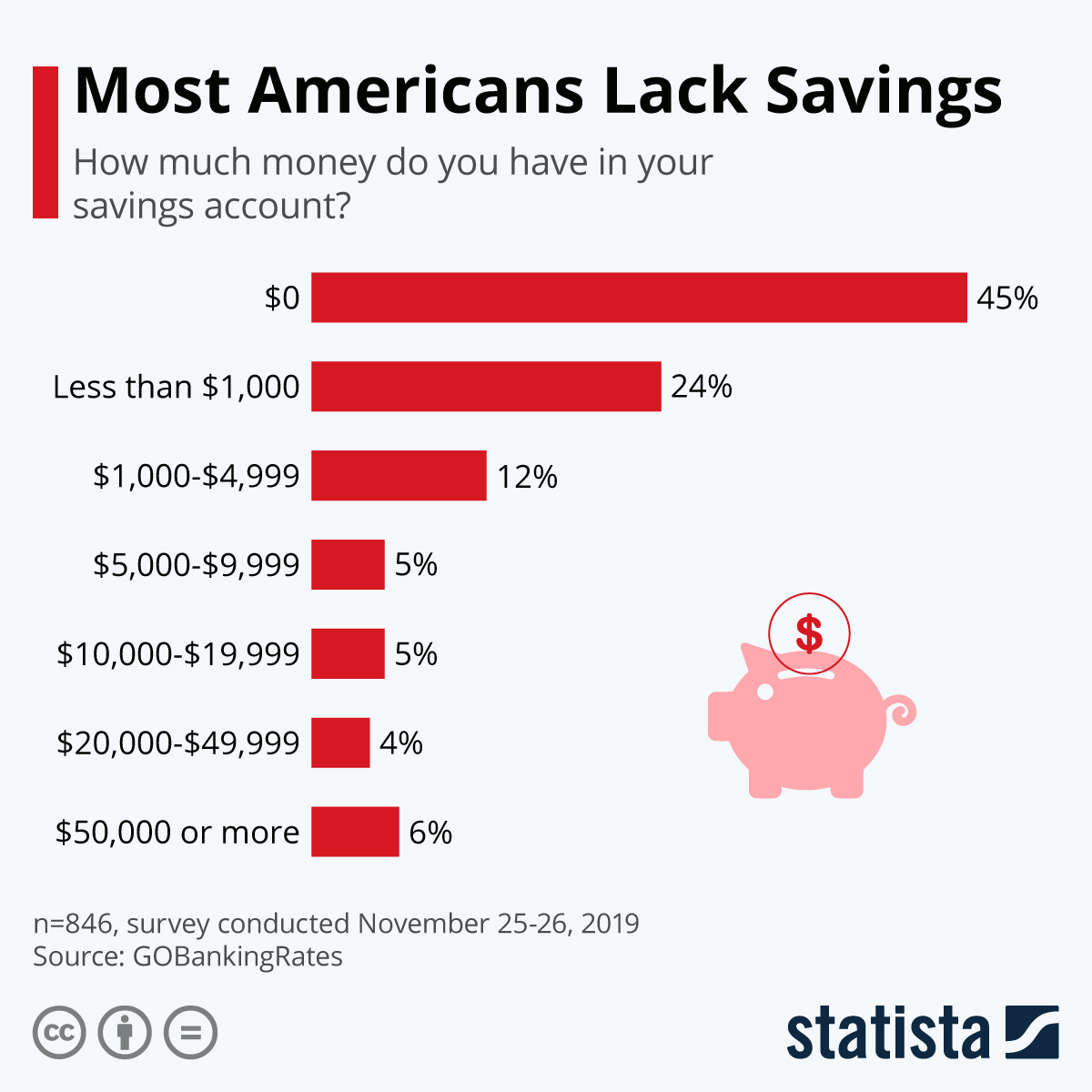

45% of Americans have NOTHING ($0) in their savings accounts.

With 64% of Americans living paycheck-to-paycheck, it makes you wonder how the average American manages their finances.

An additional 24% of Americans have less than $1000 in their savings account.

READ MORE: 7 Foods That Cause Anxiety and Depression

REALITY CHECK!

Nearly 6 in 10 Americans don’t have enough savings to cover a $500 or $1,000 unplanned expense, according to a new report from Bankrate.

The problem is not that Americans are making too little. The issue stems from the fact that as peoples’ wages increase, so do their expenses.

How to Get Rich Without a College Degree

How did we let this happen?

Well, they don’t teach financial literacy in public schools across America, so that explains a lot!

Maybe if we taught the future of America how to manage their money and cut down their expenses, they’d be a little better off right now.

20 CRAZY Technologies That Will Be Mainstream by 2050

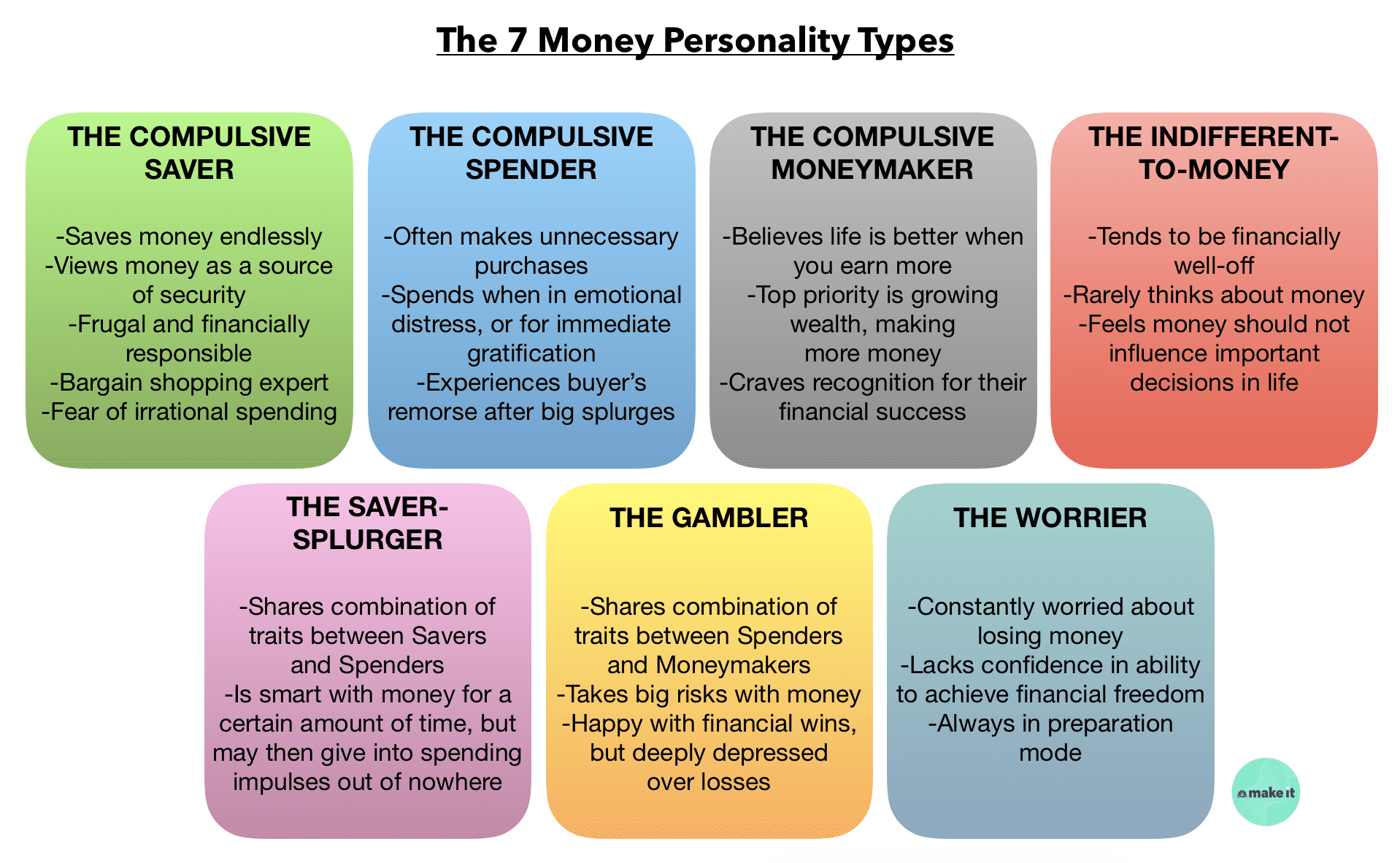

The 7 Money Personality Types – Which One Are You?

1. The Compulsive Saver

Signs you might be a Compulsive Saver:

- You save money CONSTANTLY, at any given chance you get.

- You believe money is a source of security and treat it as such.

- You’re very frugal. You spend your money cautiously.

- You consider yourself to be a financially responsible person.

- You love to find the best deals on different purchases you make (as one should!)

- You might fear is irrational, compulsive spending.

If you consider yourself to be a “compulsive saver,” CONGRATULATIONS!

Most Americans, 45% to be exact, have NOTHING ($0) in their savings accounts. An additional 24% of Americans have less than $1000 in their savings account, proving that most Americans don’t know how to save their money and manage their finances responsibly.

Considering financial literacy is not taught in public schools, we can’t blame them for struggling!

However, it’s never too late to educate oneself and make a change that will be life-changing for most.

10 of History’s Most Tragic Assassinations

2. The Compulsive Spender

Signs you might be a Compulsive Spender:

- You tend to make “unnecessary purchases.”

- You spend money when you are in an emotional state, such as feeling extremely happy or sad.

- You spend money for instant gratification.

- You might find yourself experiencing “buyer’s remorse” after big splurges.

Even if they have large amounts of debt, compulsive spenders will continue to spend their money like there’s no tomorrow.

They may even try to hide large purchases from friends and family. In extreme cases, these individuals can be at risk of going bankrupt if they are constantly spending more money than they earn.

Their credit score? Don’t ask.

5 Ways Women can Reduce Their Spending.

3. The Compulsive Moneymaker

Signs you might be a Compulsive Moneymaker:

- In your eyes, everything can be seen as an opportunity to make money.

- Your brain is wired to look for financial opportunities and growth.

- You believe life is better when you’re financially well-off or comfortable.

- Your top priority is growing and securing your wealth.

- You might crave recognition for your financial success.

Don’t be ashamed by your drive to make more money. Those who earn more money are in fact, happier.

According to a study by the University of Pennsylvania, people’s well-being rises with the amount of money they make, even beyond $75,000.

Money gives people the ability to make choices about how they live their lives, says Matthew Killingsworth, study author and senior fellow at Wharton, who studies human happiness.

Interesting Statistics:

37.8% of Americans earn less than $50,000 a year.

54.3% of America earns less than $75,000 a year.

Thinking of Leaving America? The 10 Best Countries For Ex-Pats

4. The Indifferent-to-Money

Signs you might be an Indifferent-to-Money:

- Tends to be financially well-off

- Rarely thinks about money.

- Feels money should not influence important decisions in life.

Even if you are financially “well-off,” it’s still important to be cautious of how you spend your money and what you are doing to earn more. As always, avoid debt like the plague and keep your expenses to a minimum.

5. The Saver-Splurger

Signs you might be a Saver-Splurger:

- Shares combination of traits between savers and spenders.

- Is smart with money for a certain amount of time, but may then give into spending impulses out of nowhere.

The saver-splurger might be great at saving, but is also great at spending.

In turn, what you are likely left with is a savings accounts with little to no savings.

Be cautious of your bad “money habits” and try to improve the areas you fall victim to most. If you find yourself making huge purchases that cause you to lose money, consider why and don’t do it again.

Learn your lesson the first time, so you don’t have to lose more money in the future.

20 CRAZY Technologies That Will Be Mainstream by 2050

6. The Gambler

Signs you might be a Gambler:

- Shares combination of traits between spenders and moneymakers.

- Takes big risks with money.

- Happy with financial wins, but deeply depressed over losses.

It’s not unusual for gamblers to experience sudden devastating losses.

The worst is when the gambling gets out of control and they borrow against things like their retirement money or children’s college funds to make up for their losses (or gamble more).

Be careful and get help before the damage is irreversible.

Don’t be ashamed. We all have our own hardships and struggles, and if you are brave enough to admit your own the universe will surely reward you for it.

READ MORE: According to the Declaration of Independence, An “Insurrection” is PERFECTLY LEGAL!

7. The Worrier

Signs you might be a Worrier:

- Constantly worried about losing money.

- Lacks confidence in ability to achieve financial freedom.

- Always in preparation mode.

It’s always a good idea to be cautious and careful with your money, HOWEVER, if you find yourself in an extreme state of worry, anxiety, or stress, that’s a signal from your body that you need to relax.

It’s not healthy to worry or be anxious all the time.

Talk to someone you trust, such as a family member, a financial advisor, or someone you look up to that could give you advice to address your anxiety.

Therapy might be a good idea, because if you’re worried about money, you’re probably worried about other things too.

Do some yoga, go for a swim, or spend time with loved ones. Do whatever you can to stay calm and collected.

Which personality type sounds most like you?

READ MORE: 5 Easy Ways to Save $1000 This Month

ABOUT THE WRITER:

Elena Patestas is a journalist and writer for Valuetainment media. She attended Pepperdine University in Malibu, California, and Adelphi University on Long Island, New York. She was born and raised in Roslyn, New York, and currently lives in Miami, Florida.

Elena is passionate about bringing positive change to our world and believes education is the root to solving many societal problems. After overcoming a chronic health condition, Elena became passionate about health and believes food is the key to preventing dis-ease and achieving optimum health.

Amongst her many goals, she hopes to bring positive, impactful change to our world to create a healthy, financially sound, and unified society.

Add comment