What is ESG?

An ESG score is a measure of how well a company addresses risks with respect to environmental, social, and governance issues in its day-to-day work and operations. These risks include matters like carbon emissions, employee safety, and board diversity. The system uses analysts and algorithms to calculate environmental, social, and governance ratings that are then combined into a score.

Why Do Companies Care About Their ESG Score?

On Google you get a generic answer…

This answer doesn’t explain how companies are financially impacted by a low ESG score

- So why do they care?

In December 2020 The Net Zero Asset Managers initiative was launched

- 301 Asset Managers controlling $59 Trillion dollars committed to investing in companies aligned with Net Cero Emissions by 2050

- What does this have to do with the woke / LBGT movement?

- ESG sores are the criteria used by this net zero agreement

- Environmental AND SOCIAL Governance

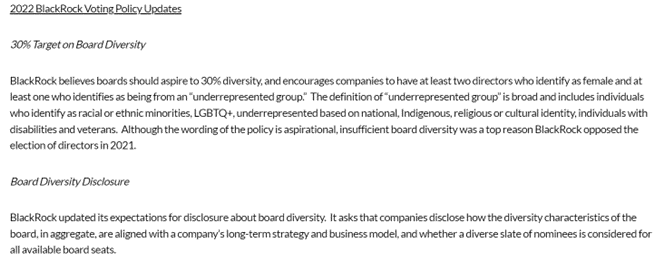

- Take a look at BlackRock’s policy statement

From Gibson & Dunn Legal:

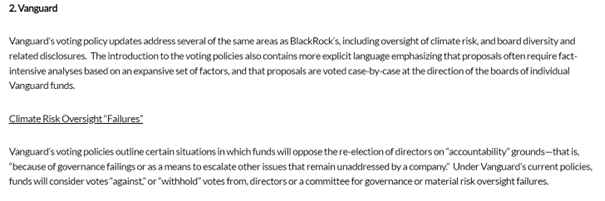

- Take a look at Vanguards policy statement

- Take a look at StateStreet’s policy statement

From Harvard Business Review:

- One of either Blackrock, Vanguard, or State Street is the largest shareholder in 88% of S&P 500 companies. They are the three largest owners of most DOW 30 companies. Overall, institutional investors (which may offer both active and passive funds) own 80% of all stock in the S&P 500.

- The Big Three collectively held a median stake of 21.9% in S&P 500 companies, which represented a proportion of 24.9% of the votes cast at the annual meetings of those companies.

- These three firms control roughly 80% out of about $4 trillion in total ETF assets

There are significant situations in which index fund votes could determine whether a vote passes or not, both for proxy contests and for environmental, social, and governance (“ESG”) matters. And even where votes are not close, the outcome of votes can play an important part in influencing the behavior of corporate managers

From Bloomberg:

In 2020Larry Fink, the chief executive officer of BlackRock Inc., declared that a fundamental reshaping of global capitalism was underway and that his firm would help lead it by making it easier to invest in companies with favorable environmental and social practices.

“Our flows continue to grow and dominate,” Fink said regarding ESG funds, On the same conference call with analysts, he added: “BlackRock is a leader in this, and we are seeing the flows, and I continue to see this big shift in investor portfolios.”

What Fink did not say is that BlackRock drove a significant part of that shift by inserting its primary ESG fund into popular and influential model portfolios offered to investment advisers, who use them with clients across North America. The huge flows from such models mean many investors got into an ESG vehicle without necessarily choosing one as a specific investment strategy, or even knowing that their money has gone into one.

In short, an apparent BlackRock-led rush of investors into ESG in the past two years has been something of a self-fulfilling prophecy, at least when it comes to the biggest such fund on the planet, a BlackRock exchange-traded fund that trades under the ticker symbol ESGU, according to data from BlackRock and Morningstar.

In December 2021 Bloomberg found that only one of 155 ESG upgrades of S&P 500 companies cited an actual cut in emissions as a factor.

Conclusion:

- ESG is being used to force corporate ESG compliance

- These 3 massive companies manage enough money to influence board decisions

- They can influence stock prices in a very subtle way

- Distorting the market

- The next question to answer is what is the driving force behind $59 Trillion dollars worth of Capital being unified behind this message?

- I’ll have more on that in the future!

- One thing is for sure, it’s not out of the goodness of their heart!

Sincerely,

Brandon

Add comment