It would be an understatement to say that this concept is more important than pretty much anything you will come across in your entire life. It’s a crime that school does not mention this and it’s a tragedy that most people go their entire lives without understanding it.

Einstein called it the 8th wonder of the world because of its immense power to make or break people. The 8th Wonder of the World is (Compounding Interest). Einstein said, “those who understand it, earn it, and those who don’t will pay it.”

You don’t need to be an expert in finance to understand this, it’s simply the difference between owing debt and paying interest on it vs owning an asset that pays interest.

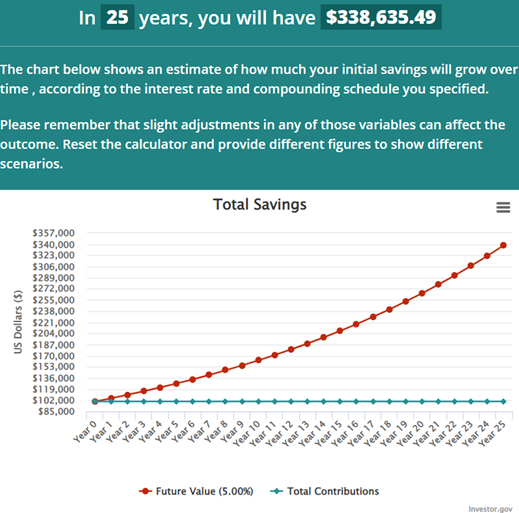

Below is an example of the two scenarios. The following image is an example of what would happen to $100,000 if it gained 5% interest for a period of 25 years.

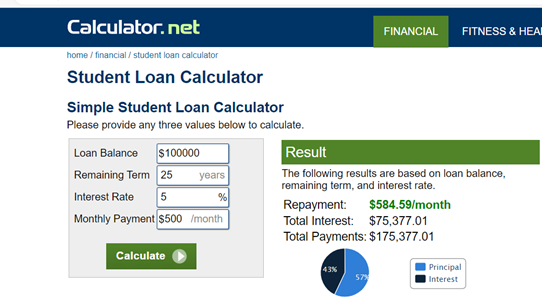

This image shows a breakdown of how much money is actually paid on $100,000 of student loan debt over 25 years.

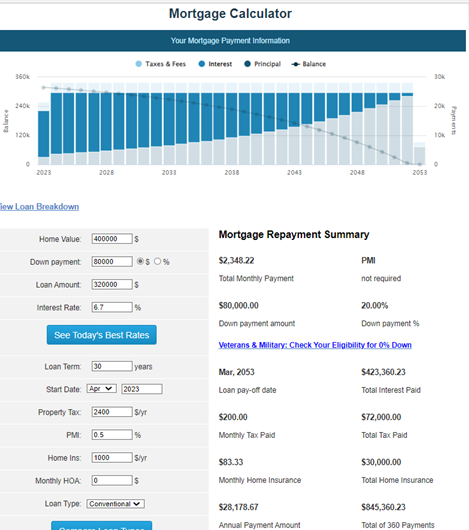

The problem is that when an 18 year old takes a $100,000 student loan at 5% interest they assume it means $105,000. Same thing when people take a mortgage to buy a house. See below, a $400,000 house with a 6.7% interest rate ends up costing $845,000 by the time you’re finish paying it off. The chart at the top shows how most of the initial payments go towards the interest.

This principle applies to any debt that does not generate cashflow. This 8th wonder of the world determines if you become financially independent or a financial prisoner.

We’re entering a time where interest rates are higher than they have been in a long time, which makes the 8th wonder of the world even more powerful. U.S. Treasuries, Money Markets, and CDs are all offering interest rates of roughly 5% while mortgage rates and car loans have rates of nearly 7% today.

So, what will you do now that you know this? I can’t tell you what to do, nor do I want to. I’m thankful that I learned this critical information in my mid 20’s, but I dearly wish that somebody would have shown it to me this when I was a teenager. Because the proper course of action becomes painfully obvious when presented this way. If you find this information valuable, I urge you to share it with anybody you believe can benefit from it. Help yourself and the people in your life be a beneficiary of compounding interest instead of a prisoner to it!

Thank you for reading and feel free to ask any questions!

Sincerely,

Brandon

Add comment