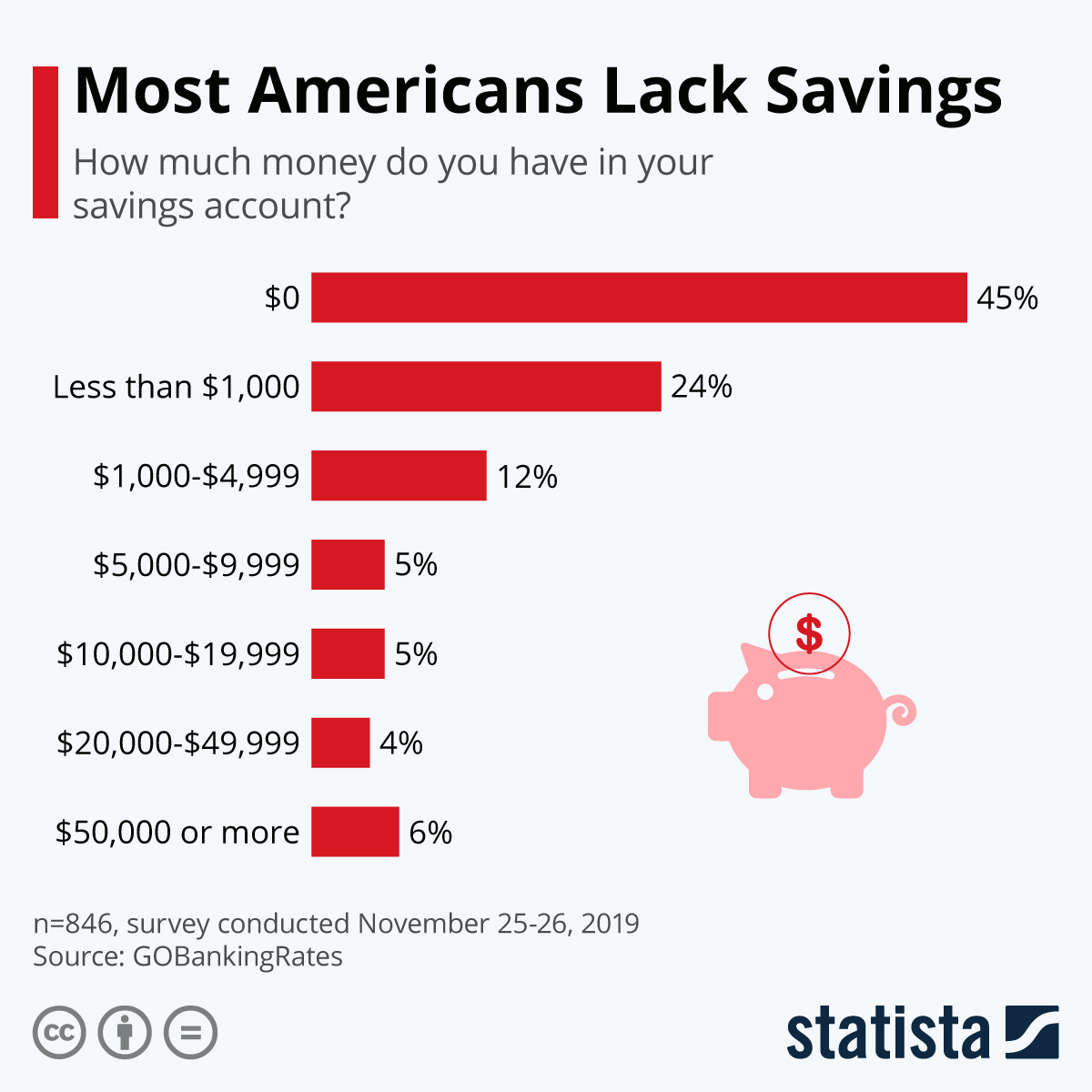

45% of Americans have NOTHING ($0) in their savings accounts.

With 64% of Americans living paycheck-to-paycheck, it makes you wonder how the average American manages their finances.

A recent survey found that 24% of Americans have less than $1000 in their savings account.

Even worse, 45% of Americans don’t have a DIME ($0) in their savings accounts.

How did we let this happen?

Well, they don’t teach financial literacy in public schools across America, so that explains a lot! Maybe if we taught the future of America how to manage their money and cut down their expenses, they’d be a little better off right now.

REALITY CHECK!

Nearly 6 in 10 Americans don’t have enough savings to cover a $500 or $1,000 unplanned expense, according to a new report from Bankrate.

The problem is not that Americans are making too little. The issue stems from the fact that as peoples’ wages increase, so do their expenses.

People’s salaries increase and they think it’s an opportunity to upgrade their car or home, and to splurge on more things.

Maybe they’ll even pop out another kid, which costs on average $272,049 to raise from birth to age 17.

THIS DOES NOT INCLUDE THE COST OF A COLLEGE EDUCATION.

Raising a child can be rewarding emotionally but very costly financially. According to the U.S. Department of Agriculture, the average cost of raising a child to age 18 was $233,610 as of 2015.

With an annual adjustment for inflation of 2.2% each year factored in, the lifetime cost of raising a child born in 2022 could be estimated at $272,049.

I REPEAT, these numbers do NOT include the additional cost of sending a child to college.

Financial Literacy

America has many improvements to make to its public education systems, however, based on our current financial situation, financial courses should certainly be added to the curriculum

Add comment