$37 billion |

| Clean Fuel and Vehicle Tax Credits | -$36 billion |

| Conservation, Rural Development, Forestry | -$35 billion |

| Building Efficiency, Electrification, Transmission, Industrial, DOE Grants and Loans | -$27 billion |

| Other Energy and Climate Spending | -$14 billion |

| Health Care | -$98 billion |

| Extension of Expanded ACA Subsidies (three years) | -$64 billion |

| Part D Re-Design, LIS Subsidies, Vaccine Coverage | -$34 billion |

| Total, Spending and Tax Breaks | -$485 billion |

| Health Savings | $322 billion |

| Repeal Trump-Era Drug Rebate Rule | $122 billion |

| Drug Price Inflation Cap | $101 billion |

| Negotiation of Certain Drug Prices | $99 billion |

| Revenue | $468 billion |

| 15 Percent Corporate Minimum Tax | $313 billion |

| IRS Tax Enforcement Funding* | $124 billion |

| Closure of Carried Interest Loophole | $13 billion |

| Methane Fee, Superfund Fee, Other Revenue | $18 billion |

| Total, Savings and Revenue | $790 billion |

| Net Deficit Reduction | $305 billion |

| Memo: Deficit reduction with permanent ACA subsidy extension | ~$155 billion |

*IRS funding provision involves an $80 billion expenditure over ten years, which CBO estimates will yield $204 billion in additional revenue for a net savings of $124 billion. Figures are rounded, based on available information as of 8/3/2022, and subject to change. Figures may not sum due to rounding

According to the Committee for a Responsible Federal Budget, “Although reconciliation was designed for deficit reduction, this would be the first time in many years it was actually used for this purpose. It would also be the largest deficit reduction bill since the Budget Control Act of 2011.”

“With inflation at a 40-year high and debt approaching record levels, this would be a welcomed improvement from the status quo.”

READ MORE: According to the Declaration of Independence, An “Insurrection” is PERFECTLY LEGAL!

ABOUT THE WRITER:

Elena Patestas is a journalist and writer for Valuetainment media. She attended Pepperdine University in Malibu, California, and Adelphi University on Long Island, New York. She was born and raised in Roslyn, New York, and currently lives in Miami, Florida.

Elena is passionate about bringing positive change to our world and believes education is the root to solving many societal problems. After overcoming a chronic health condition, Elena became passionate about health and believes food is the key to preventing dis-ease and achieving optimum health.

Amongst her many goals, she hopes to bring positive, impactful change to our world to create a healthy, financially sound, and unified society.

Add comment